Old Republic International Corporation’s Title Insurance earnings performed well in the first quarter 2017, far outpacing last year's first quarter.

The company noted that all of the year's operating earnings improvement emanated from more profitable consolidated underwriting and related services operations.

Home, commercial automobile (trucking) and national accounts continued to post the strongest general insurance gains.

Outside of those listed above, positive general insurance earned premiums trends were unevenly distributed among various insurance coverage’s and sources of business.

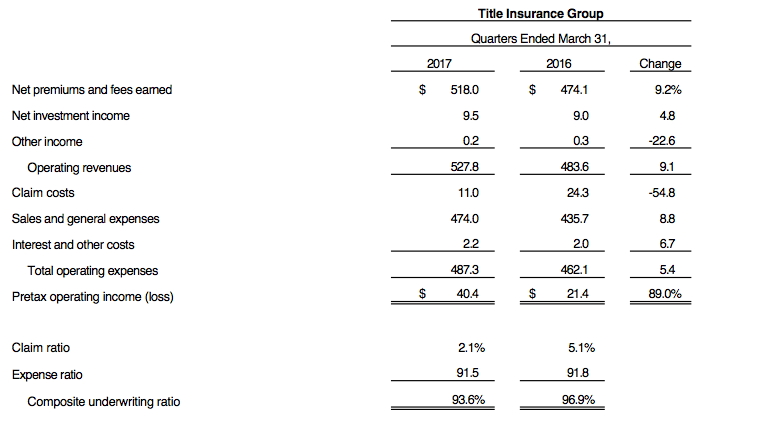

This year's first quarter operating income for title insurance was better than expected as both revenues and claim costs extended the favorable trends of recent years.

The chart below looks solely at the title insurance business.

Click to enlarge

(Source: Old Republic)

As for mortgage insurance, investment income was also lower as reduced premium volume and on-going claim payments affected downward pressures on the invested asset base.

While the declining premium base led to an increase in the claim ratio for 2017, reported claim costs for mortgage insurance were relatively flat in comparison to the first quarter of 2016, the earnings reports.

The chart below pulls out the mortgage insurance segment of Old Republic.

Click to enlarge

(Source: Old Republic)