Mortgage defaults remained quiet in November despite a slight uptick heading into the holiday season, according to the most recent S&P/Experian Consumer Credit Default Indices.

The report gives a comprehensive measure of changes in consumer credit defaults.

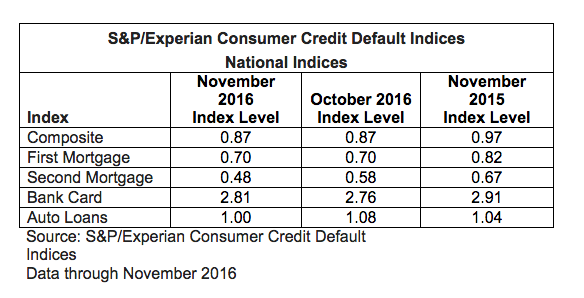

Both the overall composite rate and first mortgage default rate remained unchanged from last month at 0.87% and 0.7%, respectively, in November.

This is a change from the three-basis-point rise in the mortgage default rate witnessed in October.

“Recent data paint a picture of a strong economy, and lower consumer credit defaults reflect this,” said David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices.

“Default rates are modestly lower than a year ago, even as continued strength in home sales, auto sales, and retail sales are supporting expanded use of consumer credit,” said Blitzer. “Money market rates rose after Election Day, the Fed raised the target range for the Fed funds rate last week, and has indicated that further increases lie ahead. The favorable default trends are likely to be tested in 2017 as interest rates rise.”

Earlier this month, the Federal Open Market Committee announced in its highly anticipated December meeting that it is finally raising the federal funds rate for the first time since exactly a year ago. Since then, mortgage interest rates have steadily started to increase.

The chart below summarizes the November 2016 results for the S&P/Experian Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

Click to enlarge

(Source: S&P/Experian Consumer Credit Default Indices)