The last report from Freddie Mac shows the average 30-year fixed-rate mortgage interest rate came in at 3.95%, but what about for borrowers with less-than-perfect credit scores?

LendingTree recently conducted a study which analyzed the actual rates lenders offered to borrowers to see the average interest rate broken down by credit scores.

“Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment,” LendingTree said of its report. “Most borrowers do not fit this profile. Our report includes the average quoted APR by credit score, together with the average down payment and other metrics described below.”

The report measures factors such as actual APR borrowers are offered, the down payment amount, loan-to-value ratio, loan amount and lifetime interest paid.

December’s best offers for borrowers with the best profiles held an average APR of 3.8% for conforming 30-year fixed loans, up from 3.75% in November. Refinance offers increased one basis point in December to 3.7%.

However, this is just for the most qualified applicants. Mortgage rates vary depending on parameters such as credit scores, loan-to-value, income and property type.

For the average borrower, LendingTree’s report shows purchase APRs for 30-year fixed loans increased 12 basis points in December to 4.42%, the highest since July 2016.

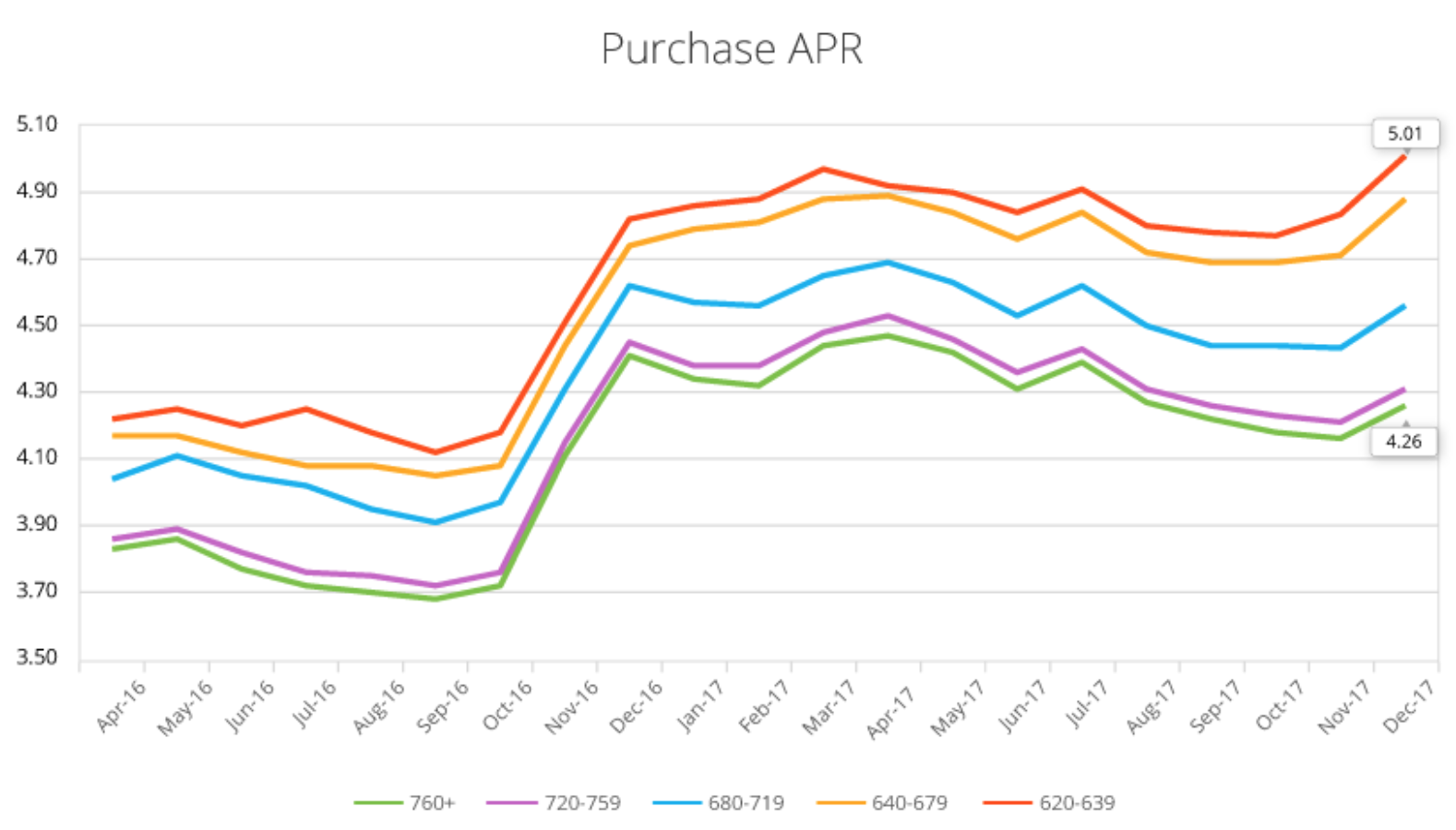

Consumers with the top credit scores, those over 760, saw APRs of 4.26% in December, up from 4.56% for consumers with credit scores between 680 and 719. This is a spread of 30 basis points, the widest gap since April 2016, and could mean nearly $15,000 additional costs for borrowers with lower credit scores over the 30-year period for an average loan amount of $233,586.

The chart below shows the movement of mortgage rates throughout the year for each range of credit scores.

Click to Enlarge

(Source: LendingTree)

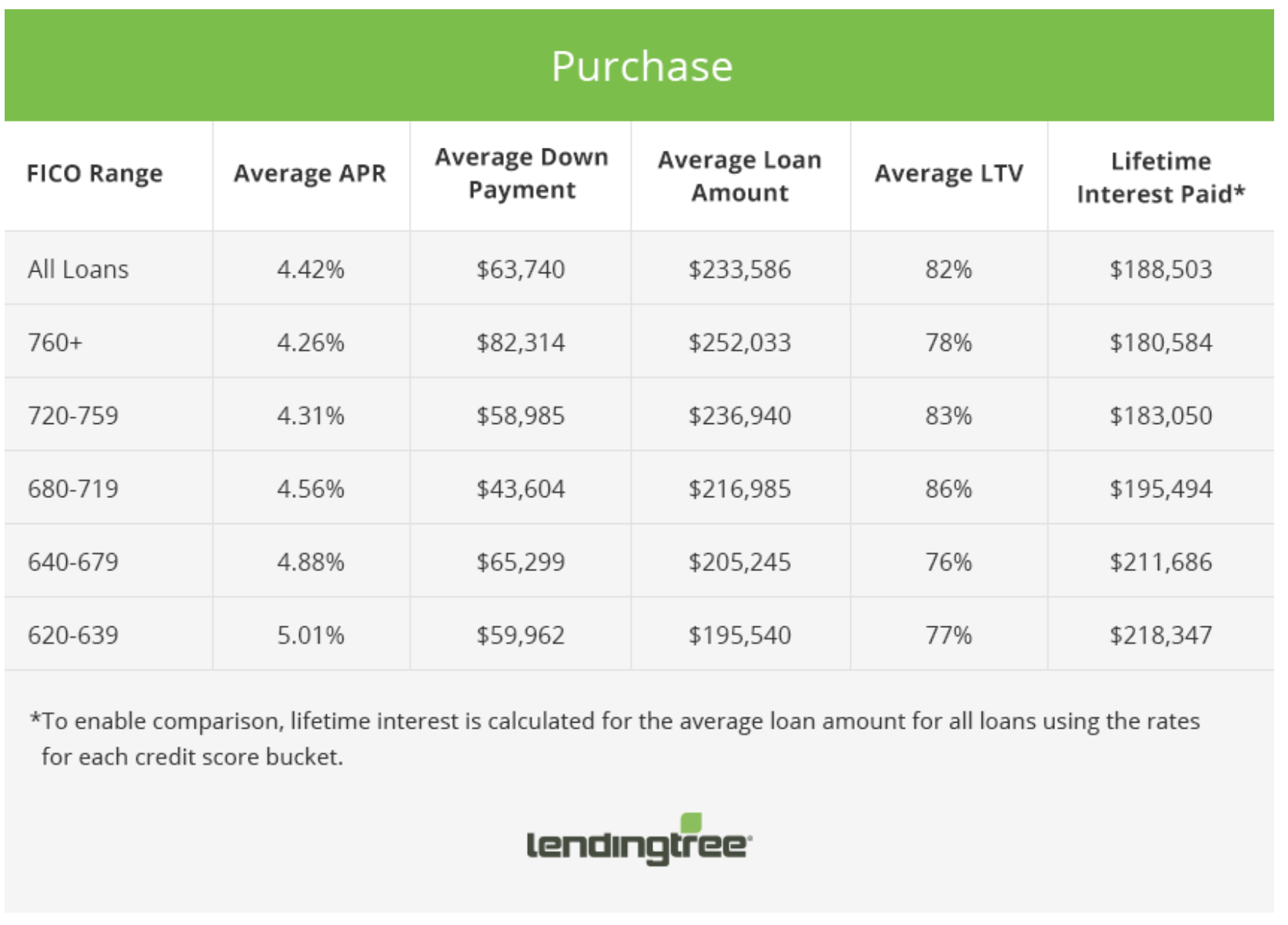

Average purchase down payments increased for eight straight months to reach $63,740 on an average loan amount of $233,586. For borrowers with the best credit scores, 760 or higher, borrowers put a total of $82,314 down on an average loan amount of $252,033.

Borrowers with lower credit scores, in the 680 to 719 range, put down an average $43,604 for a loan amount of $216,985. The chart below breaks down the details for borrowers in each credit score range.

Click to Enlarge

(Source: LendingTree)