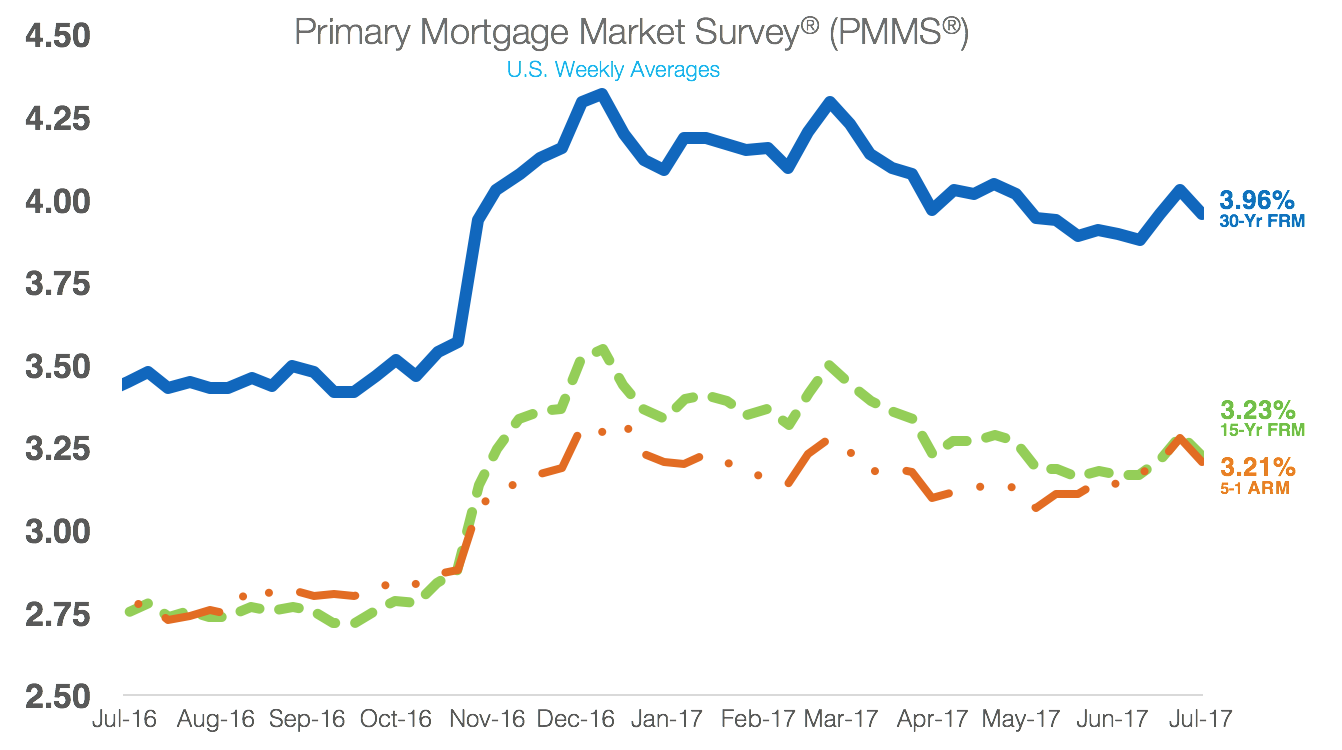

As the market becomes less certain about the current state of the economy, mortgage rates inched lower, once again falling below the 4% mark.

“Continued economic uncertainty and weak inflation data pushed rates lower this week,” Freddie Mac Chief Economist Sean Becketti said. “The 10-year Treasury yield fell five basis points this week.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage decreased to 3.96% for the week ending July 20, 2017. This is down from last week when it averaged 4.03%, but still up from last year’s 3.45%.

The 15-year FRM also decreased, falling to 3.23% from last week’s 3.29%. The 15-year mortgage was also up from last year’s level of 2.75%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage also decreased, falling seven basis points from last week’s 3.28% to 3.21% this week. This is up from 2.78% last year.

“The 30-year mortgage rate moved with Treasury yields, dropping seven basis points to 3.96%,” Becketti said.