Consumer-facing home valuation tools, especially Zillow’s “Zestimate”, have long been a source of consternation in the housing industry.

While Zillow describes the Zestimate as simply a “great starting point” for determining the value of a home, homebuyers and sellers often believe that the Zestimate is the true market value of the home.

And while Zillow’s tool is mainly designed for people looking to buy or sell a home, there’s a new home valuation tool on the market for people looking to buy, sell, or mainly to refinance their mortgage.

The new valuation tool is from LendingTree, which announced Wednesday that it is rolling out a new home valuation feature within its financial intelligence platform, My LendingTree.

According to details from the company, any of My LendingTree’s 5 million current users (or anyone else who signs up for the service) will now have the ability to get a valuation of their home within LendingTree’s system.

The company says that its home valuation tool “leverages a proprietary home valuation model that estimates home value by accessing third party data and tracking it to visualize the user's home value data trends over time.”

So why is LendingTree offering this service, beyond increasing consumers’ knowledge about their financials, of course?

To boost home equity lending, it appears.

LendingTree, which bill itself as “nation's leading online loan marketplace,” connects lenders with consumers – and the company views its home valuation tool as a way to provide its users with “actionable” information about their homes and mortgages.

Here’s how the company describes it:

My LendingTree utilizes existing mortgage balance information to estimate the user's home equity, and through real-time marketplace data, informs users when there's an actionable opportunity to tap into home equity.

According to details from the company, My LendingTree users that have a mortgage have an average home value of $310,000 and an average mortgage balance of roughly $178,000, which translates into roughly $132,000 of “untapped home equity” on average.

And the company wants to help its users “tap into” that home equity.

“We're continuing to evolve the My LendingTree platform to bring consumers valuable information they need to make smarter financial decisions,” Nikul Patel, LendingTree's chief product and strategy officer, said. “Our home valuation feature allows borrowers to see an estimate of their home value and untapped equity that can be accessed for home improvement projects, debt consolidation, education costs and more.”

Here’s how it’s going to work.

My LendingTree also displays information on a user’s existing financial accounts and loans, including credit card accounts, mortgages, home equity loans, auto loans, personal loans, and student loans.

Through My LendingTree, users are also provided with completely free credit scores, an analysis of their credit report that highlights important changes, and grades for the six primary factors that influence their score, LendingTree said.

My LendingTree then alerts users when an opportunity emerges to save money, based on real-time marketplace data on the LendingTree network.

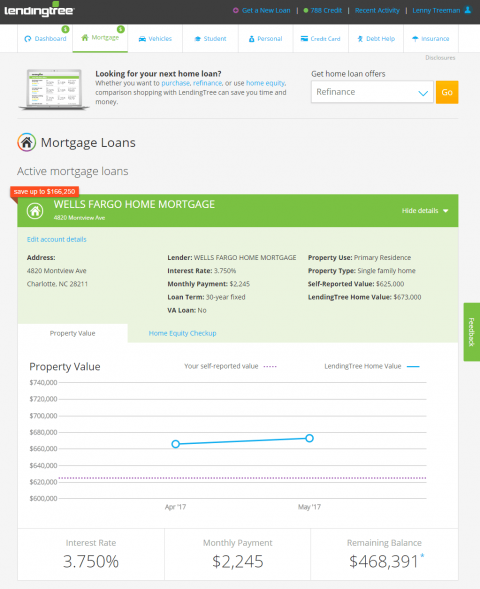

My LendingTree users will also be able to into the system to get a valuation of their home and compare it to their mortgage (as seen in the image below).

(Click to enlarge)

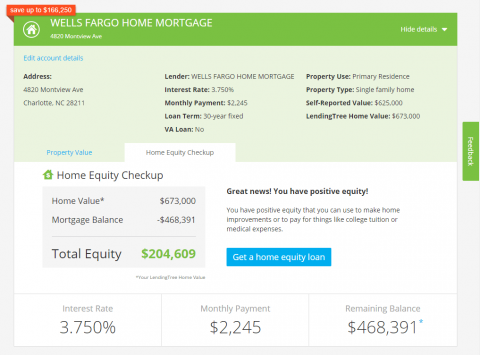

From there, users can easily click over to the “home equity checkup,” which compares the home valuation data and mortgage balance data from a user's credit report. Then, My LendingTree calculates how much equity users have in their homes so they can “immediately see their home value and available equity in one convenient location.”

As seen in the image below, users are then shown the total equity they have in their home and encouraged to get a home equity loan, if they are interested.

(Click to enlarge)

According to LendingTree, the company “has facilitated more than 65 million loan requests” since its inception, and the company’s network currently includes more than 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more.”

And if this new valuation tool is successful, there will undoubtedly be a few more home equity loans for some of those lenders.