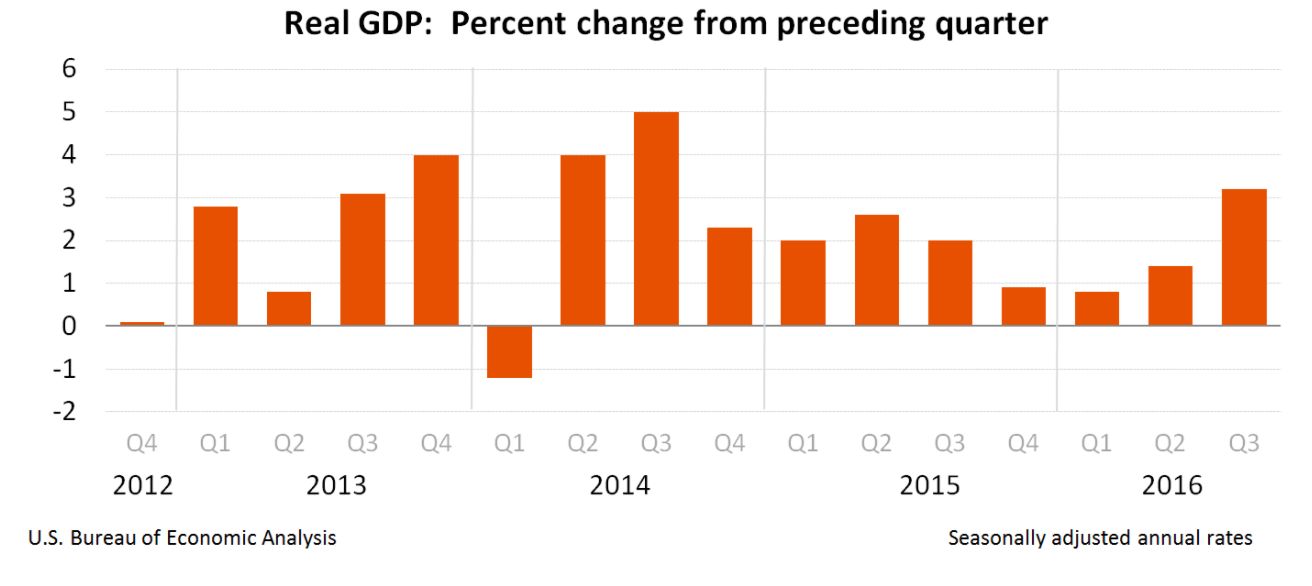

The Gross Domestic Product of the United States, basically the strongest indicator of the overall strength of this nation’s economy, increased at its strongest rate in two years.

Today’s quarterly revision states that “real” GDP increased at an annual rate of 3.2% in the third quarter of 2016 after a disappointing second quarter.

From the Bureau of Economic Analysis:

“The acceleration in real GDP in the third quarter primarily reflected an upturn in private inventory investment, an acceleration in exports, an upturn in federal government spending, and smaller decreases in state and local government spending and residential fixed investment, that were partly offset by a deceleration in PCE, an acceleration in imports, and a deceleration in nonresidential fixed investment.”

The strong GDP is based on strong corporate profits, though this did not translate into a rally in the bond markets, as some would expect, especially considering that federal spending is also up (See BEA release).

So why the bearish bond activity?

There may be some trepidation over rising 10-year Treasury yields (though slightly down on today's news) and the expectation of an almost certain rise to the Federal Funds Rate next month.

Both of these indicate mortgage rates will continue to inch higher, possibly dragging down investments in housing and mortgage finance.

Click chart to enlarge: