As it turns out, the United Kingdom’s decision to leave the European Union is quite the boon for U.S. mortgage originators, as a new report from the Urban Institute shows that mortgage originator profits rose sharply post-Brexit.

In fact, the Urban Institute report, released earlier this week, showed that mortgage originator profits hit a three-year high in the wake of the Brexit vote.

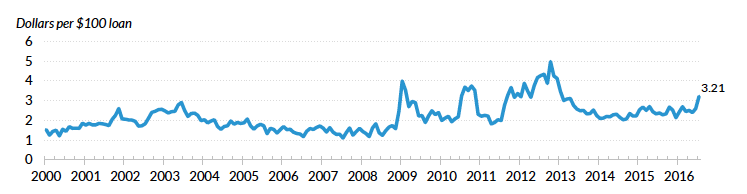

According to the Urban Institute’s measure of originator profitability, which is called the Originator Profitability and Unmeasured Costs and is formulated and calculated by the Federal Reserve Bank of New York, mortgage originators made, on average, $3.21 per $100 of a mortgage during July.

The $3.21 per $100 of a loan is the highest that figure has been since January 2013, the Urban Institute said. Extrapolating that figure out means that for a $200,000 loan, an originator earned $6,420 in profit.

Per the Urban Institute, this figure is determined by looking at the price at which the originator actually sells the mortgage into the secondary market and adds the value of retained servicing (both base and excess servicing, net of g-fees) as well as points paid by the borrower.

And as interest rates fell post-Brexit, originator profits rose, as shown in the graphic below, courtesy of the Urban Institute. Click to enlarge.

Those figures echo a recent report from the Mortgage Bankers Association, which also showed that independent mortgage banks and mortgage subsidiaries of chartered banks reported an increase on their net gain on each loan they originated during the first quarter.

Although, it should be noted that the MBA report showed a net gain of $825 for each loan originated by an independent mortgage banks or mortgage subsidiary of a chartered bank in the first quarter of 2016, a far cry from the a profit of $6,420 on a $200,000 loan, as suggest by the Urban Institute report.

According to the MBA report, the profit per mortgage fell by 60% after the implementation of the Consumer Financial Protection Bureau’s TILA-RESPA Integrated Disclosures rule in October.

The first quarter report from the MBA showed that profits are back on the way up, but profits still have a long way to go to get back to the level witnessed in the first quarter of 2015, at least according to the MBA’s report, which showed that independent mortgage banks and mortgage subsidiaries of chartered banks recorded a net gain of $1,447 on each loan they originated during the first quarter of last year.