Two facts stand out in today’s housing market: rising home sales and flat/falling inventory.

Existing home sales are up 5% year over year in the first half of 2016, and in June reached a seasonally adjusted annual rate of 5.57 million units―the highest level since early 2007. But housing inventory, as measured by the number of existing homes for sale, was down by 130,000 units year over year in June.

This is a continuation of what has been happening since 2012. Between 2012 and 2015, home sales have increased by almost 600,000 units, from 4.67 million units to 5.25 million units, while housing inventory has been flat or down.

Figure 1. Existing home sales and housing inventory (Click to enlarge)

Source: National Association of Realtors

Why is missing inventory a puzzle?

Housing is a two-sided market. Most homebuyers are already homeowners and they typically sell their existing home before buying another one.

That is why the flat-to-down housing inventory is so puzzling in the presence of rising home sales. If people are buying more homes, why aren’t there more homes for sale?

I believe this phenomenon tells us something about what is happening to homebuyers who are more pivotal to housing demand.

First-time homebuyers, people buying second homes, and investors stand out because they do not have to sell before buying. When these buyers enter the market, they add to sales without also bringing inventory to the market. So rising home sales and flat-to-down inventory trends are consistent with more first-time homebuyers entering the housing market.

The missing inventory quantified

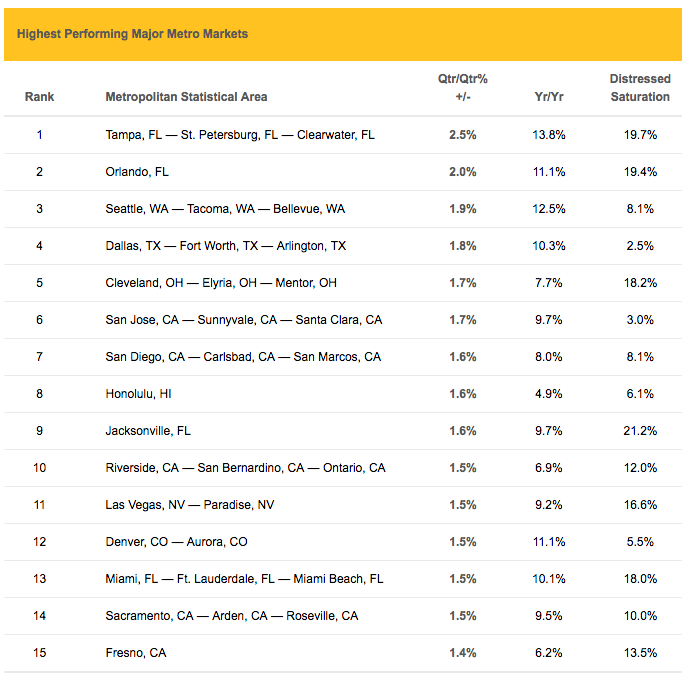

One way to understand the missing inventory is by comparing actual inventory level with the level of inventory holding constant the months of supply.

For example, actual housing inventory in 2015 was around 180,000 units less than the level of inventory if months of supply had stayed at the 2014 level. If more first-time homebuyers in the housing market explains the missing inventory phenomenon, it would have to have a similar size.

Figure 2. 2015 housing inventory – actual vs. implied (Click to enlarge)

Source: National Association of Realtors, Genworth Financial

The link with the first-time homebuyers market

The best source of information on first-time homebuyers is the mortgage insurance industry and the FHA. Both serve a large number of first-time homebuyers by lowering the down-payment hurdle.

I estimate that the industry helped around 1 million new first-time homebuyers in 2015. More importantly, our data shows that the number of first-time homebuyers increased by around 200,000 from the previous year.

This is evidence that the growing presence of first-time homebuyers was a major factor in reducing housing inventory while pushing up home sales last year. Anecdotally, I hear many stories about the lower end of the housing market being tighter. That is also consistent with more first-time homebuyers entering the market.

Data for the first half of the year suggests that we will see continued pressure from first-time homebuyers entering the housing market. Based on my estimate, the number of first-time homebuyers served by the mortgage insurance industry and the FHA combined are up by another 100,000 in the first half of 2016.

What does this mean for the housing market?

I expect rising first-time homebuyers to be a major trend in the housing market over the next few years, generating higher home sales while keeping housing inventory down or flat. The result is a tilt in favor of home sellers and a continuation of rising home prices.