SunTrust fulfilled its consumer relief obligations under the National Mortgage Settlement, wrapping up the relief requirements under a settlement with the government over mortgage servicing and foreclosure abuses.

More than three years ago, the U.S. Department of Housing and Urban Development, the U.S. Department of Justice, the Consumer Financial Protection Bureau and attorneys general in 49 states and the District of Columbia announced a $968 million mortgage origination settlement with SunTrust.

Under the settlement, SunTrust was required to provide the following consumer relief by Sept. 30, 2017:

- $475 million in consumer relief credit to distressed borrowers and by establishing a mortgage origination program.

- $25 million in consumer relief credit by refinancing mortgages of borrowers who would not otherwise qualify for refinancing.

According to Joseph Smith, monitor of the National Mortgage Settlement, SunTrust has provided more than 22,327 borrowers with $503 million in consumer relief.

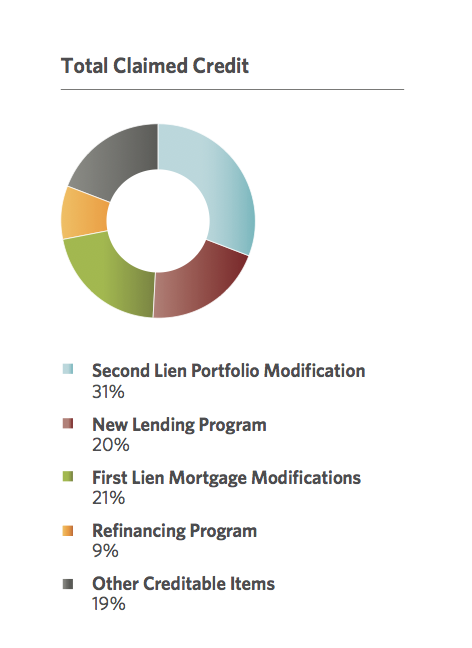

The breakdown of total credit can be found in the chart to below.

Click to enlarge

(Source: Office of the National Mortgage Settlement)

“SunTrust has satisfied its consumer relief obligation under the NMS,” said Smith. “I will continue to monitor SunTrust’s consumer compliance obligations and will report my findings to the Court and the public in the future.”

Smith noted that SunTrust passed all consumer compliance metrics tested during the second half of 2016 with one exception because the information on the company’s Proof of Claims files was not presented in the proper format. This error is being corrected and will be reported on in the future, Smith noted.