The bank formerly owned by the rumored leading candidate to head up the Department of the Treasury in President-elect Donald Trump’s administration violated federal fair housing laws by redlining minority neighborhoods and engaging in discriminatory lending practices, according to two housing advocacy groups.

On Thursday, the California Reinvestment Coalition and Fair Housing Advocates of Northern California formally filed a complaint and asked the Department of Housing and Urban Development to investigate the business and lending practices of CIT Group, and its subsidiary OneWest Bank.

OneWest, which merged with CIT Bank last year, was founded by a group of private equity investors led by Steven Mnuchin. Mnuchin and his partners formed OneWest from the remains of IndyMac Federal Bank in 2009.

Mnuchin is also a former Goldman Sachs executive and served as Donald Trump’s campaign finance chair.

In recent days, speculation began to emerge that Mnuchin is Trump’s top choice to lead the Treasury.

Mnuchin and his partners sold OneWest to CIT Group in 2015, but the California Reinvestment Coalition and Fair Housing Advocates of Northern California accuse OneWest of failing to locate bank branches in communities of color and extending very few or no mortgages to borrowers of color prior — a process commonly referred to as redlining — to the bank’s sale.

“Our analysis of OneWest suggests the bank has no significant branch presence in communities of color, and not surprisingly, its home loans to borrowers and communities of color are low in absolute terms, low compared to its peer banks, and low when compared to what one would expect, given the size of the Asian American, African American, and Latino populations in California,” Kevin Stein, deputy director of the California Reinvestment Coalition, said.

Stein said during 2014 and 2015, OneWest originated “exactly two mortgage loans” to African American borrowers in its assessment area.

“OneWest was far more likely to foreclose in communities of color than to make loans available to people in these communities,” Stein added. “We call on HUD to fully investigate CIT’s redlining practices and to hold the bank accountable for its actions and the harm it has caused to communities.”

The groups also accused OneWest and CIT of allowing foreclosed homes in minority neighborhoods to fall into disrepair, while homes in mostly white neighborhoods were well maintained.

“Our investigation revealed troubling differences in how OneWest homes maintained their bank-owned homes in predominantly white neighborhoods vs. neighborhoods of color,” said Caroline Peattie, executive director of Fair Housing Advocates of Northern California.

“The majority of OneWest REO homes in communities of color looked abandoned, had trash strewn about the yard and boarded up doors and windows, and weren’t clearly marketed as ‘for sale,’” Peattie continued. “In contrast, almost all of OneWest’s REO homes in white communities were well-maintained, had manicured lawns, and were clearly marketed as ‘for sale.’”

In a statement provided to HousingWire, CIT said that it is “committed to fair lending and works hard to meet the credit needs of all communities and neighborhoods we serve."

It should also be noted that the complaint does not mention Mnuchin or any of his partners by name.

But the housing groups state that their review of the bank’s branch locations shows that OneWest has a “sparse branch presence” in communities of color, which “effectively makes banking services and credit products (including mortgages) less available to people based on their race, color, and national origin.”

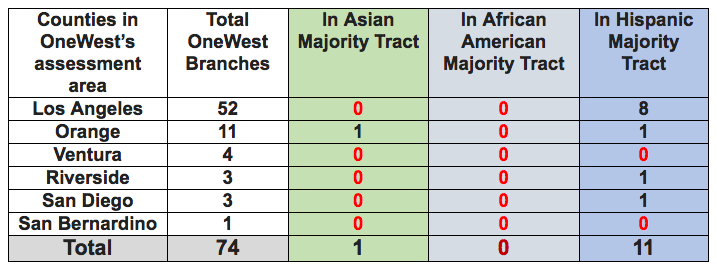

The chart below, compiled by the groups, shows OneWest’s total branch locations in six counties in California, including Los Angeles County and Orange County, and the bank’s branch presence is minority areas. Click the chart to enlarge it.

(Chart courtesy of California Reinvestment Coalition and Fair Housing Advocates of Northern California)

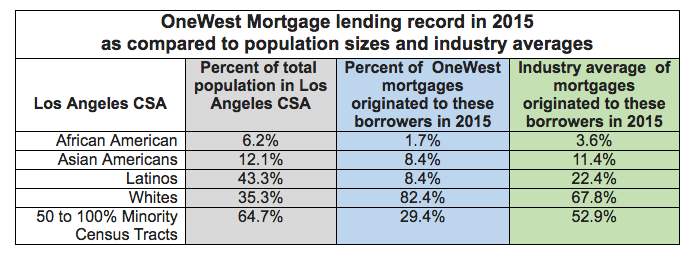

The groups also reviewed Home Mortgage Disclosure Act data, which they say shows that OneWest Bank made “very few” mortgage loans to borrowers and communities of color.

“Its home loans to borrowers and communities of color are low in absolute terms, low compared to its peer banks, and low when compared to what one would expect, given the size of the Asian, African American, and Latino populations in California,” the groups say.

As shown in the chart below, in one example, 43.3% of the total population in the Los Angeles area is Latino, but only 8.4% of OneWest’s mortgage loans went to Latinos in 2015. Click the chart to enlarge it.

(Chart courtesy of California Reinvestment Coalition and Fair Housing Advocates of Northern California)

For comparison, the groups say that the industry average share of mortgages to Latinos was 22.4% in 2015.

“The evidence included in this complaint suggests that OneWest Bank has steered clear of people of color in its assessment areas for a number of years,” Sharon Kinlaw, executive director of the Fair Housing Council of San Fernando Valley, said. “We want to know how many people were harmed and we look forward to learning what HUD finds out.”