The Brexit impact took longer to come to fruition in appraisal volume, but it’s here.

After last week’s adjustment to the Fourth of July holiday, appraisal volume surged for the week of July 10, according to the latest National Appraisal Volume Index from a la mode.

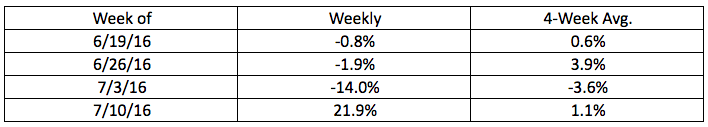

Appraisal volume jumped 21.9%, which more than made up for the 14% drop during the holiday week.

Thanks to the rise in volume, the four-week average moved out of negative territory to 1.1%.

Click to enlarge

(Source: a la mode)

a la mode is an appraisal forms software company that provides its findings exclusively to HousingWire each week.

“It appears that the Brexit volume seen in mortgage applications has made it’s way through to appraisals,” said Kevin Golden, director of analytics with a la mode.

In comparison, mortgage applications felt the effect of Brexit pretty early on. According to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending July 1, mortgage applications soared 14.2% from the previous week due to an increase in refinance applications caused by low interest rates.

Appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

Golden said he thinks appraisal volume will stay higher for at least a little while as applications take time to work their way to the appraisal part of the mortgage process.

However, he noted that appraisal volume usually begins to drop as the summer comes to a close and school starts.