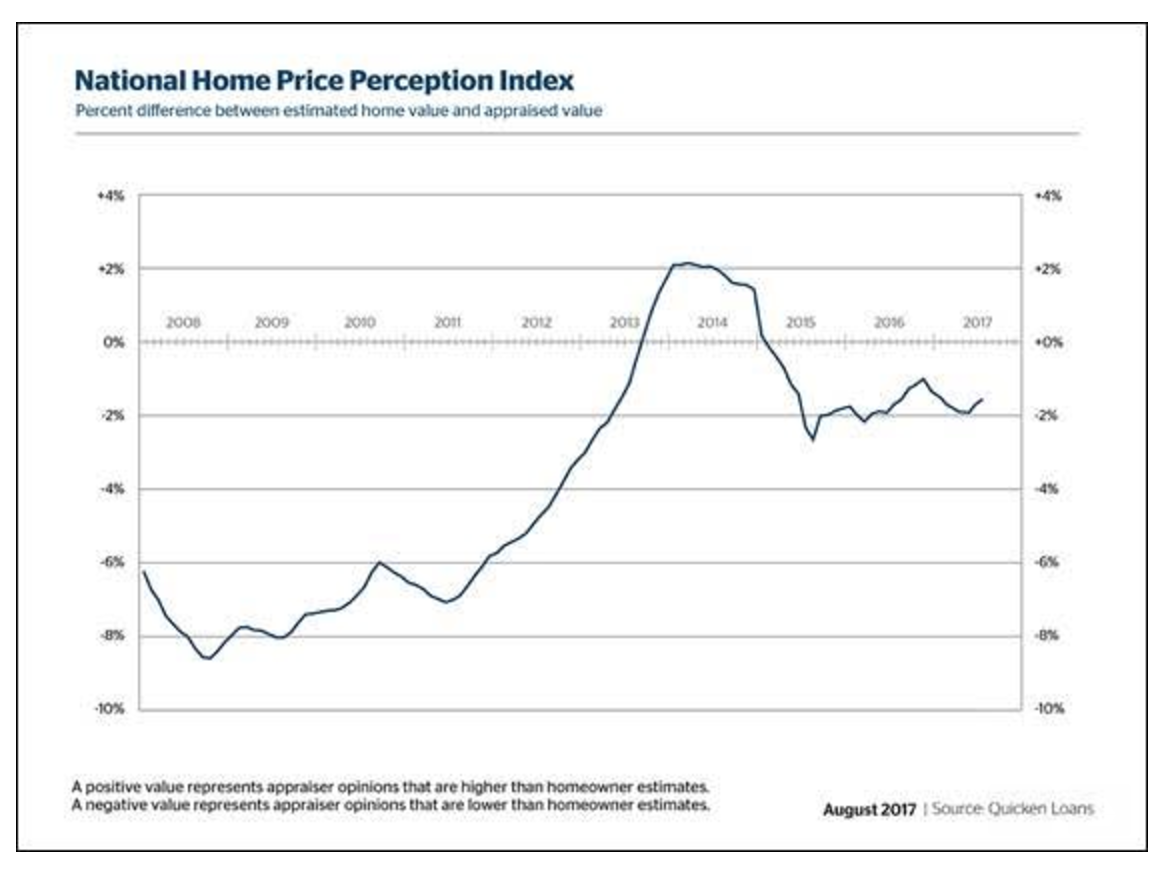

Homeowners are getting closer to guessing their home values as appraised home prices increased in June, according to Quicken Loans’ National Home Price Perception Index.

Homeowners continue to overestimate their home values by 1.55%, but this is lower than May’s gap of 1.7%, according to the index. Appraised home values increased 0.33% nationally in June, and 4.21% annually, the company’s National Home Value Index showed.

Click to Enlarge

(Source: Quicken Loans)

“The home appraisal is one of the most important data points in the mortgage process,” said Bill Banfield, Quicken Loans executive vice president of capital markets. “It determines the level of equity the homeowner has and, if the owner’s estimate is too far from how the appraiser views the property, it can cause the mortgage to be restructured.”

“Our hope is that this index is eye-opening for homeowners,” Banfield said. “Their home equity could be thousands of dollars higher, or lower, than they realize. If they are aware of the perceived trends in their area it could help them better prepare for their home purchase or refinance.”

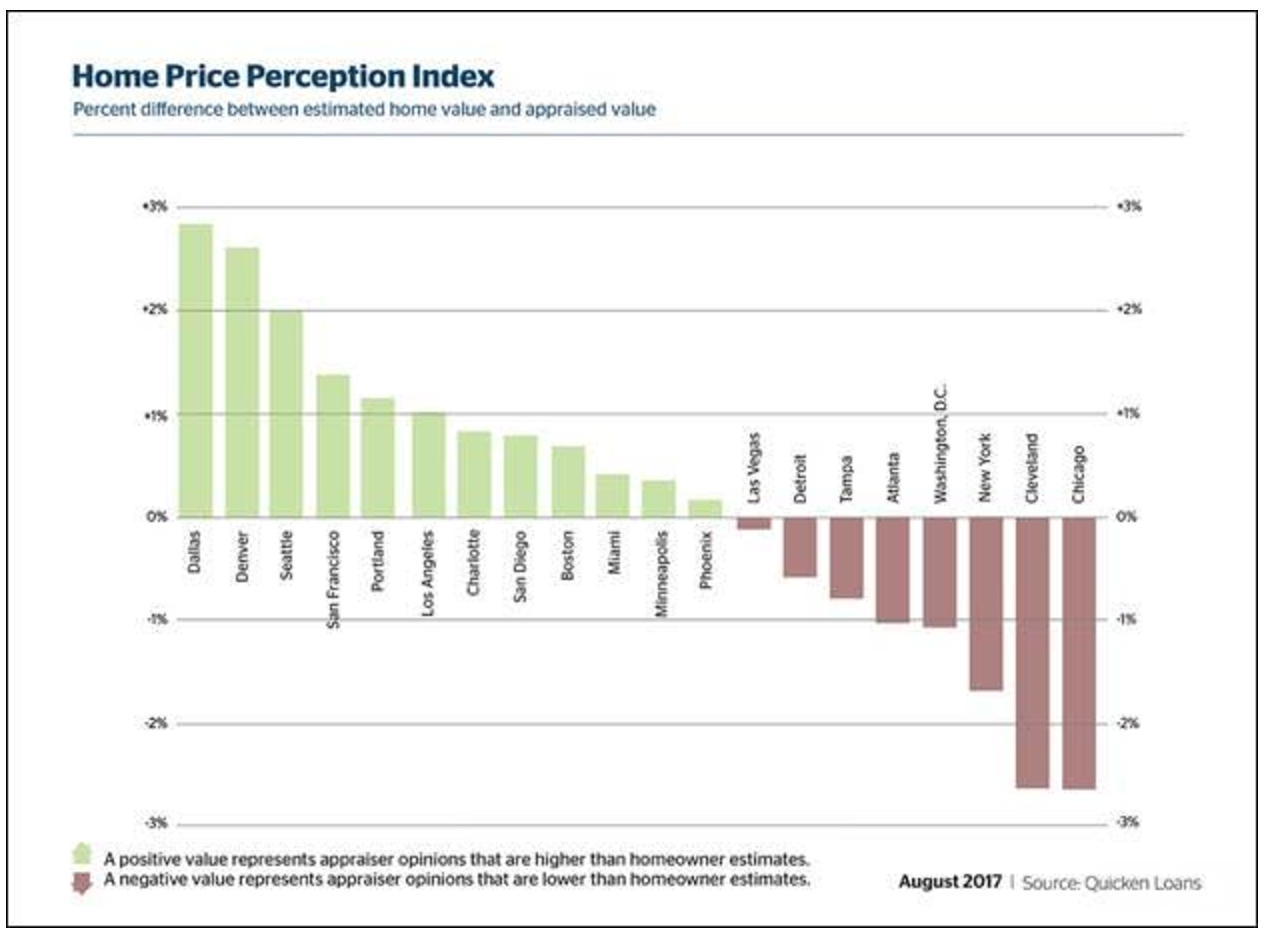

In some fast growing markets such as Dallas and Denver, home prices are growing so fast that homeowner estimates are coming in nearly 3% lower than appraised values.

Click to Enlarge

(Source: Quicken Loans)

“The regional differences in home value growth mirror the perception difference across the country,” Banfield said. “Areas with slower growth were more likely to have owners overestimating their home value, and areas with much stronger growth had higher appraisals than owners realized they would be.”

“With home values constantly changing, and the rates of change varying across the country, this is one more way to show how important it is for homeowners to stay aware of their local housing market,” he said.