Movement Mortgage is less than 10 years old and is already making a major imprint on the housing finance market between financing more than $12 billion in residential mortgages and launching a new digital mortgage app all in 2016 alone.

The Fort Mills, South Carolina-based lender, formerly known as New American Mortgage, focuses its business around a lot more than only lending, dedicating a lot of attention to the company’s culture and impact on local communities and nonprofits.

The company recently announced its first annual Movement Impact Report to stakeholders on its business operations, growth and community investments.

Back at the start of 2015, the company's founder and CEO, Casey Crawford said the company was adding about 80 employees every month and even discussed its big plans for a new headquarters.

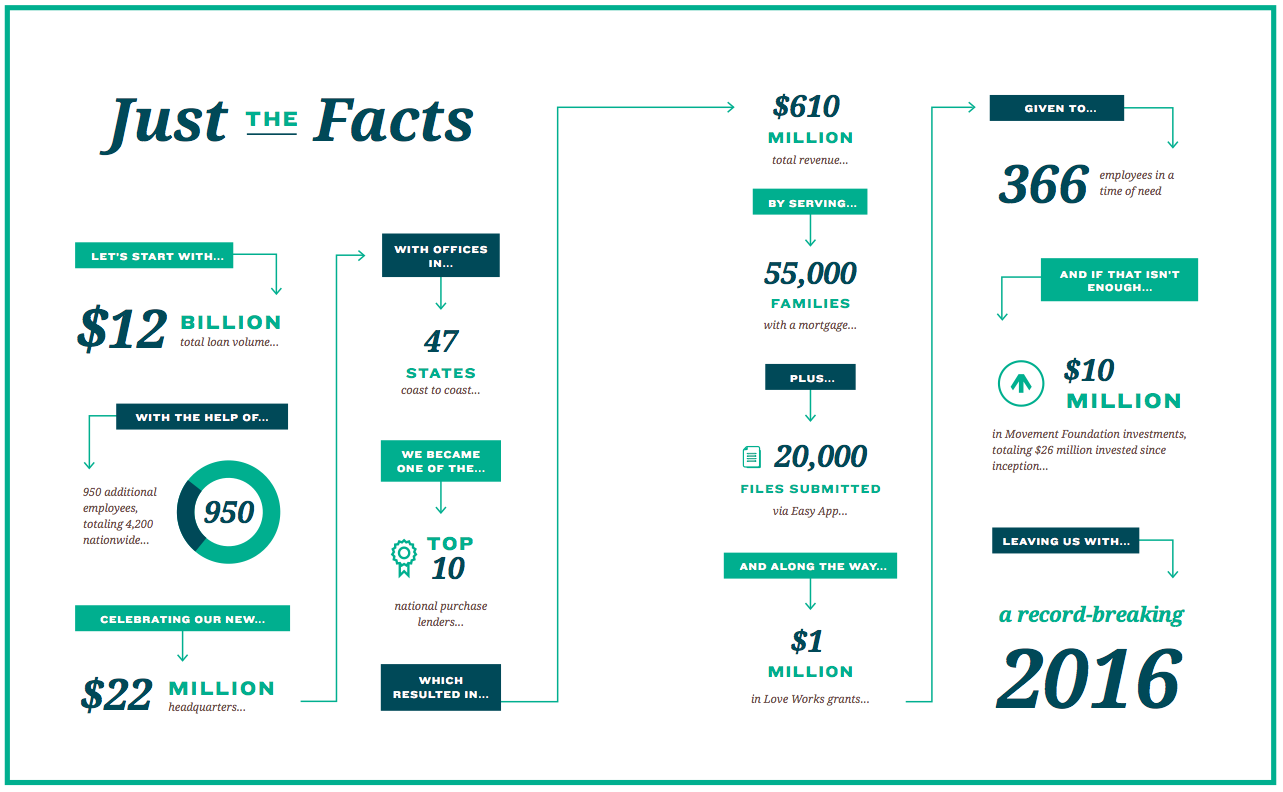

The chart below gives a breakdown of just the facts from Movement Mortgage’s lending operations in 2016, which set records in total volume, profit, national market share and employees.

Click to enlarge

(Source: Movement Mortgage)

Last year, the lender financed more than $12 billion in residential mortgages and also introduced the Easy App digital mortgage experience, which served approximately 20,000 applicants in its first three months.

On top of this, in 2016, Movement created nearly 1,000 new jobs, opened a $22 million headquarters and increased its total investment in communities through the Movement Foundation to $27 million.

The article’s main photo, provided by Movement Mortgage, is of its new headquarters in Fort Mill, S.C., which opened in March of 2016.

"Our goal is to transform our industry, corporate culture and communities through our business. These results are not our focus, but rather the evidence that we are making progress in our mission to be a movement of change," Founder and Chief Executive Casey Crawford says. "While we are certainly grateful and humbly praising God for our results so far, we're not satisfied. There are still many thousands of families and communities for us to love and serve. The best is yet to come."

The first annual letter is 57-pages long and gives an in-depth overview of how the company is performing, along with how it transformed local communities and nonprofits through its Movement Foundation.

Here are just a few highlights from the company outside of residential lending:

- Last year Movement's employee care program, Love Works, gave away $1 million in grants to 366 employees facing unexpected financial burdens.

- In 2016, Movement launched a 90-day debt loss challenge, #loseamillion, that resulted in over $2.8 million in employee personal debt eliminated across the company, almost triple the original goal.

- The Movement Center, a $3 million investment from the Movement Foundation, continues to give local ministries and nonprofits a low or no-cost co-working space for collaboration and community outreach.

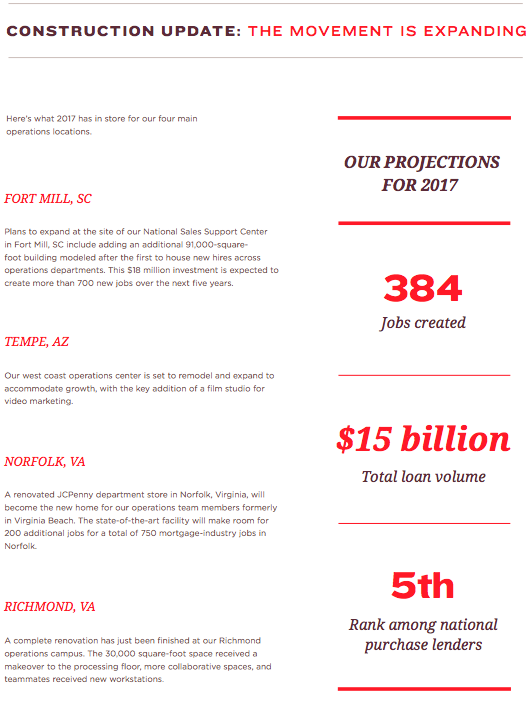

And the company only has greater plans ahead. In the annual letter, it concluded, “Moving forward into 2017, we commit to taking the next steps toward our vision to finance one out of every 10 homes purchased in America while transforming our industry, culture and communities. With the dedication of our leaders, sales teams and operations support, we are poised to see continued overflow. We are excited to see where it will all take us and what world-changing opportunities are in store.” Here’s a snapshot at the progress Movement expects to make in 2017:

Click to enlarge

(Source: Movement Mortgage)