Morgan Stanley isn’t really a big player in mortgage lending, but the company wants that to change – and it’s planning to go digital to get there.

That was the goal laid out on Tuesday by Naureen Hassan, Morgan Stanley’s chief digital officer for wealth management, during a presentation at the Morgan Stanley U.S. Financials Conference.

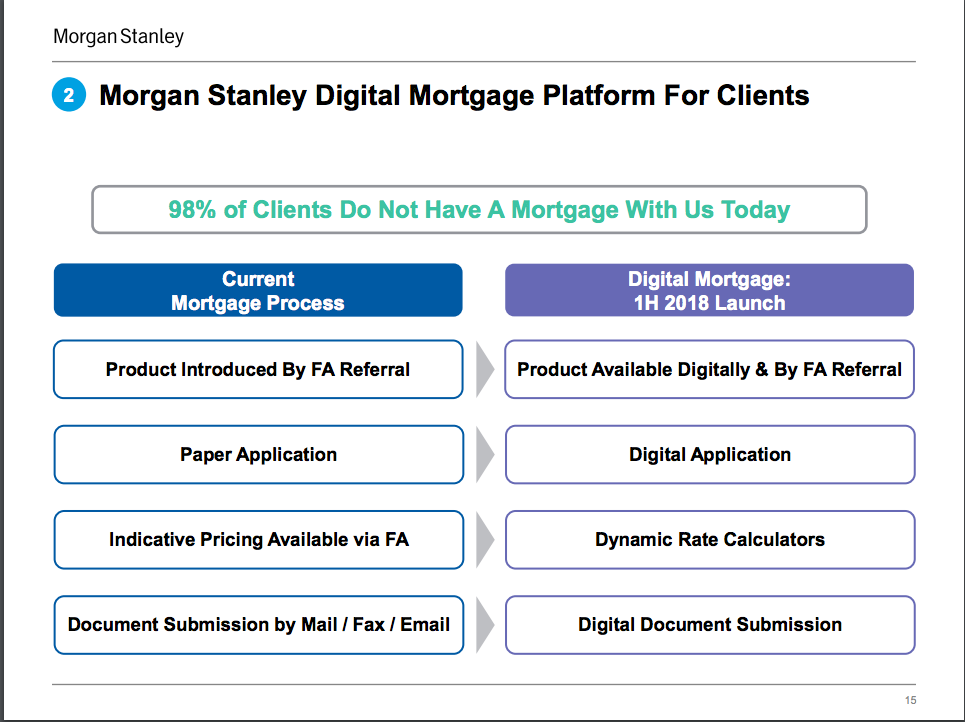

According to Hassan’s presentation, currently, 98% of Morgan Stanley’s clients do not have a mortgage through Morgan Stanley, and the company views that as an opportunity for significant growth.

Basically, the company wants to turn more of its existing clients into mortgage customers, and it is planning to update its mortgage process to entice more of those customers to turn to Morgan Stanley for their mortgages.

According to Hassan’s presentation, Morgan Stanley’s mortgage process is currently decidedly non-digital, including paper applications, and document submission via mail, fax, or email.

But the company wants that to change.

Hassan said Tuesday that the company is planning to roll out a digital mortgage application process.

According to the Reuters report, Hassan did not specify a projected date for official introduction of its digital mortgage, but the presentation made available on Morgan Stanley’s investor relations website noted that the digital mortgage will be rolled out in the first half of 2018 (as seen in the image below).

Hassan’s presentation noted that Morgan Stanley’s digital mortgage will give clients the ability to apply for a mortgage digitally, get rate estimates online, and submit documents digitally as well.

(Click to enlarge. Image courtesy of Morgan Stanley.)

The move comes right on the heels of Morgan Stanley joining with many other large financial institutions to bring person-to-person payments into the mainstream by participating in the new payment system Zelle.

(h/t Reuters)