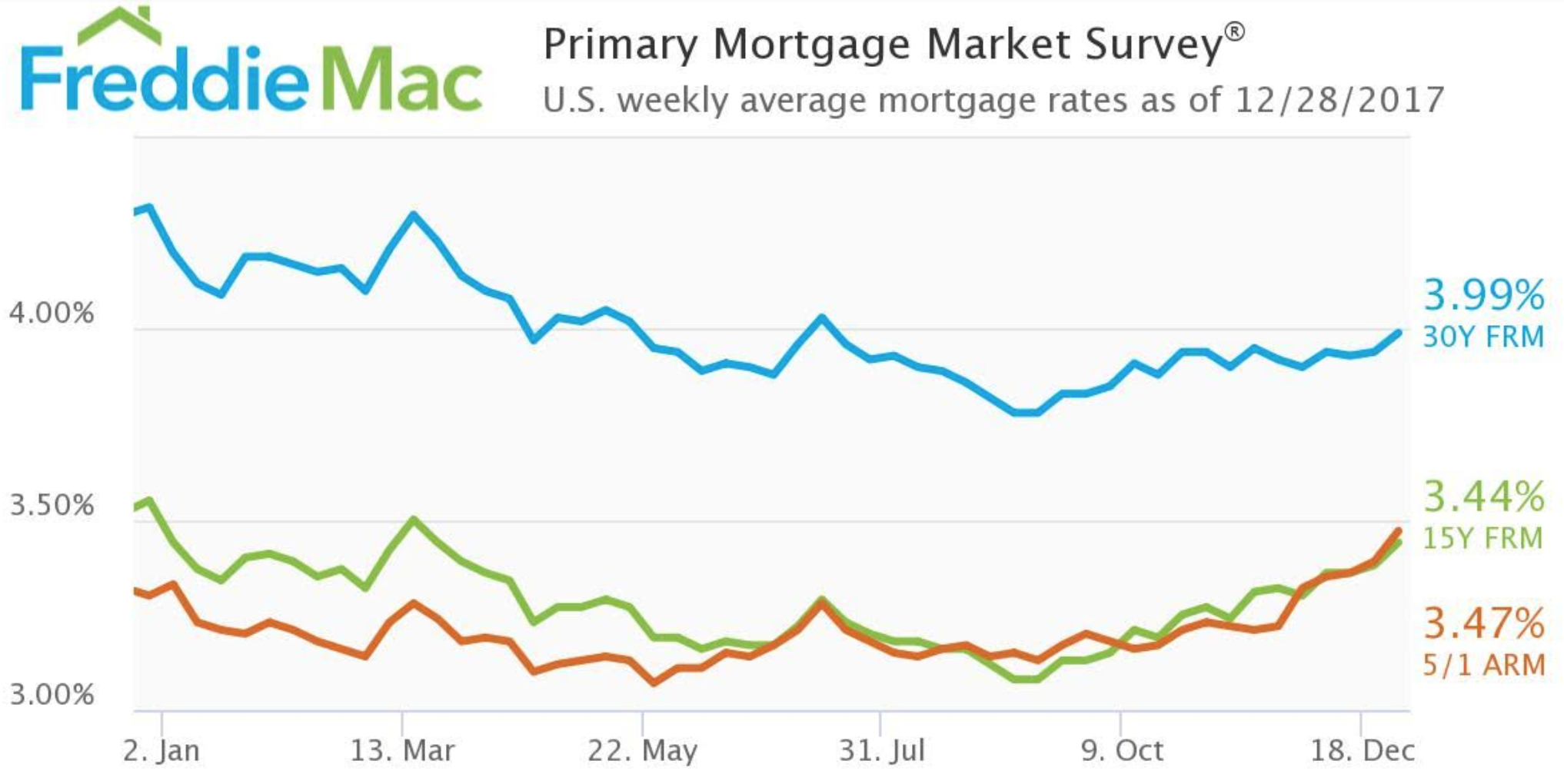

Mortgage rates increased in the final week of 2017 to a five-month high, according to Freddie Mac’s Primary Mortgage Market Survey.

“As we expected, mortgage rates felt the effect of last week’s surge in long-term interest rates in the final, shortened week of 2017,” said Len Kiefer, Freddie Mac deputy chief economist. “The 30-year fixed mortgage rate increased five basis points to 3.99% in this week’s survey.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage increased to 3.99% for the week ending December 29, 2017. This is up from last week’s 3.94% but still down from 4.32% last year.

The 15-year FRM also increased, rising to 3.44%, up from 3.38% last week but down from 3.55% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.47% this week, up from 3.39% last week and from 3.3% last year.

“Although this week’s survey rate represents a five-month high, 30-year fixed mortgage rates are still below the levels we saw at the end of last year and early part of 2017,” Kiefer said. “Mortgage rates have remained relatively low all year.”