Americans who don’t have a FICO score present both an opportunity and a challenge for lenders.

Lenders are keen to extend credit to consumers in new market segments, but need to ensure they’re making risk-aware decisions. Some lenders are asking can scoring trended data, or more accurately trended credit bureau data, as some credit score companies claim, actually help expand credit access to these consumers? The short answer is no and let’s discuss why. First, it’s important to understand two key terms:

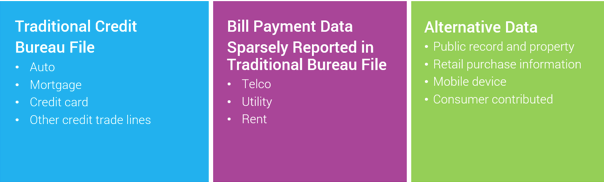

1.Trended data is a historical view of a consumer’s traditional credit bureau file.

2.Alternative data, according to the Consumer Finance Protection Bureau, refers to any credit data that is not found in the traditional credit bureau file.

Therefore, the important question to ask is whether a credit scoring model is using traditional credit bureau data or alternative data, as defined above. Traditional credit bureau data contains the most recently reported information on consumers’ monthly balances, payment amounts and limits. Trended data consists of this exact same traditional credit bureau data going back 24 to 30 months, depending on the source credit reporting agency. Trended data can be thought of as a series of snapshots of a consumer’s traditional credit bureau file.

Very little non-loan payments, such as rental, utility and cell phone payments information is available in a traditional credit bureau file. Only about 1 million consumers have rental information captured in their traditional credit bureau file, despite the U.S. Census Bureau estimating that roughly 35% of the 240 million U.S. adults live in rental housing. Similarly, even though over 60% of U.S. adults pay for utilities, only 2.4% of traditional credit bureau files contain utility payment information.

Click to Enlarge

(Source: FICO)

Because trended data is comprised only of traditional credit bureau data, a credit score’s use of it alone doesn’t truly expand credit access.

FICO estimates that out of about 240 million U.S. adults, more than 50 million do not have FICO scores. These “non-scorable” consumers do not meet the FICO score minimum scoring criteria. The minimum scoring criteria plays a critical role in ensuring the robustness and accuracy of our credit scoring system. By extension, this criteria ensures the soundness of lending decisions based on that system. To meet the FICO score minimum scoring criteria, a consumer’s traditional credit file must have the following:

- At least one account opened for six months or more

- At least one account that has been reported to the credit bureau within the past six months

- No indication of deceased on the credit report

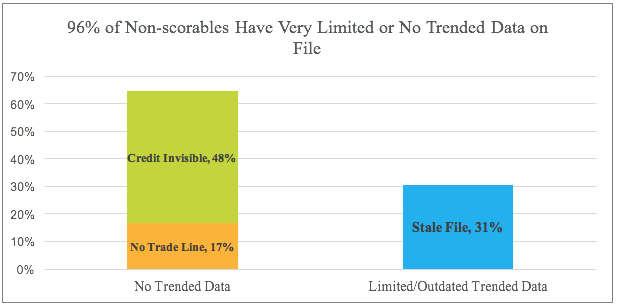

Roughly 28 million consumers do not meet the minimum scoring criteria because their credit bureau file is too stale or sparse. Another 25 million consumers, many who are young and/or new to country, do not meet the minimum criteria because they have no credit bureau file at all.

The fundamental challenge with this population is the lack of sufficient traditional credit bureau data to drive a robust and reliable credit risk assessment. See the chart below:

Click to Enlarge

(Source: FICO)

Credit scoring models that use trended data alone can’t help open the credit box. The only way to enable lenders to safely and responsibly extend credit to these “non-scorable” consumers is through the use of alternative data.

FICO is leveraging alternative data to score millions more creditworthy consumers. The goal, however, is not to simply generate more scores, but to generate scores that enable lenders to safely and responsibly extend credit to more people. Providing lenders with alternative data-driven tools that enable safe and sound underwriting can help these “non-scorable” consumers gain access to credit on their financial journey to mainstream credit.