The Home Mortgage Disclosure Act deadline looms closer, but many questions still remain unanswered.

To combat this, HousingWire set to work to bring readers answers to the most asked questions as we countdown to the end of the year.

Most of the 2015 updates to HMDA take effect in January 2018.

Before reading today’s question, make sure you’re all caught up in the series by the previous parts of this series:

This is part six.

How do you define an origination to meet the threshold for HMDA reporting?

As the HMDA deadline approaches, many lenders have asked questions about which loans they are required to report data.

In order to clear up the confusion, experts explained what causes an origination to meet the threshold for HMDA reporting.

“Beginning on January 1, 2018, an origination meets the threshold for HMDA reporting, if it is a consumer-purpose, closed-end loan or an open-end line of credit that is secured by a dwelling,” Scott Dunn, Wipro Gallagher Solutions head of product management, strategy and compliance, told HousingWire.

“For business-purpose transactions, the HMDA Rule creates a dwelling-secured standard and maintains current Regulation C’s purpose test,” Dunn said.

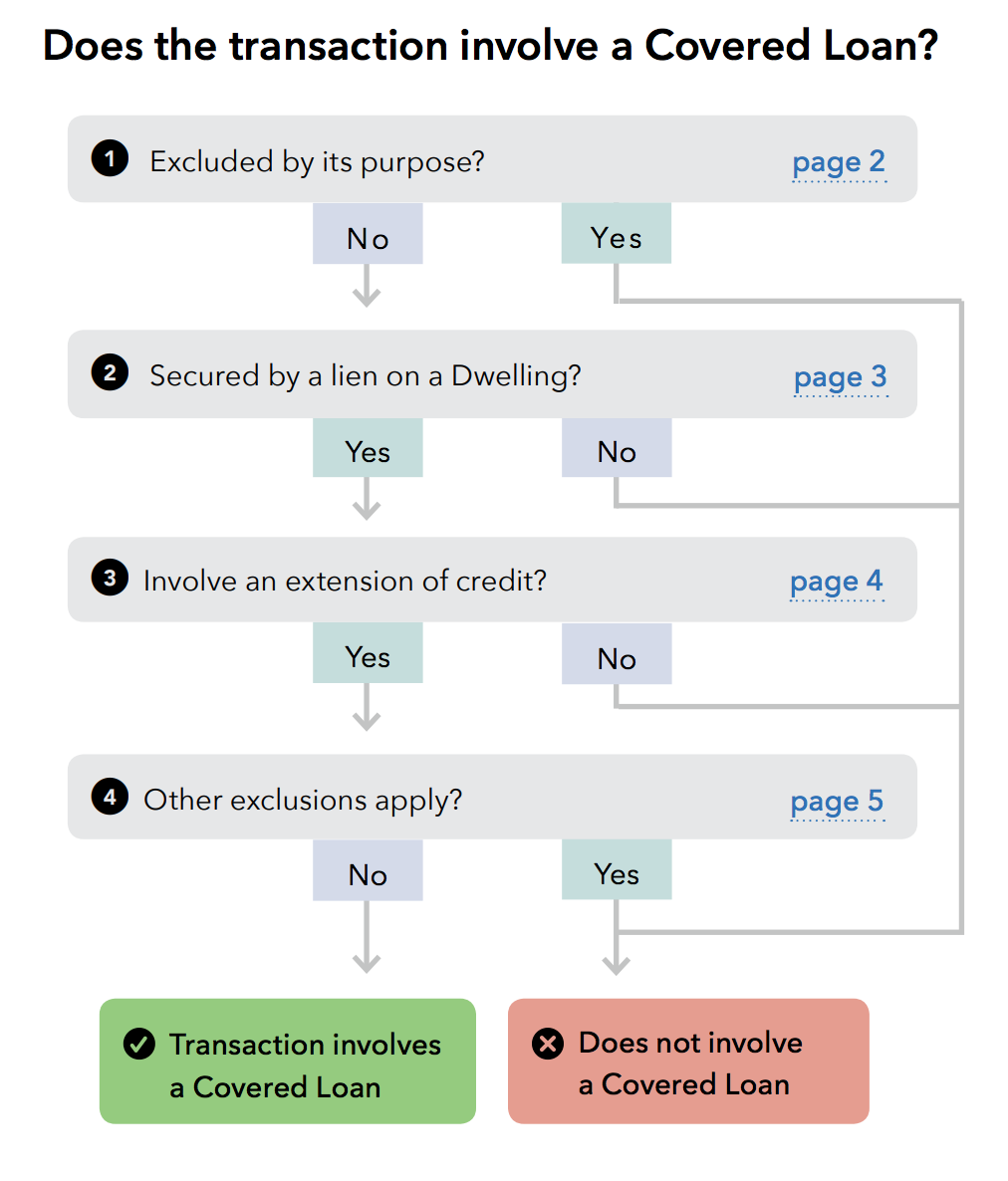

The Consumer Financial Protection Bureau published an easy to use coverage chart which takes lenders through simple questions about their loan to determine if it is reportable. Click here to see a fully interactive version in more detail of the chart below.

Click to Enlarge

(Source: CFPB)

On the CFPB’s interactive version, clicking each question leads you to another “yes or no” box which helps you determine the answer to each question in the main box pictured above.

“Under HMDA and Regulation C, a transaction is reportable only if it is an Application for, an origination of, or a purchase of a Covered Loan,” the CFPB explained.

One expert explained if a loan is categorized incorrectly, it also increases the risk of errors in the data fields.

“They key issue we have seen in this area is that lenders incorrectly categorize transactions as a covered loan,” said Beji Varghese, Navigant Capital Advisors managing director. “This increases the number of covered transactions reported and also increases the possibility that the various required fields on these transactions could be reported in-correctly.”

According to Vargheses, these are the loans that would be considered a covered loan:

- The transactions can be excluded by purpose

- It is secured by a lien on a dwelling

- It involved an extension of credit

- Any other exclusions can be applied

Check back Friday to read part seven of this series as we count down until the end of 2017.