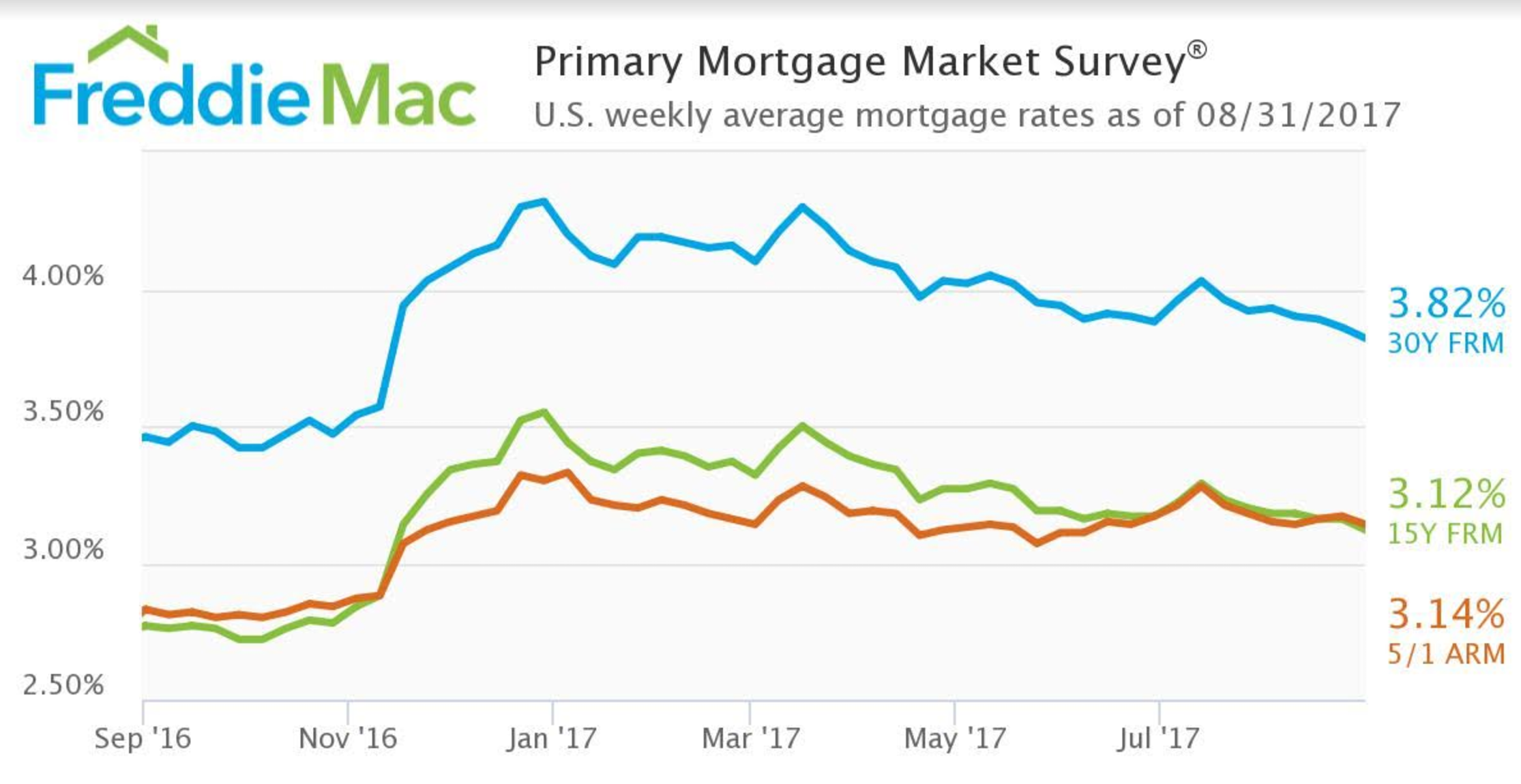

Mortgage rates hit an all-new 2017 low for the second-consecutive week, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

“The 10-year Treasury yield fell to a new 2017-low on Tuesday,” Freddie Mac Chief Economist Sean Becketti said. “In response, the 30-year mortgage rate dropped four basis points to 3.82%, reaching a new year-to-date low for the second consecutive week.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped to 3.82% for the week ending Aug. 31, 2017. This is down from last week’s 3.86% but up from 3.46% last year.

The 15-year FRM also decreased, dropping from last week’s 3.16% to 3.12% this week. This is still up from last year’s 2.77%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased to 3.14%, down from 3.17% last week but up from 2.83% last year.

“However, recent releases of positive economic data could halt the downward trend of mortgage rates,” Becketti said.