Even with a slight rise in the first and second mortgage default rates, levels are still hovering around the same low level, the latest report by S&P Dow Jones Indices and Experian for the S&P/Experian Consumer Credit Default Indices posted.

“Despite small monthly movements in consumer credit defaults, the overall default rates are stable and close to the lowest levels since shortly before the financial crisis,” said David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones Indices.

Compared to a year earlier, Blitzer noted that mortgage loan defaults are 16 basis points lower.

“Related data published by the Federal Reserve show that the growth in consumer and household debt is currently about 4.4% per year, increasing about two percentage points faster than nominal GDP growth,” he said.

According to the report, mortgage debt peaked in the first quarter of 2008 and reached its most recent low point in the first quarter of 2015. It is now up 2.1% from the low.

“Barring a repeat of the recent and severe recession, both consumer credit and mortgage debt outstanding are expected to continue growing at, or faster than, the pace of nominal GDP growth,” said Blitzer.

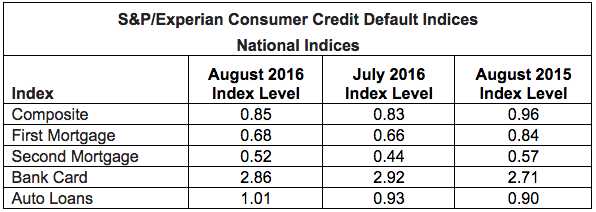

The chart below shows the August 2016 results for the S&P/Experian Credit Default Indices.

Click to enlarge

(Source: S&P/Experian Consumer Credit Default Indices)

In the last default report, Blitzer noted that with this being an election year, the economy faces more than the usual uncertainties. He added, “With the electoral outcome unknown and large differences between the candidates’ policy proposals, one should expect these uncertainties to cause some delays in business investments or consumer spending on big ticket items.”