A new analysis from Ten-X shows home sales, while near their cyclic highs, continue to lag significantly behind their previous peak.

A strong labor market and low mortgage rates combined to push home buying demand up, even as low levels of housing inventory hold back progress in sales and increase home prices, according to Ten-X’s Quarterly Residential Market Report for fall 2017.

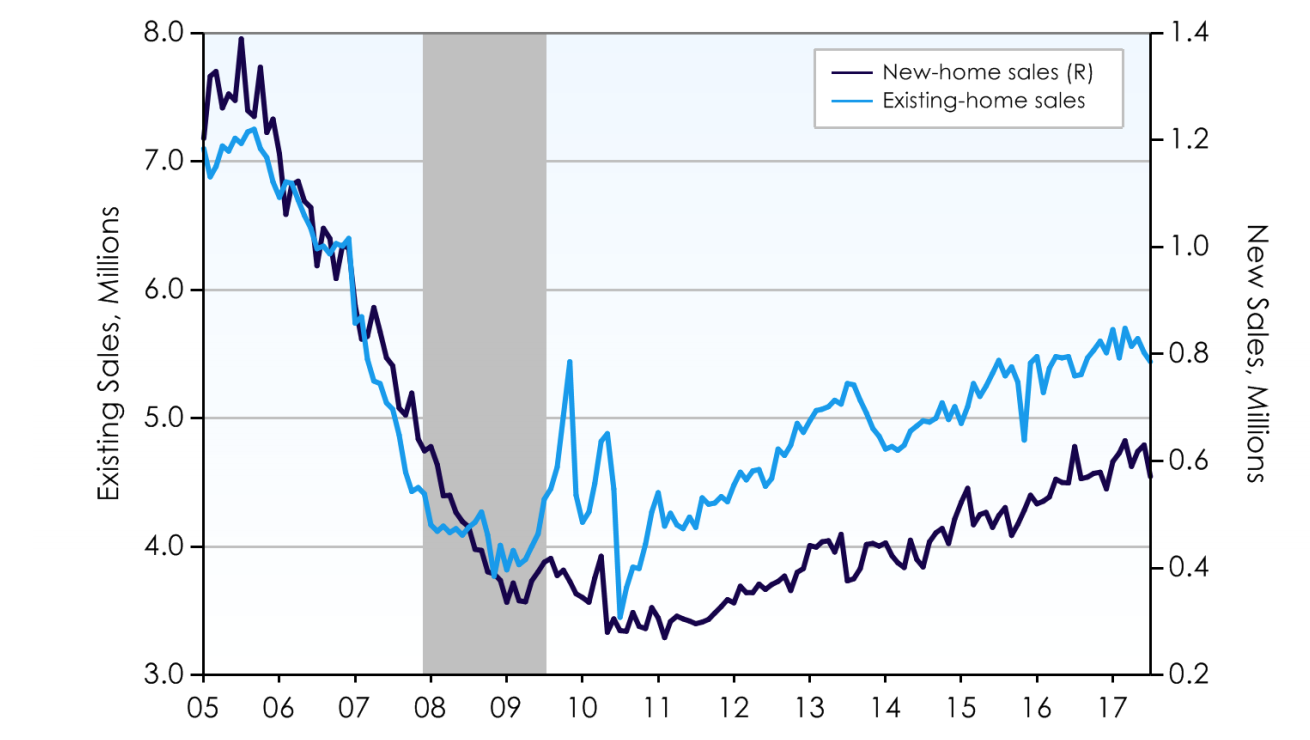

The chart below, which uses data from Ten-X, the U.S. Census Bureau and the National Association of Realtors, shows that while home sales are currently on a general upward trend, they are significantly lower than previous peak levels.

Click to Enlarge

(Source: Ten-X, U.S. Census Bureau, NAR)

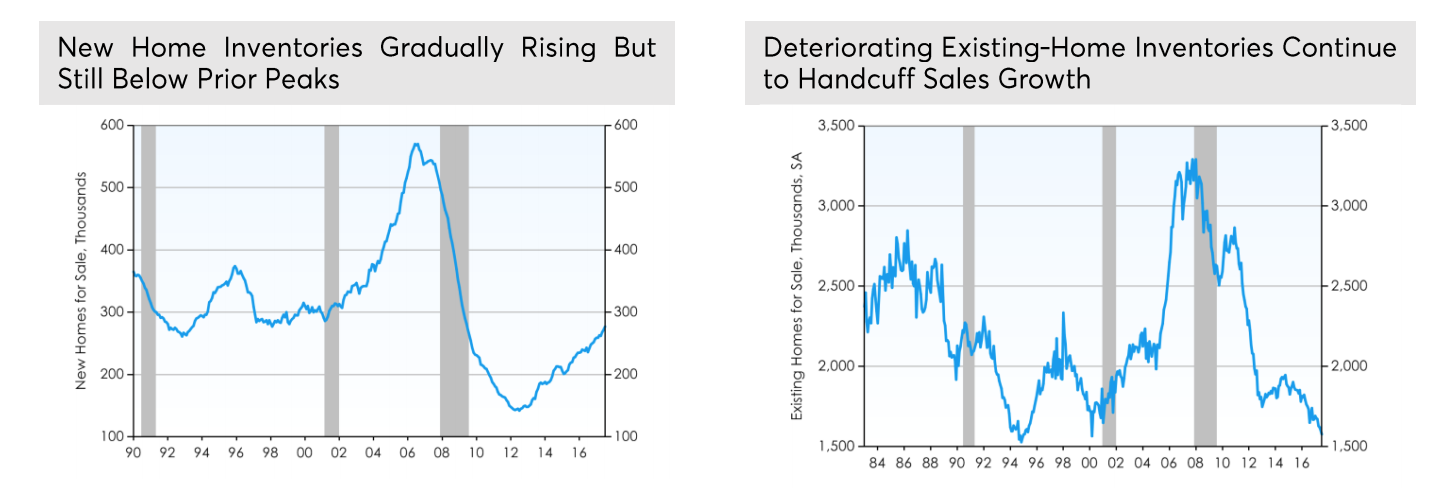

This low level is heavily due to the lack of homes available for sale. The report shows that while new home inventory has risen 17% from last year, it is still 50% below its 2006 peak. And even these yearly gains in new home sales are offset by the drop in existing-home sales.

The chart below shows that new home sales inventory is rising even as existing home inventory continues to fall, but both are significantly below their previous peak level.

Click to Enlarge

(Source: Ten-X, U.S. Census Bureau, NAR)

However, the lack of housing inventory is not fully to blame for this drag on home sales. The report explained many buyers, especially first-time homebuyers, are struggling with student debt, tight underwriting conditions and the potential for an increase in mortgage rates.

Another expert, First American Financial Corp. Chief Economist Mark Fleming, explained the recent hurricanes could also work to hold back home sales in the near future as the market’s potential for home sales shrank. He also said that affordability is another factor which is hindering home sales.

“The combination of home price appreciation driven by inventory shortages and the rise in mortgage rates over the year prior has had a meaningful impact on affordability,” Fleming said. “According to the First American Real House Price Index, affordability is down 9.3 percent in July compared to a year ago.”

Overall, existing home sales came in at a seasonally adjusted annual rate of 5.44 million in July, the lowest level in 2017 but up 2.1% from last year, NAR’s last report showed. New home sales also decreased as the latest report from the U.S. Census Bureau showed they have hovered near 600,000 sales for most of 2017.