The gap between the homes consumers want and the homes available for sale continues to grow in many markets across the U.S., according to the latest Mismatched Markets report from Trulia.

In order to examine the widening gap, Trulia compared home searches with for-sale inventory on Trulia between April and June of 2017, and compared it with that same period last year.

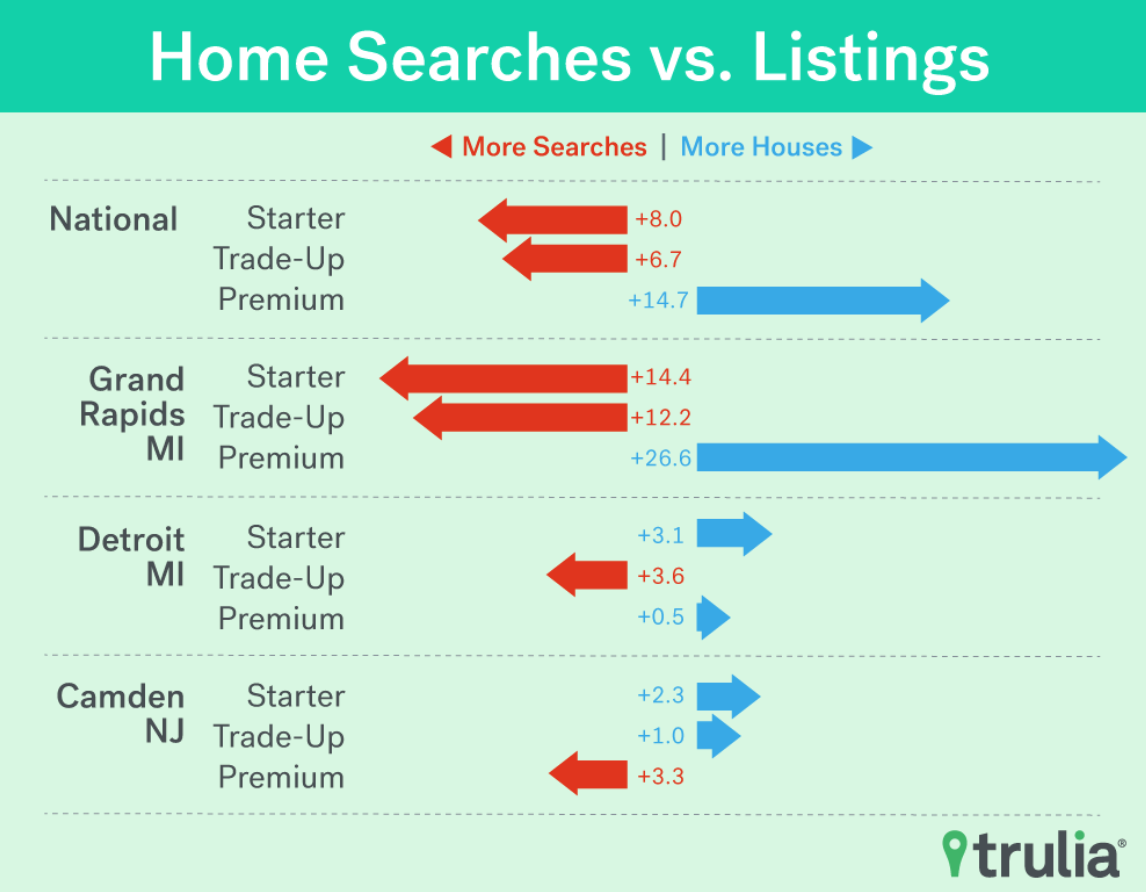

The data showed potential homebuyers continue to struggle when looking for starter and trade-up homes, but expensive luxury homes are flooding into the market. Trulia’s national mix-match score for all homes increased from 92 last year to 14.7.

This score is on scale of zero to 100, with zero being perfectly matched and 100 being completely mismatched.

The infographic below compares the number of home searches to the inventory available nationally, and in several housing markets across the U.S. While cities like Grand Rapids, Michigan have extremely mix-matched markets for all home types, other cities, such as Camden, New Jersey, are much more level.

Click to Enlarge

(Source: Trulia)

The total share of starter and trade-up homes dropped to 45.8% this year, down from last year’s 46.5%, even as the share of searches for these homes increased from 55.6% to 60.5% during the same time period.

As starter and trade-up homebuyers see falling number of homes available, with shortfalls of 8 and 6.7 percentage points respectively, luxury homes saw a surplus of 14.7 percentage points nationally.

Before Hurricane Harvey, Houston held the title of the most mix-matched market with is extremely low level of starter and trade-up homes. Trulia explained it is too early to tell what kind of impact the hurricane will leave on the housing market.

“With mortgage rates remaining favorable and unemployment low, the home-buying waters probably seem welcoming enough to bring out more home buyers, many of them younger and first timers,” Trulia stated in its report. “But with inventories at historic lows and the make-up of that inventory continuing to slide away from the make-up of home buyer interests, we expect many starter and trade-up home buyers are going to find a competitive market with few options, with the possible exception of those in a handful of unique markets.”

The good news is, while homes are increasingly difficult to find, and home prices continue to soar as a result, Americans are now better positioned than ever before to cope with the rising home prices.

The U.S. Census Bureau announced Monday that real median household income increased 3.2% from 2015 to 2016, according to its Income, Poverty and Health Insurance Coverage in the United States: 2016 report. This increase to $59,039 marks the highest median income on record. It also reported the official poverty rate decreased 0.8 percentage points to 12.7%.