While it’s only a small improvement, California still managed to record an increase in home affordability, according to the latest report from the California Association of Realtors.

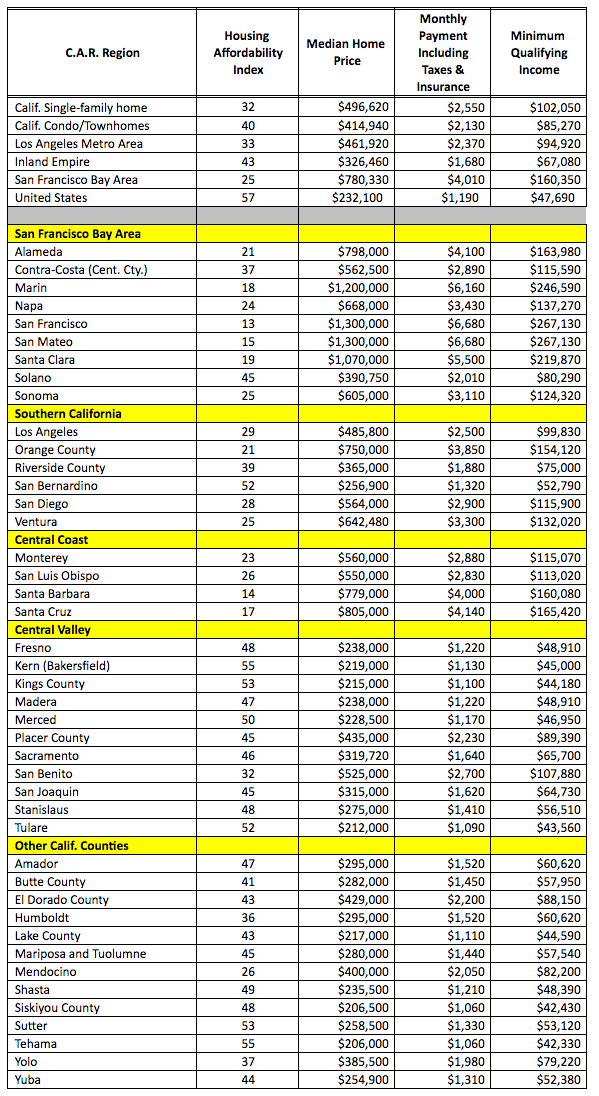

However, a look at the different counties across the states shows that geographical location makes a difference, as seen in the chart at the end of the article.

So what percentage of income should be available to get a mortgage? Well, that depends on where the house is located

Overall, the latest Traditional Housing Affordability Index from CAR posted that the percentage of homebuyers who could afford to purchase a median-priced, existing single-family home in California in first-quarter 2017 inched up to 32%. Although this is up from 31% in the fourth quarter of 2016, it is down from 34% in the first quarter a year ago.

CAR noted that this is the 16th consecutive quarter that the index has been below 40% and is near the mid-2008 low level of 29%.

For perspective, California’s housing affordability index hit a peak of 56% in the fourth quarter of 2012.

The HAI measures the percentage of all households that can afford to purchase a median-priced, single-family home in California. CAR also reports affordability indices for regions and select counties within the state.

For the whole state, homebuyers needed to earn a minimum annual income of $102,050 to responsibly qualify for the purchase of a $496,620 statewide median-priced, existing single-family home in the first quarter of 2017. The monthly payment, including taxes and insurance on a 30-year, fixed-rate loan, would be $2,550, assuming a 20% down payment and an effective composite interest rate of 4.36%.

The minimum income needed to qualify for a loan on the median-priced home is calculated using the rule that the monthly payment for principal, interest, taxes and insurance can be no more than 30% of a household's income.

The chart below gives a breakdown of individual counties and regions.

Click to enlarge

(Source: CAR)