As the mortgage regulation alphabet continues, with lenders implementing HMDA, TRID, QM and more, the industry cited regulation as having a negative impact on business production and consumer credit availability, according to the American Bankers Association’s 24th annual Real Estate Lending Survey.

The survey included responses from 159 banks. The data was collected from Jan. 19, 2017 to Feb. 24, 2017, and of the survey participants, 63% of respondents were commercial banks and 37% were savings institutions. About 76% of the participating institutions had assets of less than $1 billion.

“Non-qualified mortgage loans have been subject to heightened regulatory requirements and risk, reducing the willingness of banks to extend these loans to even the most creditworthy borrowers,” said Robert Davis, ABA executive vice president.

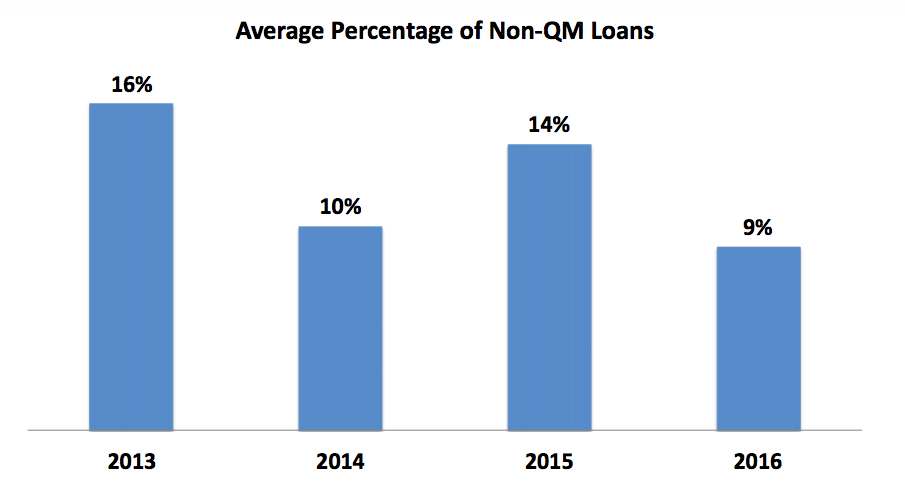

Looking at the current status of the Qualified Mortgage market, the chart bellows shows that since 2013, the average percentage of non-QM loans has significantly declined, falling from 16% in 2013 to only 9% in 2016.

Click to enlarge

(Source: ABA)

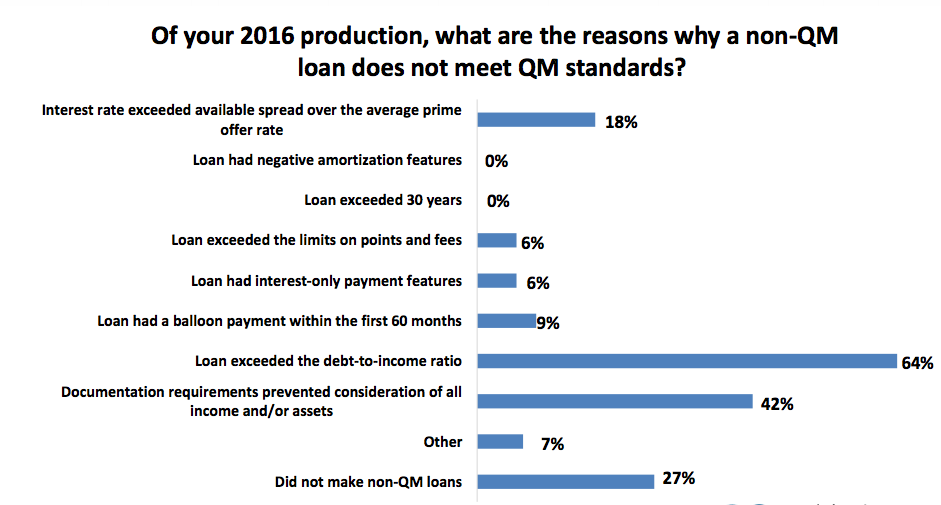

Respondents stated that the No. 1 reason why a non-QM loan does not meet QM standards is due to loans exceeding the debt-to-income ratio, as seen in both charts below.

Click to enlarge

(Source: ABA)

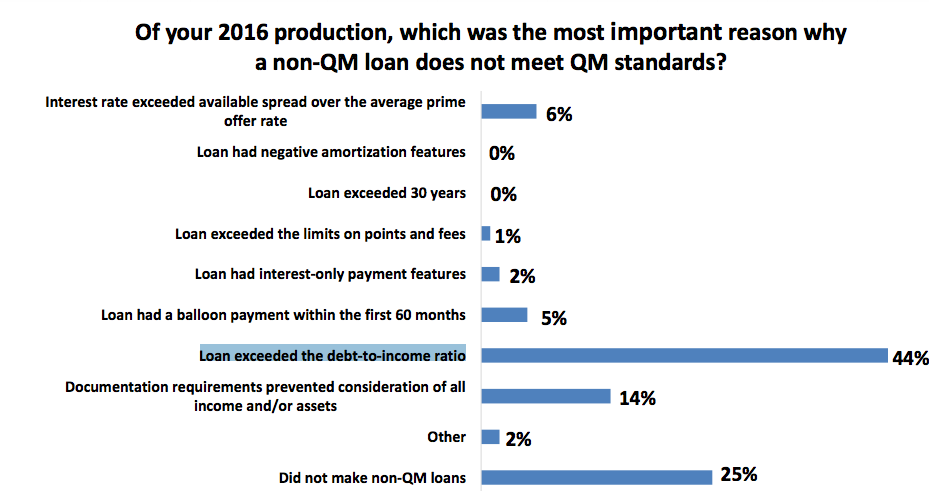

Click to enlarge

(Source: ABA)

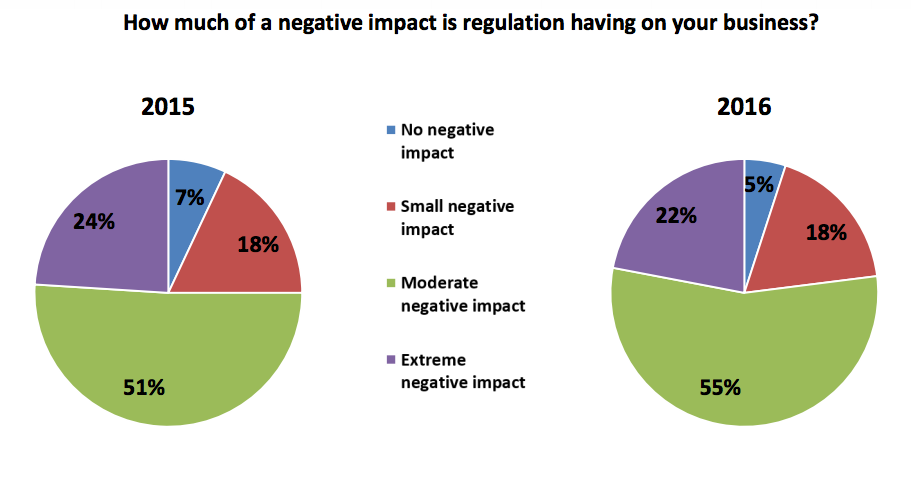

And regulation, while maybe not an extreme burden, is still causing a moderately negative impact on loans. The chart below shows that in 2016, 55% of lenders cited that regulation had a moderate negative impact on their business, compared to 51% in 2015.

Click to enlarge

(Source: ABA)

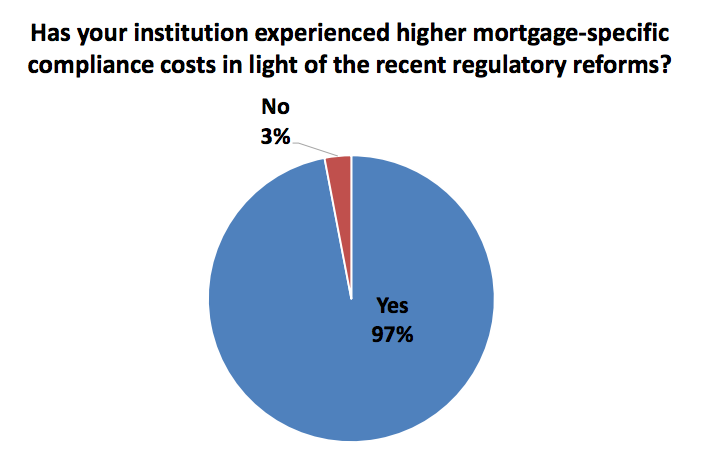

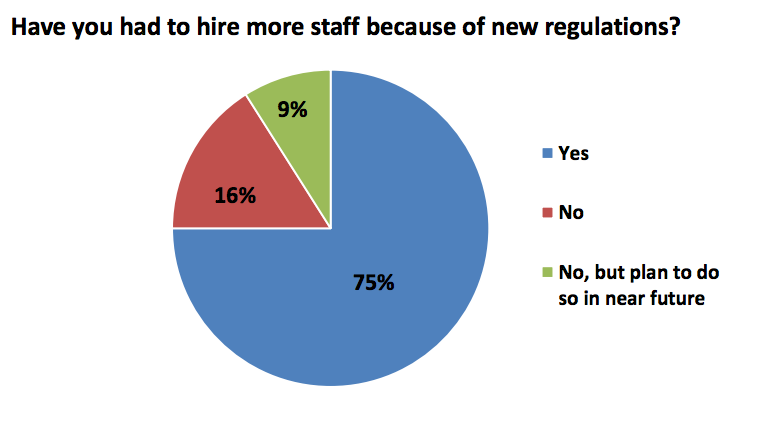

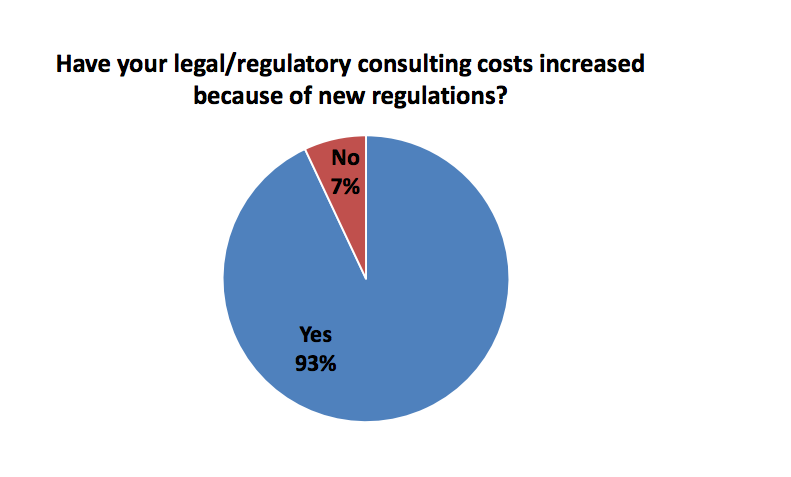

The next three charts give quick facts on how mortgage regulations have impacted costs.

Click to enlarge

(Source: ABA)

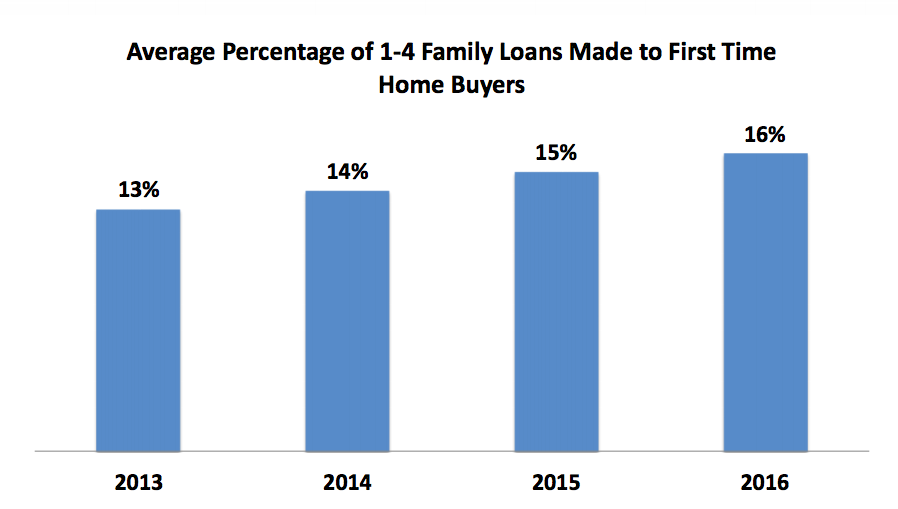

The ABA is optimistic about the future, with lenders slowly increasing the loans they originate for first-time homebuyers.

Click to enlarge

(Source: ABA)

“Despite ongoing regulatory hurdles, community banks remain resilient in their ability to manage risk levels, increase productivity and introduce more first-time homebuyers into the market.”