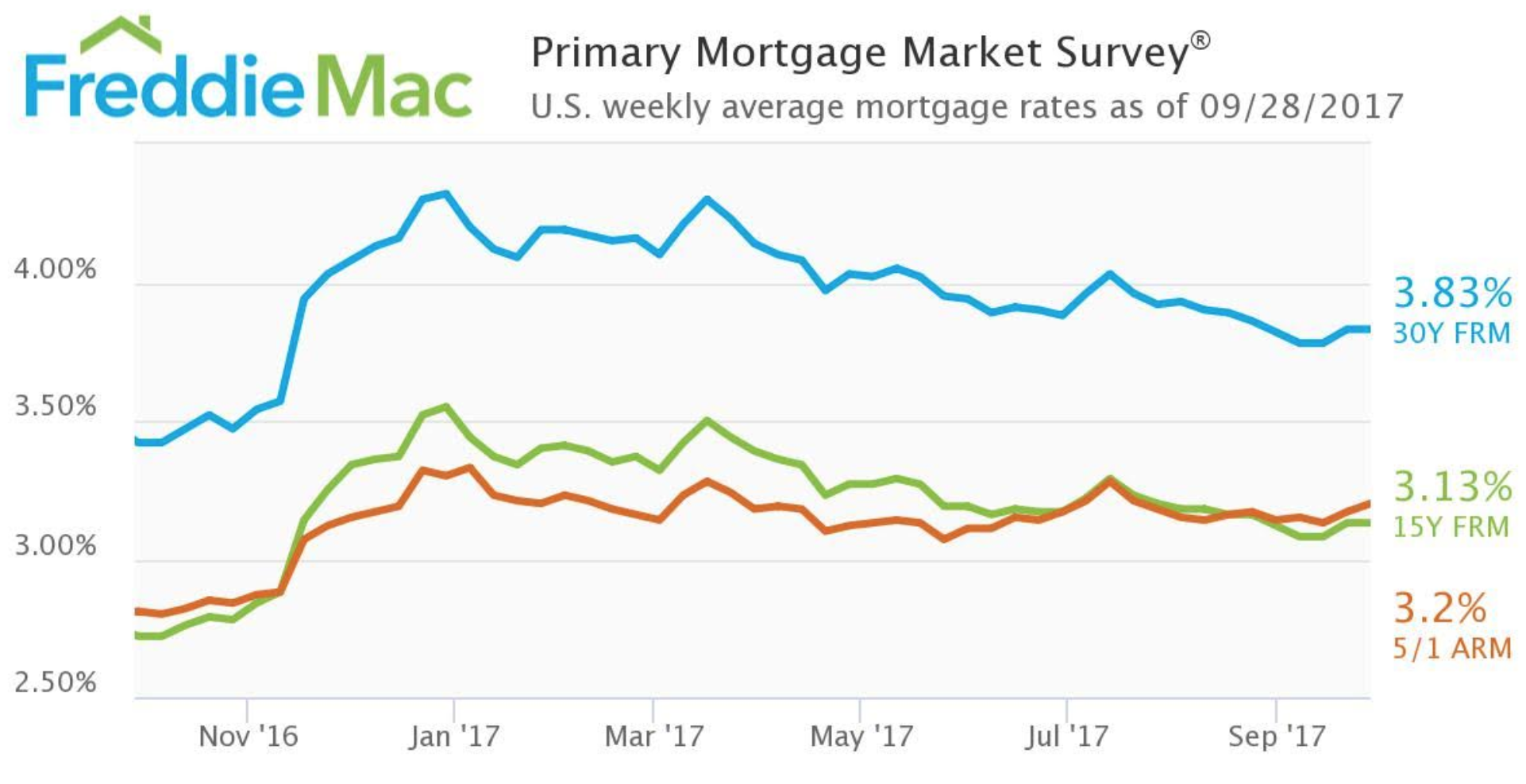

Mortgage rates came to a stop after increasing last week for the first time in months, according to the latest Primary Mortgage Market Survey from Freddie Mac.

“Rates held relatively flat this week,” Freddie Mac Chief Economist Sean Becketti said. “The 10-year Treasury yield fell just one basis point, while the 30-year mortgage rate remained unchanged at 3.83%.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage held steady at 3.83% for the week ending September 28, 2017. This is an increase from last year’s 3.42%.

The 15-year FRM also held steady from last week at 3.13%, but remained up from 2.72% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased slightly from last week’s 3.17% and last year’s 2.81% to 3.2% this week.

While the two-year Treasury yield jumped seven basis points over the last week, the 10-year increase was much more subtle at three basis points.

Because interest rates usually follow the 10-year Treasury yield, plus 150 basis points, give or take, mortgage rates could begin to increase once again next week.