Home prices increased across the U.S. from last month and last year, according to the latest Home Price Index from CoreLogic, a property information, analytics and data-enabled solutions provider.

Home prices increased a full 7% from October 2016 to October this year and 0.9% from September to October, the CoreLogic HIP showed.

“Single-family residential sales and prices continued to heat up in October,” CoreLogic Chief Economist Frank Nothaft said. “On a year-over-year basis, home prices grew in excess of 6% for four consecutive months ending in October, the longest such streak since June 2014. This escalation in home prices reflects both the acute lack of supply and the strengthening economy.”

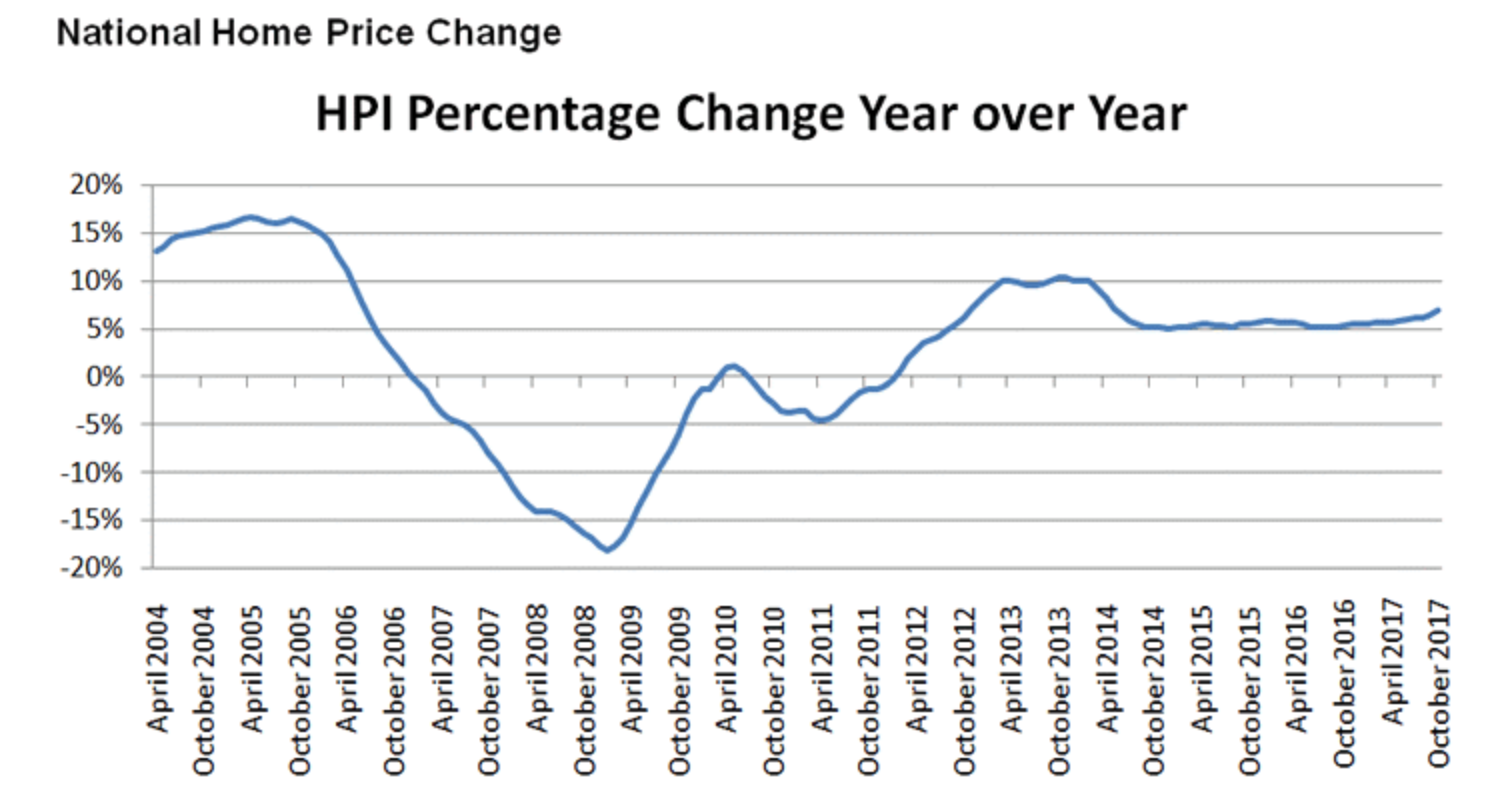

The chart below shows that, until recent months, home price increases hovered near 5%.

Click to Enlarge

(Source: CoreLogic)

In fact, home prices are up so much that out of the nation’s 100 largest metropolitan areas, 37% are now considered overvalued based on the area’s housing stock. In October, 26% of markets were undervalued and 37% were at value.

But these surging home prices will not continue into 2018, according to the CoreLogic HPI forecast. Home prices will increase by 4.2% from October 2017 to October 2018, and will increase just 0.2% from October to November.

The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The acceleration in home prices is good news for both homeowners and the economy because it leads to higher home equity balances that support consumer spending and is a cushion against mortgage risk,” CoreLogic President and CEO Frank Martell said.

“However, for entry-level renters and first-time homebuyers, it leads to tougher affordability challenges,” Martell said. “According to the CoreLogic Single-Family Rent Index, rents paid by entry-level renters for single-family homes rose by 4.2% from October 2016 to October 2017 compared with overall single-family rent growth of 2.7% over the same time.”