Wednesday, the U.S. Department of Housing and Urban Development and the U.S. Census Bureau issued a joint report which showed housing starts decreased in July – and economists are not happy with the numbers.

Although the main source of the decrease stemmed from multifamily construction, one economist explained the lack of new single-family construction was just as disappointing.

“The disappointing news for homebuyers is not that multifamily starts are down, but rather that single family has barely nudged up much in the past few months,” Trulia Chief Economist Ralph McLaughlin said. “With homeownership on the rise for young households, we need more one-to-four unit construction to help keep up with demand.”

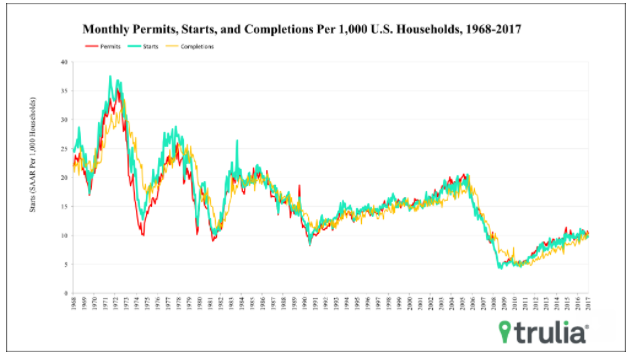

The chart below shows housing construction, while trending upward, is still far below its historical norm.

Click to Enlarge

(Source: Trulia)

Another economist pointed out the housing market isn’t the only market at risk from the declining housing inventory.

“Moreover, the latest 15% drop in multifamily housing starts and 0.5% drop in single family starts will hold back economic growth potential,” NAR Chief Economist Lawrence Yun said. “Because of this continued shortage, expect rents and home prices to rise by at least twice as fast as the broad consumer price index.”

Another expert agreed, saying the 1.15 million housing starts disappointed expectations.

“The notoriously volatile multi-family segment drove the decrease, as single family starts were more or less unchanged,” said Brent Nyitray, iServe Residential Lending director of capital markets. “The Street was looking for 1.22 million units. Building permits came in at 1.22 million, lower than estimates as well.”

But why are housing starts so low, despite the increasing demand? First American Financial Corp.’s chief economist explained.

“The employment situation report, released earlier this month, reported an increase of 5,100 residential construction jobs between June and July,” First American Chief Economist Mark Fleming said. “The number of residential construction jobs is now 4.9% higher than a year ago.” Fleming also expands on the recent data in more detail on his LinkedIn page, right here.

“The growth in residential construction jobs supports further improvement in the pace of home building because building a home does not readily lend itself to outsourcing and automation,” Fleming said. “Home building still requires manual labor as a key input into the production process. It’s very hard to increase housing starts without increasing residential construction employment.”

But not everyone was disappointed with the decrease in housing starts. One expert even pointed out the 4.1% increase in building permits and 8.2% increase in housing completions from last year is a sign of growth.

“Despite the monthly volatility, we continue to see gradual growth in starts of single family homes on a year-over-year basis,” said Bill Banfield, Quicken Loans executive vice president. “This steady increase is a sign of a stabilizing market and gives optimism that the economy can continue to support more homeownership.”

Another expert agreed, pointing out that while the decrease may seem disappointing, it does have positive points.

“With June starts generating optimism after halting three straight months of declines, the July data is disappointing and may indicate that full year projections of 1.25 million to 1.3 million starts may be optimistic,” PwC Principal Scott Volling said. “However, we see two reasons to maintain some level of optimism.”

“First, July permits were up 4.1% over last year to 1,223,000 and the June permit number was revised upward to a strong 1,275,000, signaling potential strength in starts over the coming months,” Volling said. “Second, single family starts rose 10.9% from last year to 856,000.”

“Combined with June's upwardly revised 860,000 single family starts, this is the strongest two-month result for single family starts since fall of 2007, as builders continue to prioritize addressing the pent-up demand for single family homes,” he concluded.