There’s still plenty of opportunity in the single-family rental market as steadily rising home prices keep profits up. The top places to invest in for a profit in America, however, are always fluctuating, with this quarter’s top 25 list showing a notable departure from the past several quarters.

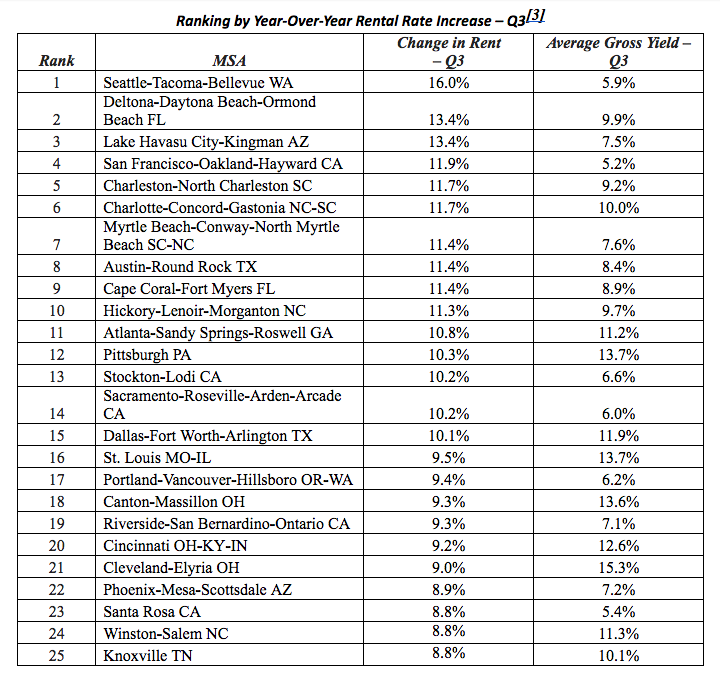

RentRange, a provider of market data and analytics for the single-family rental industry, ranked the top 25 U.S. Metropolitan Statistical Areas by average rental rate increase for single-family homes between third quarter 2016 and the same quarter in 2015.

In previous reports, the Sun Belt dominated the list, especially Florida and California. But in this report, RentRange identified a new emerging rental rate trend in the Rust Belt in areas like Pittsburgh, St. Louis and a trio of Ohio markets: Cleveland, Cincinnati and Canton.

“The emergence of rental rate increases in several Rust Belt markets is creating a unique opportunity for single-family rental market investors to pursue both property value increases and high yields,” said Wally Charnoff, CEO of RentRange Data Services.

“For years, the Rust Belt has produced strong yields, but tepid property price appreciation has kept rents relatively flat, forcing investors to choose between property appreciation or yield,” Charnoff said.

But now, he explained that strengthening economies in those markets combined with below average inventory and home-buying challenges, such as home buyers struggling to obtain mortgages, are creating the perfect environment for rental investors.

Here is a chart of the 25 markets with the biggest rent hikes:

click to enlarge

Millennials are helping fuel the single-family rental market since many are prolonging buying a home.

According to Mark Fleming, chief economist for First American Financial Corporation, since the beginning of the recession, the amount of rental households has increased by 22%, meaning there are 8.4 million new rental households.

As the biggest demographic group in American history, Millennials, finishes their education and gets jobs, they are naturally doing what so many generations before them have done, renting a place to live, he noted.

They won’t stay renters forever though as surveys suggest that the dream of homeownership is far from tarnished, just possibly delayed.