Existing home sales dropped in June as housing inventory was unable to keep up with the increasing demand for homes.

Housing demand continues to increase, one expert explained, suggesting existing home sales could increase once again later this year.

“There are several factors that are helping to boost housing demand, including: solid job gains, faster household formations, and low mortgage rates, and these suggest that existing home sales should move higher as the year progresses,” Nationwide Chief Economist David Berson said.

One expert put the amount of housing demand into perspective, and explained two possible outcomes for homebuyers due to low inventory levels and high demand.

“There are about as many homes for sale now as there were in 1994, except there are about 63 million more people in this country now than there were then,” Zillow Chief Economist Svenja Gudell said. “A combination of very low inventory and very high demand leads to two main outcomes, neither of which is particularly favorable for stressed home buyers desperate to make a deal.”

“First, those homes that are available to buy are often on and then off the market in a flash, in many cases staying on the market for only a few short days before going pending,” Gudell said. “High demand and low inventory also serves to push prices higher at a rapid clip, as bidding wars break out for those scant few homes available.”

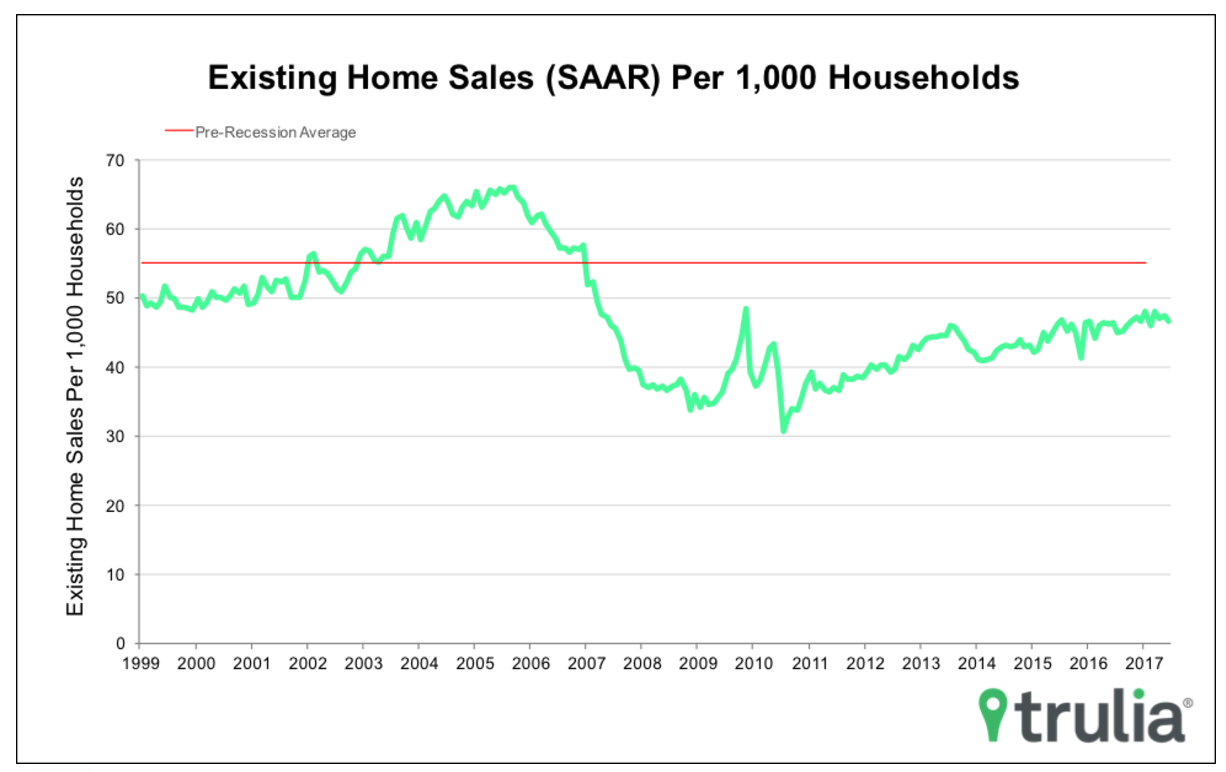

The chart below from Trulia shows how existing home sales in June compare to the pre-recession average.

Click to Enlarge

(Source: Trulia)

“The quickening pace of existing homes sales indicates a robust demand for homes,” Trulia Senior Economist Cheryl Young said. “Steady mortgage rates will continue to encourage demand even in an environment of high prices and little supply. As a result, home buyers are snatching up inventory at rates near equal to the pre-recession peak.”

One economist explained first time homebuyers and other groups looking for affordable housing are the most effected by the inventory shortage.

“This situation primarily affects low to moderate priced home buyers, including millennials, first-time buyers and people of modest means,” realtor.com Senior Economist Joseph Kirchner said. “These groups have had extreme difficulty finding homes and the plummeting sales we have seen for months isn’t showing signs of slowing soon.”