The appraisal process continues to lengthen, creating problems for many homebuyers who can’t afford to buy their home in cash, according to a new blog from Sheryl Pardo for the Urban Institute.

Urban Institute pointed out several solutions to the growing problem including reevaluating professional requirements for new appraisers and utilizing new technology in the appraisal process.

At the current pace, appraisals can kill deals and even give cash buyers an added advantage, according to Urban Institute’s report.

Some argue, there are not enough appraisers to meet the rising homebuyer demand as they struggle to fill out long or even redundant forms. Appraisers themselves often comment on HousingWire message boards and say there is no shortage; Quality appraisers are just unwilling to make, what they say, are unreasonable concessions.

While mortgage origination volume is variable, appraisers’ capacity is more fixed, the report explained. The difference often leads to unpredictable earning potential for appraisers and volatility in costs and turn times for lenders and borrowers.

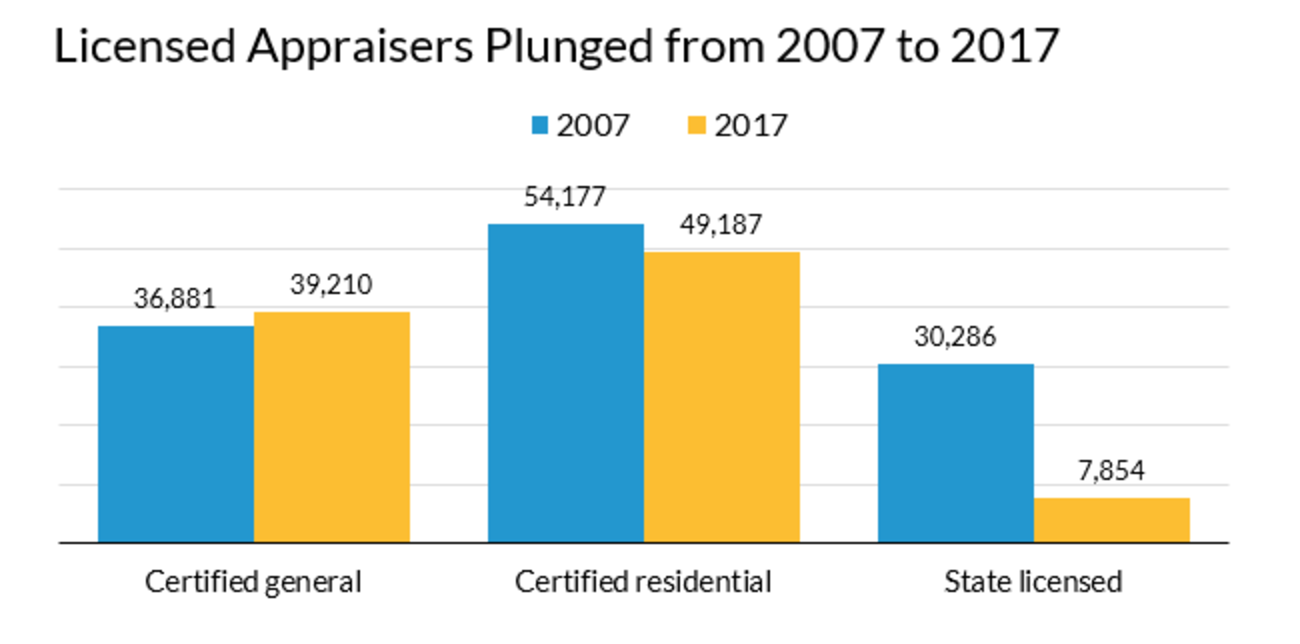

Click to Enlarge

(Source: Urban Institute)

This problem intensified in 2016 as the demand for appraisals grew. However, the unpredictable wages kept new appraisers from entering the field.

Key government agencies finally addressed the critically growing appraisal shortage crisis that’s hampering the mortgage process, highlighting two alternative options to help areas that are facing a shortage. The two options include temporary practice permits and temporary waivers.

However, according to at least one veteran appraiser, the two suggestions don’t bring the clarity needed and missed the mark on effectiveness.

The Urban Institute suggests three changes than need to take to speed up the appraisal process and make it more efficient.

Simplify the qualifications: Zach Dawson, Fannie Mae director of collateral strategy and policy, explained that the market needs a viable way to attract and retain professionals. Similarly, Pete Carroll, Quicken Loans executive vice president, argued that the college education requirement could be eliminated and the experience requirement could be shortened. He recommended targeted, relevant training and noted that the Appraiser Qualifications Board was moving in this direction.

Streamline the appraisal process: Carroll suggested that the current appraisal process be shortened and simplified to require only relevant data. Creating a centralized database with market- and property-level data would become the centerpiece of a future process, though determining who owns and maintains the database poses some challenges.

Embrace new technology: Technological advances could bring significant improvements and disruption to the appraisal industry. Susan Allen, CoreLogic senior vice president of valuation solutions, demonstrated when discussing imaging technology, relying on technology can produce unique problems. Although drones can capture many images for a property, it’s more expensive to send a drone than an appraiser. While technology is important to the field, Allen pointed out human expertise will always be needed.