By 2025, it is predicted that there will be 5.2 million more homeowners in this country.

And of this number, people born in the 80s and 90s, also known as Millennials, are expected to dominate the home-buying market.

In light of the steep increase in homeownership, HousingWire held a free webinar for those who work in mortgage lending to ask the experts what the future looks like for the industry. (Check back later for a free link to download the webinar)

HousingWire sat down with Adam Stein, CEO of LoanTek, Daren Blomquist, senior vice president, communications and economist for ATTOM Data Solutions, and Tony Wicke, vice president of sales at Land Home Financial Services, to talk about the benefits of going digital and the details behind low down payment mortgages.

For starters, Stein explained that in the mortgage market, the share of nonbank lenders has tripled, growing from 14% to 38% from 2007 to 2015.

And on top of this, he said regarding FHA loans in particular, nonbank lenders witnessed a phenomenal rise from 20% to 75% during the same period.

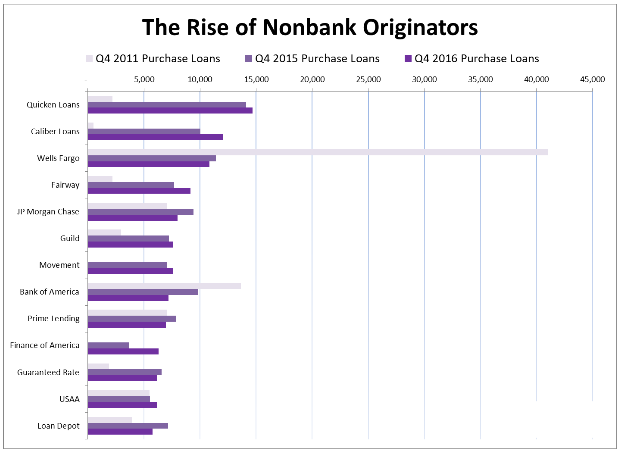

Needless to say, the share of nonbank lenders is rapidly rising compared to the past when banks like Wells Fargo and JPMorgan Chase dominated the market.

Stein went on to spotlight fintech lenders, saying that their market share tripled from 5% to 15% in the overall mortgage market for the same period.

Check out the full webinar once it's available for tips on how to disrupt the digital mortgage market. A few examples are listed below:

- Hire coordinators (web designers)

- Update strategies

- Enhance the franchise

To put these changes into perspective, Blomquist shared the chart below to better illustrate which nonbanks are dominating the market, along with how the market has shifted away from the mega banks.

Click to enlarge

(Source: ATTOM Data Solutions)

Wicke wrapped up the webinar, digging into a topic that’s been garnering a lot of attention lately: low down mortgages.

Wicke explained that as long as lenders have quality underwriting, low down mortgages can be successful.

Are low down payments the villain? No, he said.

While low down payment mortgages contributed to the financial crisis, he said they were not a major factor in the meltdown.

“Sound and prudent underwriting is the cornerstone to performing mortgages,” he said.

Between low down mortgages, the rise of nonbank lenders and the necessity of digital mortgages, the future of lending looks positive.

However, the above information only scratched the surface of what was discussed in the webinar. Check back here in one to two business days for a link to a free download of the webinar and slides.