#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;} The business case for gender diversity got a huge shot in the arm this year with data from Morgan Stanley showing a positive relationship between equity returns and the gender composition of employees. The study, “A Framework for Gender Diversity in the Workplace,” found that companies with higher gender diversity delivered better on returns, with lower volatility, than companies with low gender diversity.

While the study looked at global companies across a variety of business sectors, it found that gender diversity was especially important for sectors where employee engagement and satisfaction “reflects directly on the quality of the product or service,” and named financial services specifically.

The study is the latest attempt to get hard numbers around a slippery topic. Gender data isn’t always reported; even when it is, there is usually a long lag time, making the information less helpful. As Morgan Stanley noted in publishing its study, “While human resources departments should have ready access to gender-related data, companies either don’t consider this metric meaningful to investors or don’t want to expose themselves, particularly when no requirement exists.”

The impetus to create a gender-balanced workforce springs from many motivations, from moral and ethical considerations to more practical concerns like a company’s bottom-line performance.

“Women account for half of the global labor supply and about 70% of global consumption demand. Women’s rights are human rights but they are also a key determinant of economic prosperity,” Laura D’Andrea Tyson, former chair of the U.S. president’s Council of Economic Advisors, wrote on a McKinsey & Company blog.

For our industry, recruiting and promoting women is crucial to expanding homeownership and giving more people access to the American Dream.

So what is the state of gender equality in housing finance? What progress has our industry made and what still needs to be addressed?

Unfortunately, there are no easy answers, since the level of diversity varies based on what part of the industry you look at and what data you compare.

For example, unlike some of the traditionally male-dominated fields in our industry, women make up a majority of Realtors — 58% — according to the National Association of Realtors. However, on average, female Realtors earned only about 66% of what male Realtors earned in 2013, according to The Real Deal. But given that selling real estate involves the many intangible factors of sales jobs everywhere, it’s hard to draw any meaningful conclusions from those stats.

And our industry includes economists, accountants, mortgage brokers, appraisers, loan officers, attorneys and many more occupations. Each of those subgroups vary in the number of women who are employed or are in leadership, as well as what they get paid compared to men in those same occupations.

A tidy summation, therefore, is not possible.

However, even with the difficulty of comparing apples to apples, there is compelling data to suggest that this industry, like many others, has a long way to go to reach gender equality in employment, leadership and pay standards.

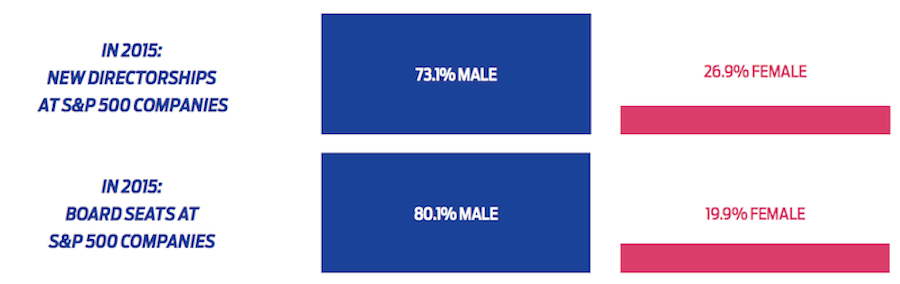

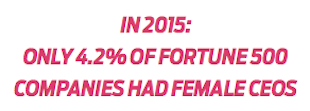

Consider the following stats:

- The biggest wage gap in the U.S. is in the “financial activities” industry. Women account for more than half of all employees, but earn only 69 cents for every $1 men make. (Catalyst.org)

- Barclays employs more women than men (51% to 49%) but almost 80% of the top jobs and board positions are held by men. (CNN Money.com)

- Of the 10 major occupation groups where women’s earnings lagged behind men’s earnings the most, five were in finance. (The Wall Street Journal)

- Female-run startups produce 31% higher return on investment than startups by men, but only 20% of female entrepreneurs receive any venture capital. (The Kauffman Foundation)

Clearly there is still much work to be done, and regulators and industry leaders are taking on the challenge.

#div-oas-ad-article1, #div-oas-ad-article2, #div-oas-ad-article3 {display: none;} HIGH STAKES

The regulators of our industry, particularly the Consumer Financial Protection Bureau, place a high priority on gender equality in housing occupations.

The CFPB’s Office of Minority and Women Inclusion (mandated by section 342 of the Dodd-Frank Act) seeks to increase the bureau’s own gender and racial balance, encourage that balance in the companies it regulates, and promote businesses owned by minorities and women, especially as it relates to government contracts.

In its 2016 annual report to Congress, the CFPB noted that its overall workforce was 52% male and 48% female, while the executive leadership percentage was less equal: 59% of executive male leaders compared to 41% female. Still, this was a 5% increase in female executive leadership over 2014.

Gender diversity is also one focus of the Mortgage Banker’s Association Diversity and Inclusion Initiative, which works to increase racial, gender, sexual orientation and ethnic diversity within the mortgage banking industry.

“Diversity and inclusion strengthens MBA, our companies, and our industry as we continue to reach out to our increasingly diverse customers. MBA benefits when our leaders represent the full breadth of our markets and the richness of our society,” a statement on the MBA’s website explains.

The trade group’s commitment to expanding opportunities for women includes an annual summit on diversity and inclusion and an awards program, the Diversity and Inclusion Residential Leadership Awards, to recognize companies who are leading out in this area. The awards, which just launched this year, will be presented at the MBA’s Annual Convention and Expo.

“Our customer base is diversifying, and we need to be more diverse too,” said Tamara King, vice president of residential policy at the MBA and lead staffer on the Diversity and Inclusion committee.

That committee, which started in 2013, reports to the MBA board and comprises senior managers and industry leaders, including owners, C-level executives and senior vice presidents.

“The idea behind the committee was to have a group that could effect and influence change in companies,” King said. “A variety of companies are represented and we made sure there are members from national, midsize and independent lenders, as well as representatives from companies that service the mortgage industry.”

The Diversity and Inclusion committee’s goal is to heighten the awareness of the issue and drive change in the industry by educating MBA members on the benefits of diversity and inclusion.

As part of that education effort, the committee reviewed and supported a diversity and inclusion self-assessment tool created by VRMU that looks at four areas: organizational commitment, workforce profile and employment practices, procurement and business practices and transparency and communication.

The tool is voluntary and free and no data is collected from the tool. It enables companies to benchmark their compliance with the Diversity and Inclusion standards that were developed by the OMWI office as part of the Dodd-Frank Act.

“The standards that came out of section 342 are voluntary,” King said. “VRMU has enabled us to provide a toolbox for our members to help them comply with these voluntary standards.”

Although the standards are voluntary, at least for now, King sees a larger issue for lenders and others in the industry beyond compliance.

“The face of the customer is changing. There are more women, more immigrants, more Hispanic, African American and Asian borrowers. If your company isn’t prepared to do business with those new entrants, you are disadvantaging your company.”