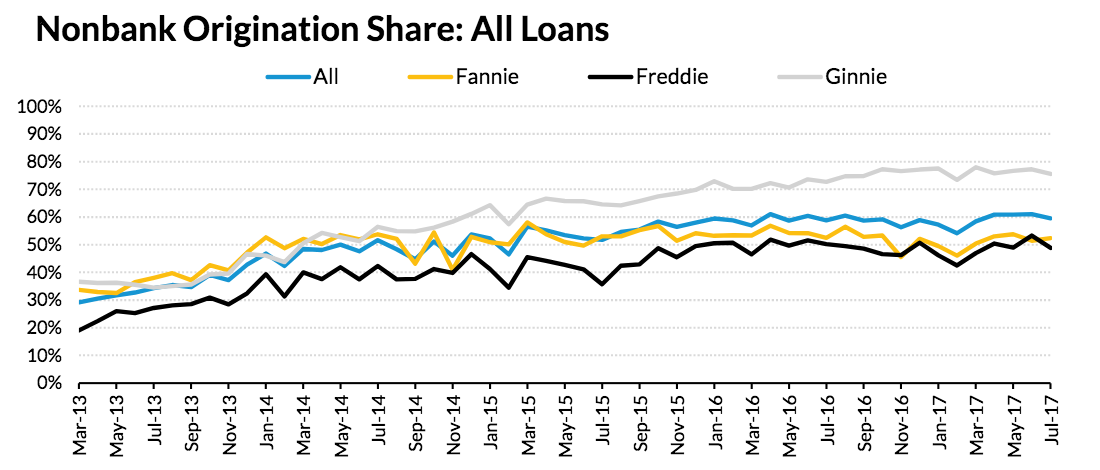

The origination share from nonbanks has increased significantly over the past five years, and is bringing several changes to the residential lending market, according to Urban Institute's August Chartbook.

Overall, the nonbank origination share increased from 30% in 2013 to 60% in July 2017. During that same period, Ginnie Mae saw the highest increase, moving from 37% to 75%. Freddie Mac’s share increased from 22% to 49% and Fannie Mae’s jumped from 38% to 52%.

The chart below shows the increase over the past five years.

Click to Enlarge

(Source: eMBS and Urban Institute)

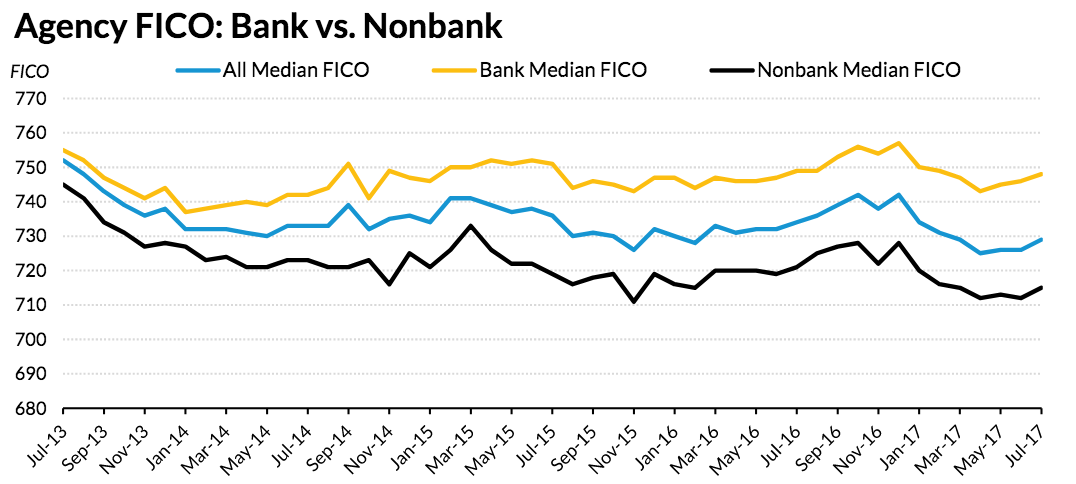

And this increasing share of nonbanks is bringing several changes to the housing industry. For example, nonbanks played a major role in opening access to credit. The chart below shows the average FICO score among nonbanks is much lower than banks.

The average FICO score among nonbank customers rests lower than 720, while the average score among banks is just under 750.

The chart below shows the average FICO scores among bank and nonbanks over the past five years.

Click to Enlarge

(Source: eMBS and Urban Institute)

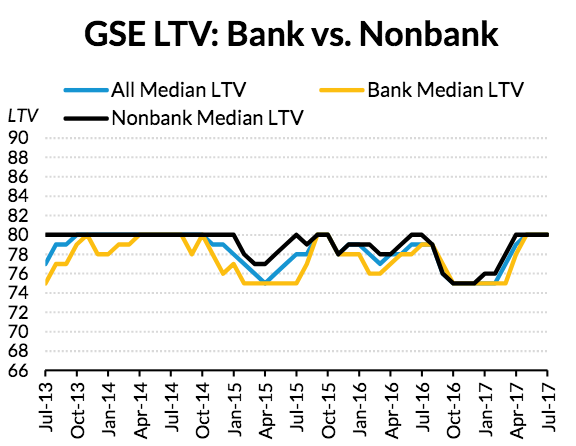

But a lower average FICO score isn’t the only way nonbanks are opening the credit box. The chart below shows nonbanks originate loans with higher loan-to-value ratios.

Click to Enlarge

(Source: eMBS and Urban Institute)

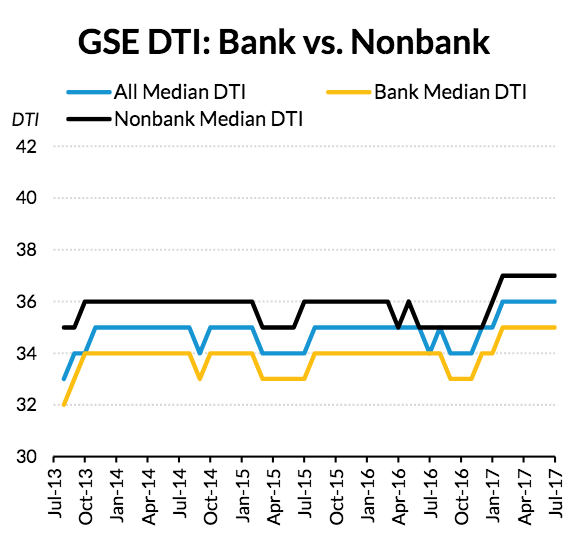

Nonbanks also originate loans with higher debt-to-income ratios, as the chart below shows.

Click to Enlarge

(Source: eMBS and Urban Institute)