Thanks to the residential mortgage-backed security market continuing its strong performance in the month of May, RMBS-related issuance is now on track to have its best year since 2013, a new report from Standard & Poor’s Global Ratings shows.

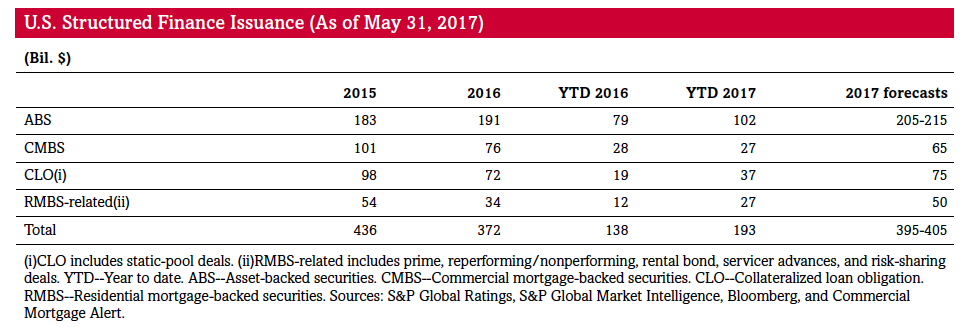

According to the S&P report, 2017’s total RMBS-related issuance, which S&P defines as prime, re-performing/nonperforming, rental bonds, servicer advances, and risk-sharing deals, sat at $27 billion at the end of May.

That’s more than double the total RMBS-related issuance during the first five months of 2016, when there was only $12 billion issued.

And according to S&P’s report, if issuance continues at the same pace throughout the rest of the year, 2017 could see $65 billion of potential issuance, which would far outstretch S&P’s current forecast of $50 billion.

In fact, based on the strength of the first few months of 2017, S&P previously raised its 2017 forecast for RMBS issuance from $35 billion to $50 billion, so $65 billion in issuance would almost double S&P’s original forecast for the year.

Additionally, it should be noted that 2017’s current projected RMBS issuance of $65 billion would be the most in four years, as 2016’s total issuance was $34 billion, while 2015’s total was $54 billion, and 2014’s total was $38 billion.

Breaking down May’s strong performance, S&P said:

Monthly RMBS-related issuance reached a new monthly high of $6 billion, creating $27 billion of issuance so far in 2017. Credit risk transfers posted over $2 billion of the total spread across two Fannie Mae deals. Remaining offerings were supported by a variety of collateral, including re-performing loans, nonperforming loans, performing loans, prime, and seasoned performing.

Overall, year-to-date issuance of structured finance, which also includes asset-backed securitizations, collateralized loan obligations, and commercial mortgage-backed securitizations, now stands at $193 billion, up about 40% year-over-year, as shown in the chart below.

(Click to enlarge. Courtesy of S&P)

As for the cause for the strong year, S&P says it’s due to multiple factors.

“While no one specific factor is driving issuance, we note that conditions have been ideal, with tight spreads offering attractive financing levels for

issuers,” S&P notes.

“Rates are also expected to increase, which may be driving some ABS issuers to move more assets off their balance sheets to free up capacity,” S&P continues.

“Overall interest rates have remained relatively low and attractive to borrowers that currently have low debt service obligation,” S&P concludes. “Prorating 2017 issuance so far would create more than $460 billion of issuance, but it is still difficult to say how much longer these ideal market conditions will continue.”