While mortgage default rates slightly increased in October, the market is heading into the busy holiday-spending season, so overall default rates could be on the rise, according to the most recent S&P/Experian Consumer Credit Default Indices.

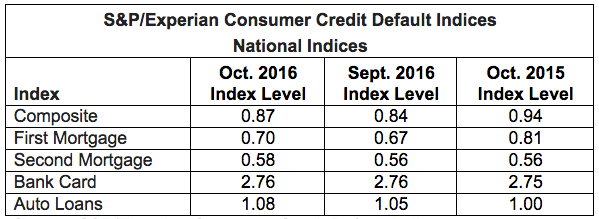

The report found that the composite default rate, first mortgage default rate and auto loan default rates all increased by three basis points last month to 0.87%, 0.70%, and 1.08%, respectively, in October.

The bank card default rate is the only one that didn’t change and remained at 2.76%.

This chart shows the consumer credit default indices.

Click to enlarge

(Source: S&P/Experian Consumer Credit Default Indices)

Those increases aren't necessarily a bad thing though, explained David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices.

“Consumer credit and mortgage debt outstanding are rising and economic growth picked up in the third quarter,” said Blitzer. “These positive signs are accompanying small increases in the consumer credit default rates.”

However, he added, “With recent reports showing improved consumer sentiment and the holiday spending season fast approaching, default rates may bear scrutiny."

It’s important to note that the data in this report pre-dates the election, so it is too early to tell if the election will affect consumers’ borrowing plans.