By the end of the third quarter this year, the number of serious delinquencies decreased over the past year to the lowest level since the recession, according to the Q3 2017 Industry Insights Report from credit reporting agency TransUnion.

The serious mortgage borrower delinquency rate, which is considered 60 days or more past due, dropped about 16% annually to 1.91% by the end of the third quarter of 2017, according to TransUnion’s report.

“Serious mortgage delinquency rates continue to drop to new post-recession lows, indicating there may be opportunities to responsibly expand access,” said Joe Mellman, TransUnion senior vice president and mortgage business leader.

“We did note that the shape of the delinquency trendline has been flat during the second and third quarters of 2017, suggesting that a natural floor for delinquencies might be forming,” Mellman said. “However, a similar period of flat delinquencies occurred between the second and fourth quarters of 2016, before they once again began to decline.”

Delinquency rates have continued to drop consistently year-over-year since the third quarter of 2010, and now fell to the lowest point since the recession. In fact, the only state that didn’t see a decrease in annual delinquency rates was Alaska, which continues to struggle with lower oil prices.

The total number of outstanding mortgages increased 1% over the last year to 52.7 million mortgages in the U.S., reversing last year’s trend of annual declines. The average mortgage debt per borrower also increased from $193,489 last year, reaching $199,417, continuing the trend unbroken since the first quarter of 2005.

However, probably due to a decrease in the share of refinance originations, the average new account balance dropped 2.4% from last year to $224,502 in the third quarter. The share of refinances decreased to 33% in the second quarter this year, up from 37% in the second quarter of 2016. TransUnion explained refinances tend to hold higher balances than purchase originations.

“A higher interest rate environment and market saturation have negatively impacted refinance market share, and we anticipate it to decline even further,” Mellman said. “Tight supply, especially for starter homes, will pose some growth headwinds, though a strong economy and a high demand for housing will likely overcome that and lead to growth in home purchase activity.”

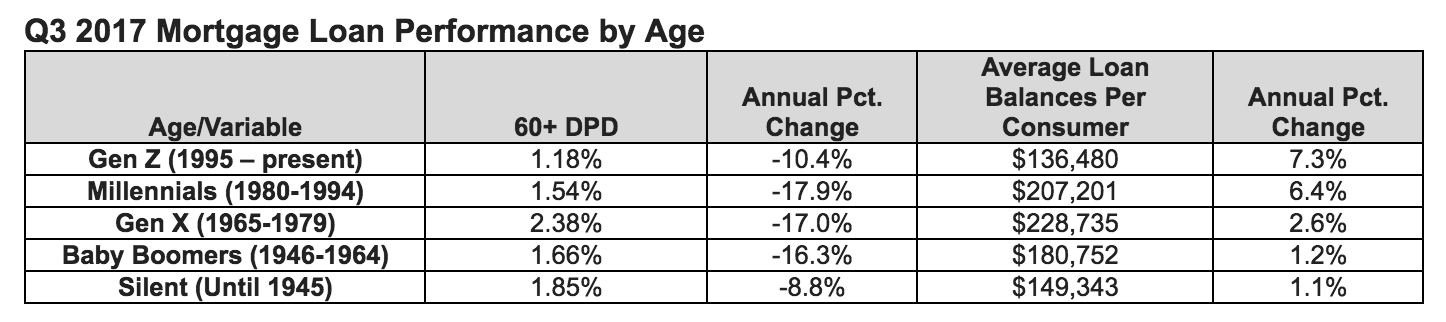

Broken down by generation, one age group leads the rest in its share of serious delinquencies – and it’s not Millennials. In fact, Millennials hold one of the best mortgage delinquency rates out of all generations.

The chart below shows the mortgage loan performance by generation:

Click to Enlarge

(Source: TransUnion)