#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

After a 10-year exodus out of the mortgage servicing business, financial institutions are starting to reverse course. Rising interest rates and the prospect of looser regulations under President Trump make servicing a smart play again, providing companies with an alternative as refinances dry up.

In the aftermath of the financial crisis, low interest rates and strict capital requirements combined to make servicing a losing proposition for many banks, who sold off their mortgage servicing rights at every opportunity. The sharp glare of regulators didn’t help either, as banks and nonbanks navigated the already thankless waters of servicing with a new target on their backs.

But all that changed abruptly in the fourth quarter of 2016 with the one-two punch of a Trump win and a rate hike by the Federal Reserve. Seemingly overnight, the economic outlook for servicing was once again sunny, and companies that held tight to servicing rights over the last decade are facing a bright future indeed. In fact, the new environment might just be enough to lure banks back to expand their servicing business again.

RISING INTEREST RATES

On December 14, 2016, the Federal Open Market Committee raised the federal funds rate for only the second time in 10 years, moving the target range from 0.5% to 0.75%. The Fed had been waiting to see better employment numbers and a return to 2% inflation before making the move, but, although inflation was still at about 1.5%, the Fed felt optimistic enough to act in December.

“Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year,” the Fed said in a statement.

“Job gains have been solid in recent months and the unemployment rate has declined. Household spending has been rising moderately but business fixed investment has remained soft,” it continued. “Inflation has increased since earlier this year but is still below the committee’s 2% longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports.”

The last time the Fed had raised the federal funds rate, in 2015, was the first increase since June 2006. In its latest December meeting, the Fed indicated that it expected to raise rates three times in 2017, although some in the industry remain skeptical.

Jason Obradovich, executive vice president at New American Funding, said he couldn’t see three rate hikes “unless there’s some massive tax cuts or infrastructure spending or deficit spending by the Trump administration.”

Rising interest rates are good news for servicers. In a low-rate environment, the cost and trouble of mortgage servicing could easily outweigh the benefits. With low interest rates, borrowers can pay off their loans sooner, cutting the value of mortgage servicing rights. Yet compliance costs increased tremendously during this same period.

In 2007, the average cost to service a mortgage loan was $55 per loan per year, according to the MBA’s Servicing Operations Study. By 2016, that cost had grown to $208 per loan per year. As a result, the largest banks consistently cut their mortgage servicing portfolios, particularly third-party mortgages, over the last six or seven years.

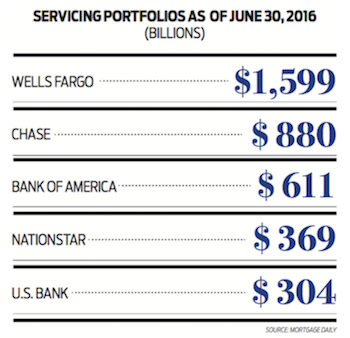

Nasdaq.com reported in November that there were around $8.9 trillion in outstanding mortgages in the U.S. at the end of Q3 2016, and 40% of those are serviced by the five largest banks in the country. “However, these banks have seen a notable reduction in their total mortgage servicing portfolio over recent years, as the figure has fallen from over $3.8 trillion at the end of Q3 2015 to below $3.6 trillion now — a year-on-year reduction of 7%.

“This is because stricter regulatory requirements since the economic downturn have made the mortgage servicing business less profitable — resulting in banks running off their third-party mortgage servicing portfolios,” the article concluded.

Some of that reduction is due to Basel III requirements, rules that address capital shortfall, leverage risk and liquidity risk for banks, but don’t apply to nonbanks. Marshall Lux and Robert Greene wrote about the servicing trend in a working paper for the Mossavar-Rahmani Center for Business and Government at the Harvard Kennedy School in 2015.

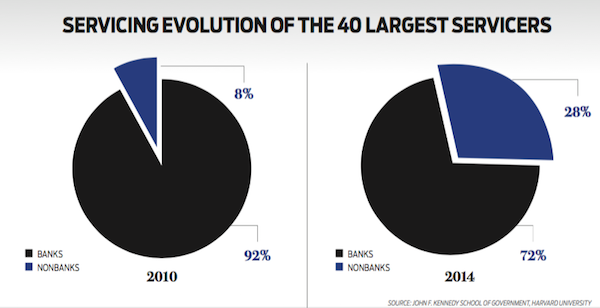

“In recent years, pressures that exclusively affect depository institutions – including capital requirement adjustments and regulatory scrutiny – have driven them to sell MSRs to nonbanks,” Lux and Greene wrote. “In 2014, non-banks held 28.2% ($2.02 trillion) of outstanding servicing obligations amongst the top 40 servicers ($7.16 trillion); yet in 2010, non-banks held just 7.9% ($657 billion) and in 2005 held only 14.2% ($947 billion).”

As just one example, the report notes that Citigroup sold 21% of its MSRs in 2013, worth $63 billion at the time.

#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

A REGULATORY QUAGMIRE

Capital requirements aren’t the only regulations banks have had to contend with — they have also been under intense scrutiny from the Consumer Financial Protection Bureau and other regulators for how they treat consumers in the servicing process. In the National Mortgage Settlement of 2012, five of the country’s largest mortgage servicers during the financial crisis — Ally/GMAC, Bank of American, Citi, JPMortgan Chase and Wells Fargo — paid $25 billion in fines for their abuse of consumers.

“Goldman Sachs research notes that the fines and penalties incurred by depository institutions engaged in servicing are driving their exit, and today’s nonbanks – which were largely not active in pre-crisis origination and servicing – enjoy a regulatory advantage, driving their growth in market share,” Lux and Greene wrote.

But although it’s true that nonbanks weren’t part of the National Mortgage Settlement, they have felt their share of regulators’ wrath when it comes to servicing practices.

Three of the banks named in the settlement — JPMorgan Chase, Bank of America and Ally Bank — sold much of their MSRs to Ocwen Financial, which became the fourth-largest servicer and the largest nonbank servicer as a result. In doing so, Ocwen also invited intense regulator scrutiny, becoming a frequent target of legal action from the Securities and Exchange Commission, the CFPB and the New York Department of Financial Services.

After a barrage of legal challenges and settlements, Ocwen decided to exit agency servicing in December of 2014. In a conference call to investors that month, Ocwen’s CEO, Ron Faris, said, “We estimate the difference between our $1.1 billion book value and fair value of our agency MSRs is between $400 and $500 million dollars.”

And Ocwen is far from the only nonbank that regulators have scrutinized.

After purchasing MSRs from Bank of America, Green Tree Servicing, a subsidiary of Walter Investment Corp. (now merged with another Walter subsidiary, Ditech) paid $63 million to resolve Federal Trade Commission and CFPB charges in 2015.

And in November 2016, the NYDFS fined PHH $28 million for “shoddy mortgage origination and servicing practices,” which PHH maintains were related to “legacy” issues that took place from 2010-2014. PHH decided to sell “substantially all” of its Ginnie Mae MSR portfolio and related servicing advances to Lakeview Loan Servicing, and said it expects the proceeds of the deal, excluding transaction and other costs, to be $122 million.

Both federal and state regulators have stepped up their oversight of nonbanks in the past few years. In 2013, the CFPB issued mortgage servicing rules that applied to both kinds of financial institutions, thus limiting some of the advantage the non-depository institutions had servicing loans.

#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;}

THE NEW AGE OF SERVICING

So what do experts expect the new servicing landscape to look like?

For one thing, it’s likely that both banks and nonbanks will increase their servicing portfolio with loans they originate. The regulatory oversight may loosen under Pres. Donald Trump (see related feature here), but the risk involved in third-party servicing is still high.

During an RMBS servicer roundtable hosted by Fitch Ratings in November, industry experts predicted more business for nonbanks. According to a Yahoo Finance article, “The overwhelming consensus (89%) of panelists at Fitch’s roundtable agreed that nonbank servicers will continue to take market share from banks in 2017. That said, the source of nonbank portfolio growth is evolving.”

The Yahoo article quotes Fitch Managing Director Roelof Slump: “Whereas MSR sales and subservicing had in the past driven servicing growth among nonbanks, future activity will be driven by new loan origination activity by competitive nonbanks who also service loans. Servicing sales from banks who want to reduce the associated regulatory impact on capital will also drive growth.”

One of those competitive nonbanks is surely Quicken Loans, the nation’s largest online retail mortgage lender, and the second-largest retail mortgage lender overall. The company not only closed $220 billion of mortgage volume from 2013-2015, but has won all sorts of customer accolades doing it.

One of those competitive nonbanks is surely Quicken Loans, the nation’s largest online retail mortgage lender, and the second-largest retail mortgage lender overall. The company not only closed $220 billion of mortgage volume from 2013-2015, but has won all sorts of customer accolades doing it.

Quicken has been ranked highest in customer satisfaction for primary mortgage origination for seven straight years by J.D. Power — from 2010 through 2016. It was also ranked highest in the nation for client satisfaction among mortgage servicers for three consecutive years.

The Detroit-based company, like other nonbanks, uses technology not only to make it easy for customers to navigate their loan process, but to create effective loan modification programs. From the Harvard working paper:

“Most notably, Quicken has leveraged technology to predict the risk of default and determine loss reduction strategies. Technological innovation has also enabled other servicers – such as Walter Investment Management (ninth largest) and Nationstar (fifth largest) – to become more competitive by improving customer experience and channel efficiency; nonbanks have lowered delinquency rates by leveraging technology to improve borrower education, streamline processes, and determine loan modification processes that effectively work.

“State regulators note that nonbanks’ ‘advanced servicing technology systems’ can improve ‘loss mitigation alternatives to troubled borrowers.’” [Note: the rankings of the servicers have shifted since the Harvard article was published. Nationstar, for example, is now the fourth largest servicer.]

The study singled out Ocwen Financial for its application of technology in servicing some of the most difficult loans. “Ocwen was able to grow its servicing market share through a ‘superior level of technology,’ according to Morningstar. It was able to perform rapid loan modification due to proprietary technology and has designed software that transformed how a servicer interacts with an at-risk borrower.”

These tech innovations may be easier for nonbank servicers to develop and sustain than large legacy lenders, but the big banks haven’t been idle either. The net effect of increasing regulation is to hardwire efficiency into every part of the process. Large banks that have invested millions in this process are better able to compete with independent nonbanks than ever before.

The increasing interest rates that create a more welcoming servicing landscape have the opposite effect on overall origination volume. The MBA is projecting a sharp decline in refinancing volumes to just $145 billion in the first quarter of 2017, according to a Kroll Bond Rating Agency report. “Purchase mortgages are projected by the MBA to rise to $1.1 trillion in 2017, but refinancing volumes will be cut in half for the full year, leading to an overall decline in mortgage origination volumes of 20% next year compared with 2016.”

The jump in purchase mortgages will increase the opportunity for all kinds of servicers, and rising interest rates are a welcome change from the last decade.

“You’re going to see prepays slow down and you’ll see amortization expense go down, which will result in higher profits,” said Jay Bray, president and CEO of Nationstar.

“It should be great for the servicing business. And frankly, that was one of our initial investment pieces when we bought these portfolios — that rates can’t stay low forever. It’s just taken 10 years. But now that it’s happened, I think we’re going to benefit significantly,” Bray said.