[Update 1: Fed raised rates, full coverage here.]

The Federal Reserve will determine if it will raise the federal funds rate in its June meeting, which will be announced Wednesday afternoon.

The majority of experts believe this will be the second of three or even four rate hikes in 2017, although some experts disagree. The general consensus, however, is that the market will see a rate hike in June.

But one economist explained a federal funds rate hike will not matter to the housing market.

“With the Federal Reserve Open Market Committee meeting to decide whether to increase the Federal Funds rate in just a few days, the potential for an increase in mortgage rates dominates the housing news and industry chatter,” said Mark Fleming, First American Financial Corp. chief economist. “Yet, changes to the short-term rate matter little to the housing market.”

Fleming explained changes to short-term interest rates have little influence on mortgage rates.

“Mortgage rates, particularly the very popular 30-year, fixed-rate mortgage, are benchmarked to the 10-year Treasury bond,” Fleming said. “A wide range of global political and economic factors can influence the yield on long-term bonds, such as the ten-year Treasury bond.”

“For example, last summer the Brexit vote caused a ‘flight to safety’ and increased demand for U.S. Treasury bonds,” he said. “In the week following the Brexit vote, the yield on the 10-year Treasury declined by 0.3 percentage points and the mortgage rate fell from 3.56% to 3.41%.”

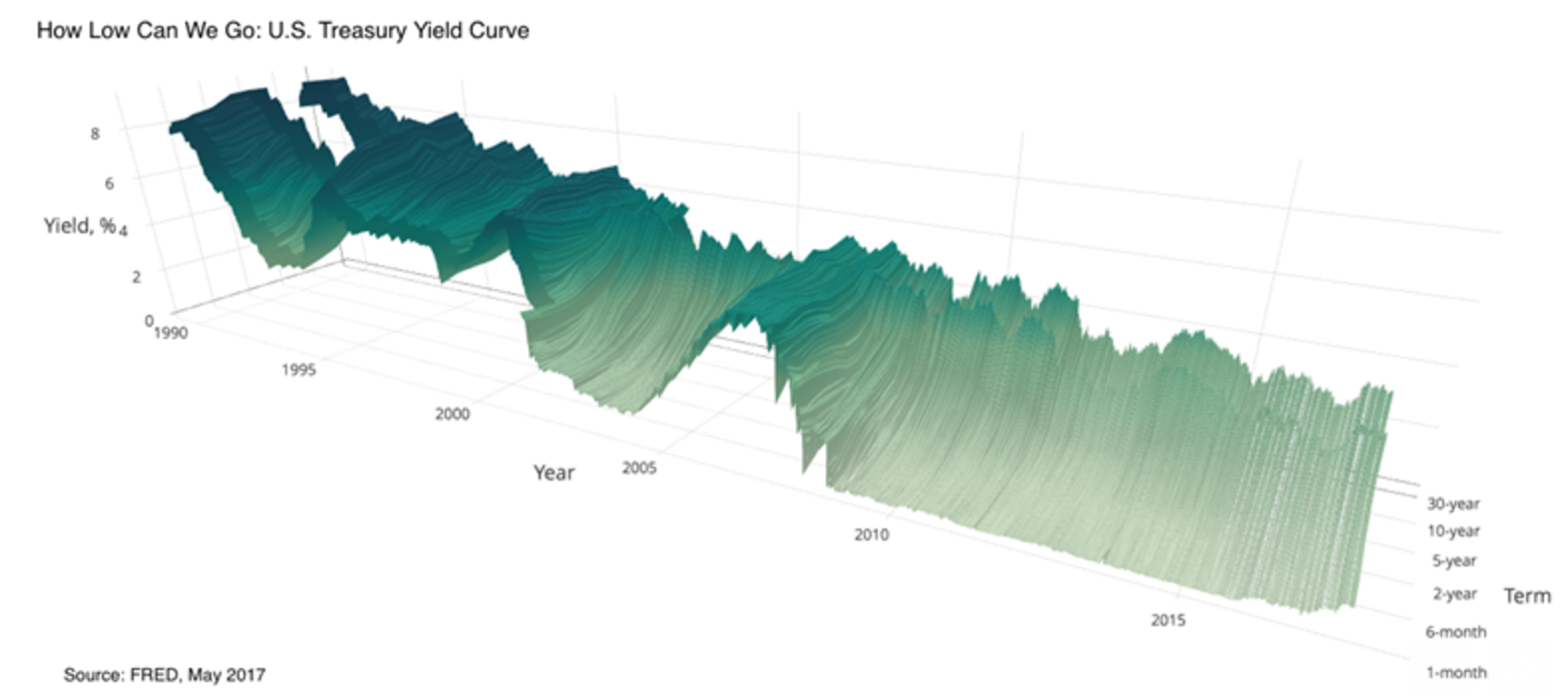

This chart shows the yield curve remains flat even as the FOMC continues to raise rates. Fleming predicted if the Fed continues to raise rates, the yield curve will flatten futher.

This chart shows the Treasury Yield Curve since 1990:

Click to Enlarge

(Source: FRED)

“Today, by historic standards, the yield curve is flat, but not inverted, and rates are low,” Fleming said. “The housing market has benefited as mortgage rates have stayed at or near historic lows, even as the Fed has started to increase the Federal Funds rate and push up the short end of the yield curve.”

“So, where will rates go from here?” he said. “If the FOMC raises rates again, will the yield curve flatten further, or will longer-term rates feel the pressure and rise as well? History suggests further flattening.”