While there's already a push to get more consumers to shop around for a mortgage and branch out beyond getting a mortgage where they already bank, many consumers don't check out other options.

The Consumer Financial Protection Bureau previously cited that almost half of borrowers seriously consider only a single lender or broker before deciding where to apply.

Borrowers are used to comparing flights and hotels, and yet this mentality doesn’t transfer over to shopping around for a mortgage.

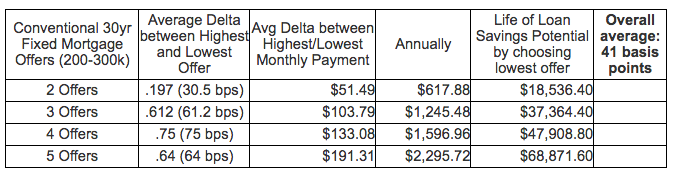

A new chart from LendingTree puts into perspective exactly how much money borrowers could save by shopping around for more offers. Spoiler alert, it could save thousands annually.

The data used in the chart below is from a sample of more than 5,000 consumers who received at least two offers through LendingTree for a 30-year fixed rate conventional loan in the past 30 days. LendingTree is a website that allows potential borrowers to compare loans options.

At the bare minimum, borrowers who received two offers witnessed a 30.5 bps difference in offers and had the potential to save an average of $617.88 annually.

On the high end, borrowers who received five different offers witnessed a 64 bps difference in offers and had the potential to save an average of $2,295.72 annually.

The chart below also shows how much money a borrower could save over the entire life of the loan, reaching as high as $68,871.60.

Click to enlarge

(Source: LendingTree)

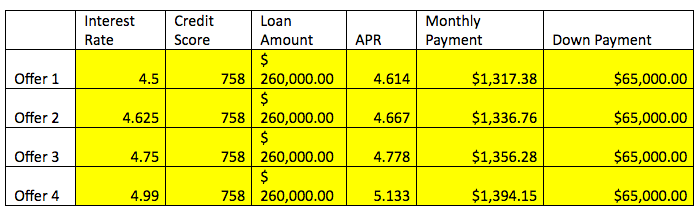

The second chart below gives an example of a real-life scenario where a consumer received multiple offers. In the example, the difference between the highest APR and lowest APR option would be $27,637.20 over the life of the loan. It’s important to note that this borrower has a high credit score and is putting more than 20% down, which isn’t typical for first-time homebuyers.

Click to enlarge

(Source: LendingTree)

Chris Meyer, co-founder at Magilla Loans, recently explained in an interview that home shoppers tend to be so beat down by the time they get to the mortgage part that they just want to get it done quickly. So to save time, they cut out the search process for the best home loan.

Magilla is also an online loan comparison site. Meyer stressed in the interview that the most salient thing people should do is shop for the loan before they buy the house.