Mortgage rates dipped slightly, and according to the Federal Reserve, this decrease is due in part to the low inflation rates.

“Earlier this week, Federal Reserve officials highlighted the influence of continued weak inflation data on rates,” Freddie Mac Chief Economist Sean Becketti said.

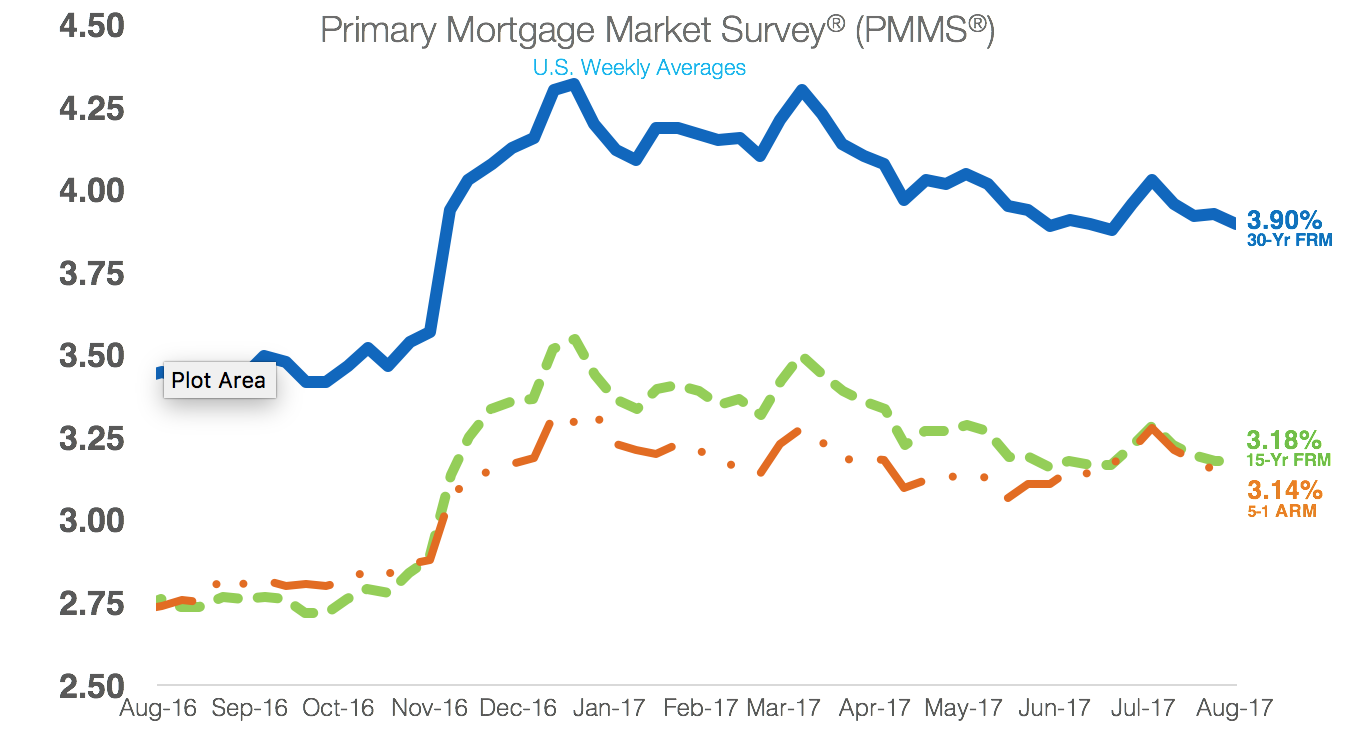

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed rate mortgage decreased to 3.9% for the week ending August 10, 2017. This is down from 3.93% last week but up from 3.45% last year.

The 15-year FRM remained the same as last week at 3.18%, up from last year’s 2.74%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased slightly to 3.14%, down from last week’s 3.15%. This is up from last year’s 2.74%.

“After holding relatively flat last week, the 10-year Treasury yield fell four basis points this week,” Becketti said. “The 30-year mortgage rate moved in tandem with Treasury yields, dropping three basis points to 3.9%.”