Home prices increased once again in April, up from the previous month and previous year, according to the House Price Index released by the Federal Housing Finance Agency.

Home prices increased 0.7% month-over-month in April, FHFA’s seasonally adjusted index showed. This marks an increase of 6.8% annually. And the previous month’s reported 0.6% increase was revised upward to reflect a 0.7% increase in home prices.

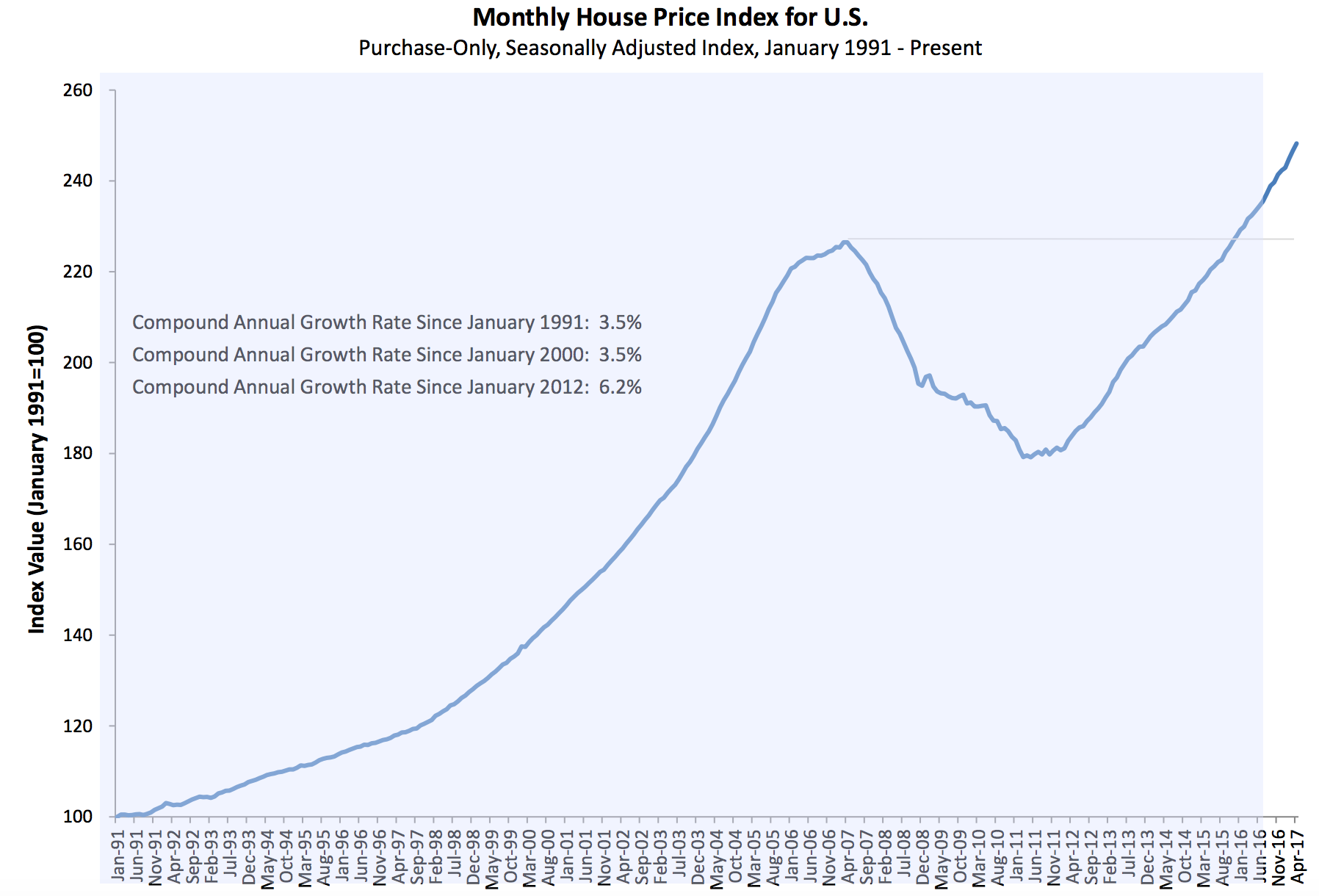

This chart shows the solid trend of increasing home prices since early 2012, and the point where home prices surpassed their previous peak in 2016:

Click to Enlarge

(Source: FHFA)

And the FHFA report isn't the only one reporting increaing home prices. The existing home sales report, released Wednesday by the National Association of Realtors, shows the median home price for existing home sales increased to a new high in May.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. Because of this, the selection excludes high-end homes bought with jumbo loans or cash sales.

Regionally, adjusted monthly price changes from March to April ranged from a decrease of 0.1% in the East South Central division to an increase of 1.6% in the West South Central division. On a year-over-year basis, the changes ranged from an increase of 4.7% in the West North Central division to an increase of 8.9% in the Mountain division.

Here is a list of which states are in each of those divisions:

East South Central: Kentucky, Tennessee, Mississippi, Alabama

West South Central: Oklahoma, Arkansas, Texas, Louisiana

West North Central: Michigan, Wisconsin, Illinois, Indiana, Ohio

Mountain: Montana, Idaho, Wyoming, Nevada, Utah, Colorado, Arizona, New Mexico