Oct. 3, 2016 marked the one-year anniversary of the implementation of Consumer Financial Protection Bureau’s Know Before You Owe rule, which also goes by a couple of other names – the TILA-RESPA Integrated Disclosure rule and TRID.

Preparing for the rule, which is designed to help borrowers understand the terms and costs of their mortgage before closing, caused a number of issues for the mortgage industry, as home sales slowed, mortgage closing times rose, and compliance issues with the new rules ran rampant.

Earlier this year, a report from ACES Risk Management (or ARMCO) showed that the rate of serious mortgage defects was on the uptick, since TRID came into force.

Now, a new report from ARMCO shows that as the mortgage industry becomes more accustomed to operating in the post-TRID world, serious mortgage defects are actually declining.

According to ARMCO’s new report, serious mortgage defects fell during the second quarter, marking the first decline in mortgage defects in a year.

The report from ARMCO, a provider of financial quality control and compliance software, is its second Mortgage QC Industry Trends report, which breaks down loan defects using the Fannie Mae loan defect taxonomy to identify where defects are occurring.

ARMCO’s report uses post-closing quality control data from more than 60 lenders, and covers more than 50,000 unique loans, and while the dataset is not industry-wide, it does show that lenders appear to be learning the rules of the road.

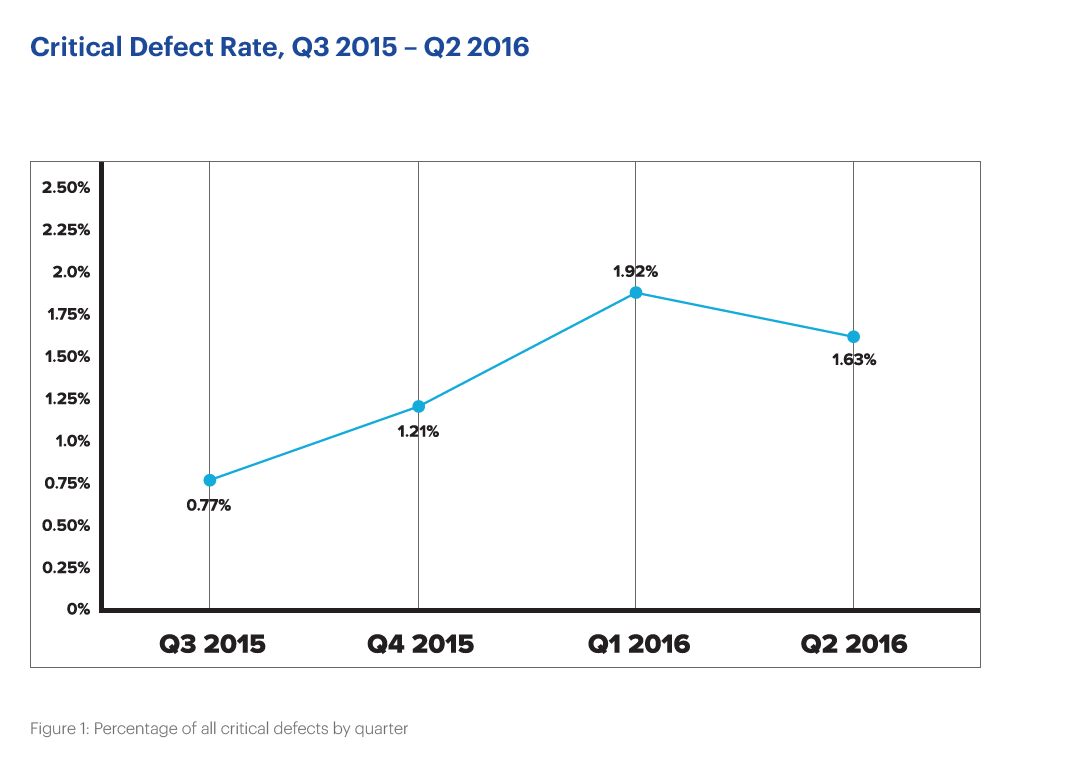

According to ARMCO’s report, loan defects peaked in the first quarter, but the overall industry critical defect rate dropped to 1.63% in the second quarter.

That decline halted an upward trend that spanned the previous three quarters.

As shows in the graph below, the critical defect rate in the second quarter was still above the totals of the third and fourth quarters of 2015, but further inspection of the data shows that the decline is legal/regulatory/compliance category, meaning that lenders are submitting loans with fewer compliance issues.

(Click to enlarge. Image courtesy of ARMCO.)

But just because the decline came from the legal/regulatory/compliance loan category, that doesn’t mean lenders are out of the woods yet.

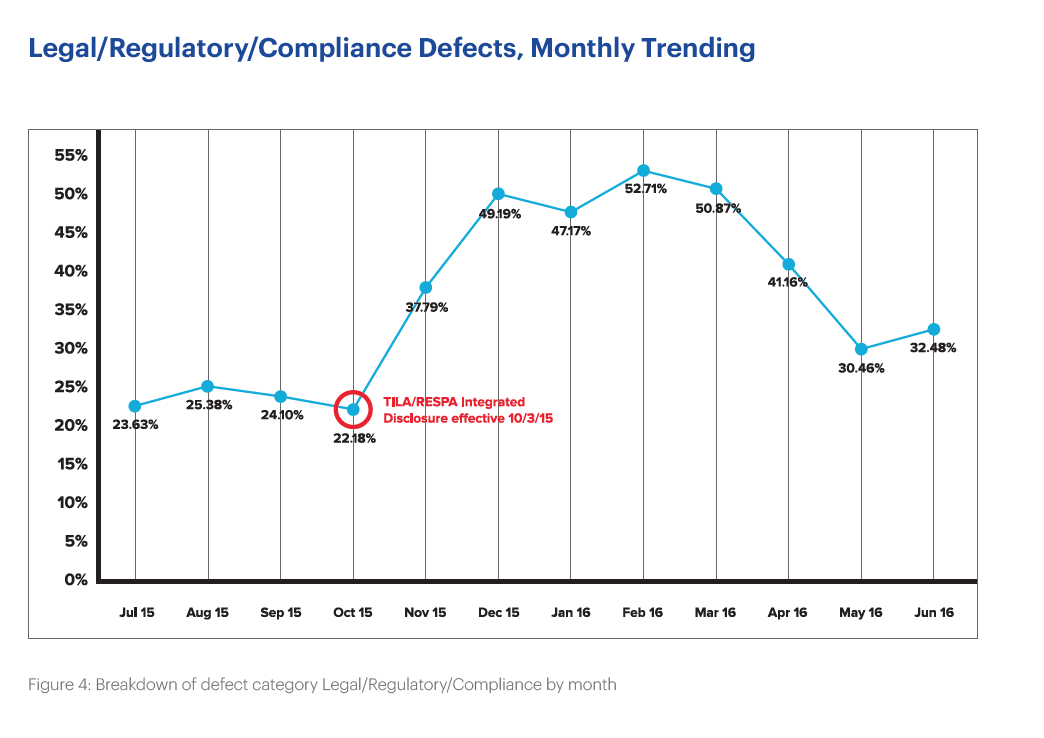

According to ARMCO’s report, 34% of all defects reported were in the legal/regulatory/compliance category, which represented the largest reported defect category.

But that’s still down from the 50% of all defects that came from the legal/regulatory/compliance category in the first quarter.

“While TRID-related defects are still driving the majority of legal/regulatory/compliance defects, we’re seeing a decline in defects in this category as a result of corrective action planning lenders undertook through the first six months of 2016,” said Phil McCall, chief operating officer for ARMCO. “As lenders determine the most effective strategies for addressing TRID-related defects, we expect to see this category decline further.”

According to ARMCO’s report, there are some common themes among the covered lenders when it comes to the decline in defects in the legal/regulatory/compliance category.

“The top reported corrective action has been lenders working diligently with their loan origination system, internal personnel and external providers during the first six months post-TRID to implement automated solutions to mitigate many of the common data errors seen earlier in the implementation phase,” ARMCO said in its report. “An example of this collaboration is the concerted effort to standardize the naming conventions of all loan fees to provide consistency in how fees are disclosed from the initial loan estimate thru the final closing disclosure.”

The graph below shows the progression of defects in the legal/regulatory/compliance category before TRID and after TRID.

(Click to enlarge. Image courtesy of ARMCO.)

As the graph shows, defects in the legal/regulatory/compliance category rose quickly after TRID’s implementation, but began falling in March of this year as the industry became more comfortable with handling TRID-related issues.