The construction of new homes increased in October to meet the rising homebuyer demand, according to the latest report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Privately-owned housing starts increased in October to a seasonally adjusted annual rate of 1.29 million, up a full 13.7% from September’s revised estimate of 1.14 million. However, it is 2.9% below the 1.33 million in October 2016.

Of these, single family housing starts made up part of the increase, rising 5.3% from 833,000 in September to 877,000 in October.

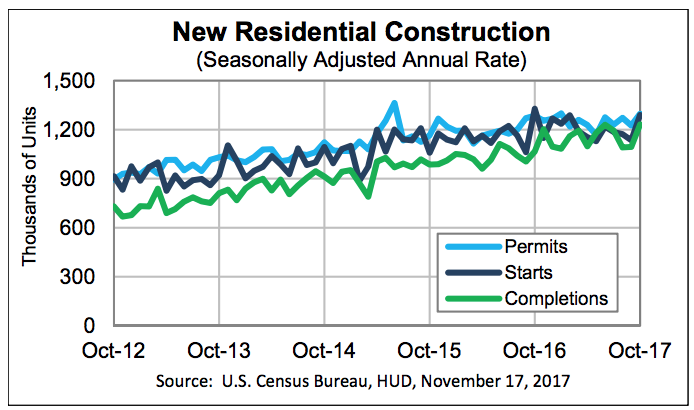

The chart below shows new home construction continues to trend upward as demand increases:

Click to Enlarge

(Source: U.S. Census Bureau, HUD)

But one expert explained this increase is not surprising due to the recent hurricane activity, and pointed out the numbers are still far below their long-term average going back to the 1990s. He said the increase could be just a temporary jump.

“I don’t really think the big jump is surprising,” said Terrell Gates, Virtus Real Estate Capital CEO, in an interview with HousingWire. “I think most of us were expecting to see a little bit of a dead cat bounce from the hurricanes. From my view it’s too early to say the economy is expanding.”

Other experts agreed, saying the market would need to see several changes to keep up with the housing tightening inventory.

“While the overall housing trend is up slightly, this won't do much to alleviate the tight housing market,” said Robert Frick, Navy Federal Credit Union corporate economist. “The National Association of Realtors recently reported that homes are staying on the market for the shortest time in 30 years – three weeks – that was this year through June.”

“For a significant increase in new homes, municipalities are going to have to work harder to make more land available for building,” Frick said.

But privately owned housing units authorized by building permits also increased, indicating this upward trend could continue in the months ahead. Building permits increased 5.9% from 1.23 million in September to 1.3 million permits in October. This is also 0.9% above last year’s 1.29 million.

Single family authorizations also increased in October, rising to 839,000, up 1.9% from 823,000 permits in September.

“Permits to build homes, often viewed as a leading indicator of future starts, climbed by 5.9% to an annualized pace of 1.3 million units – suggesting that the upward trend in housing starts should continue,” Nationwide Chief Economist David Berson said.

And other experts agreed housing permits show a bright future ahead for housing permits in the months to come.

“Even more encouraging than the above estimated housing starts rate is the pickup in permit applications for single-family dwellings, indicating that we should see more new construction in the coming months,” said Bill Banfield, Quicken Loans executive vice president of capital markets. “Despite monthly fluctuations, generally low mortgage rates also signal homebuilding activity across the country can be expected to grow steadily.”

But this increase in multifamily activity could be increasingly important for today’s economy as the rental market grows less and less affordable.

“Single family rental is becoming a much more significant piece of the problem,” Gates told HousingWire. “Affordability gaps are getting worse. In the past where you have places like New York or San Francisco where people expect to pay more of their income to their housing needs, now we are seeing that trickle down to other cities – the Dallas, the Atlantas, the Denvers.”

And other experts agreed regional affordability is becoming a growing problem, even forcing some homebuyers to relocate.

“Overall, the total activity for the country is moving in the right path,” NAR Chief Economist Lawrence Yun said. “More supply will boost future home sales.”

“The West region, however, could experience slowing job growth as affordability conditions worsen from the ongoing inventory shortages that are driving up prices,” Yun said. “This could ultimately force residents and potential job seekers to start looking to other parts of the country.”

Privately owned housing completions increased 12.6% to a seasonally adjusted annual rate of 1.23 million in October, up from 1.1 million in September. This is also up 15.5% from last year’s 1.07 million.

Single family housing completions increased just 2.6% in October to 793,000 completions, up from 773,000 in September.

Gates explained that improving new home construction could help with the nation’s rising affordability issues.

“There’s not one silver bullet, but obviously there are areas we could focus on.”

He listed solutions such as working to lower construction costs, get all sectors involved – public and private, federal or local government subsidies and utilizing different types of housing options.

“We all need to focus on making affordable housing a priority,” he said.