Private mortgage insurer Radian Group’s new mortgage insurance written jumped 25% in the first quarter 2017, helping drive a strong start to the year.

According to its first-quarter earnings release, new mortgage insurance written hit $10.1 billion for the quarter, compared to $13.9 billion in the fourth quarter of 2016 and $8.1 billion in the prior-year quarter.

Similar to industry trends, refinance insurance dropped in the first quarter, accounting for 16% of total NIW, compared to 27% in the fourth quarter of 2016, and 19% a year ago.

Net income for the quarter increased to $76.5 million, or $0.34 per diluted share, up from $66.2 million, or $0.29 per diluted share, in the first quarter 2016.

“I am pleased to report strong first quarter results for Radian, including year over year growth in net income, book value and new MI business written,” said Radian’s CEO Rick Thornberry. “As persistency rises, we expect our large, high quality MI in-force portfolio to grow and generate future premium revenue. This is the primary driver of future earnings for Radian.”

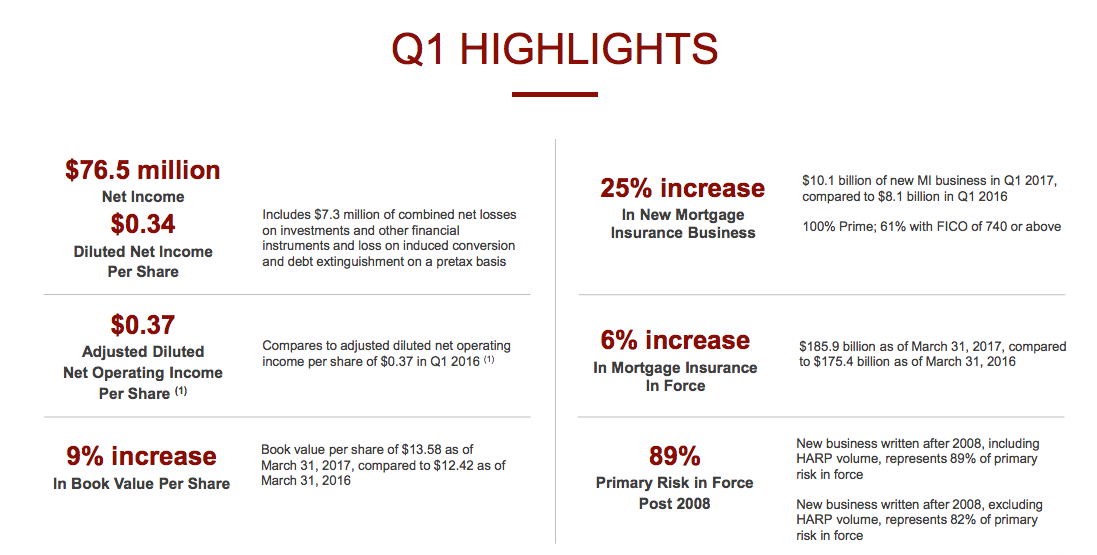

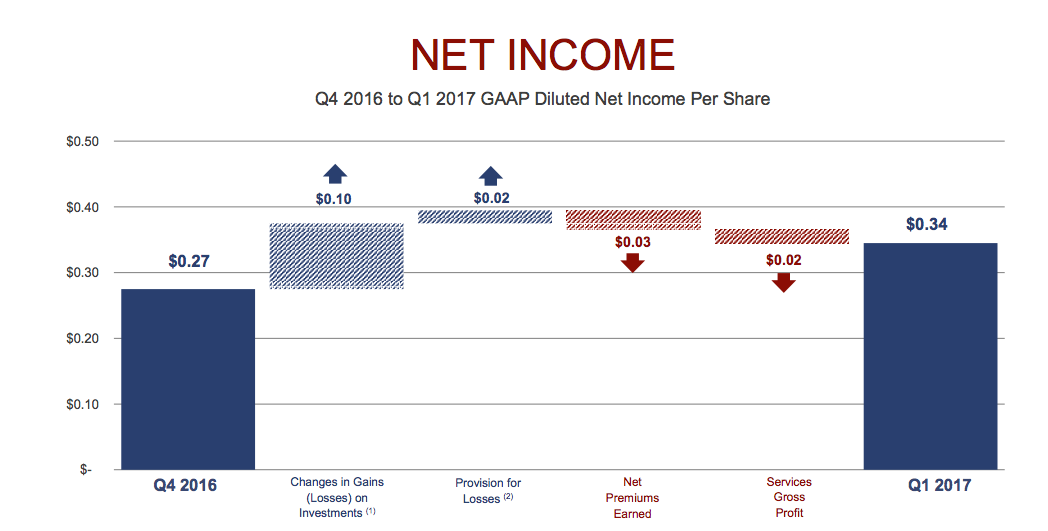

The two charts below break down the highlights from Radian’s earnings.

The first gives an overview of how the mortgage insurer improved in the first quarter, while the second one looks specifically at net income.

Click to enlarge

(Source: Radian)

Here are other quick highlights from the report:

- Total primary mortgage insurance in force grew to $185.9 billion, compared to $183.5 billion as of Dec. 31, 2016, and $175.4 billion as of March 31, 2016.

- The mortgage insurance provision for losses came in at $47.2 million in the first quarter, down from $54.7 million in the fourth quarter of 2016, but up from $43.3 million in the prior-year period.

- The total number of primary delinquent loans fell by 11.4% in the first quarter from the fourth quarter of 2016, and by 16.4% from the first quarter of 2016.

- Total net mortgage insurance claims paid dropped to $82.1 million in the first quarter, down from $116.5 million in the fourth quarter of 2016, and $127.7 million in the first quarter of 2016.

“After nearly two months with Radian as CEO, my excitement about the prospects ahead continues to grow. I decided to join the company based on the excellent businesses, great team, diversified set of products and services, high quality portfolio, and the institutional commitment to serve customers,” Thornberry added. “Those qualities, along with a strong capital base, solid profitability and excellent market opportunity, are a winning combination.”