Mortgage interest rates are nearing all-time record lows and mortgage applications are up dramatically, all thanks to the Brexit, but it looks like those figures may not lead to a huge jump in actual mortgages being taken out, because it’s still getting harder to get a mortgage.

The wet blanket news for prospective homebuyers comes courtesy of a new report from the Mortgage Bankers Association, which showed that mortgage credit availability fell during the month of June.

That marks the fourth straight month that credit availability decreased.

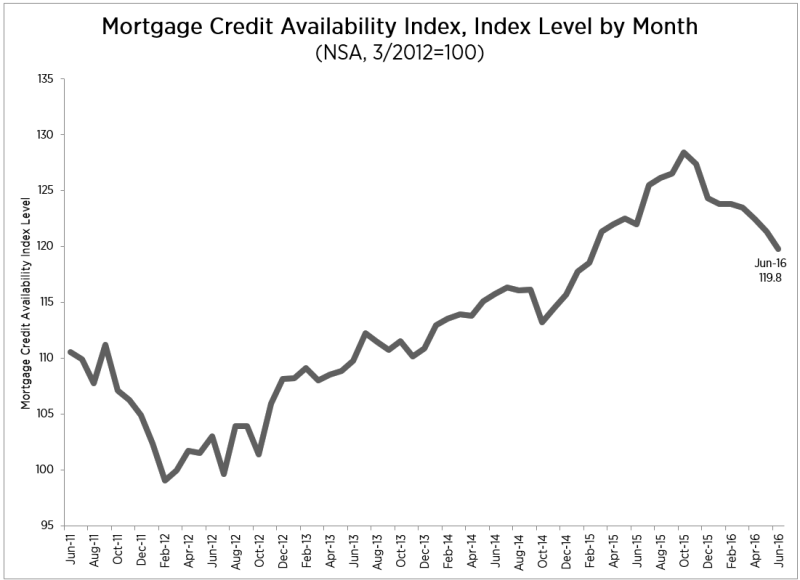

According to the MBA’s report, its Mortgage Credit Availability Index fell by 1.3% to 119.8 in June.

The MCAI analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. An increase in the MCAI would indicate that lending standards are getting looser, but a decline shows that lending standards are tightening.

June’s decline comes on heels of the MCAI decreasing by 0.8% to 121.4 in May.

According to the MBA’s report, of the four component indices, the Conventional MCAI saw the greatest tightening (down 2.4%) over the month. The Conforming MCAI was down 1.8%, while the Jumbo MCAI fell 0.9%, and the Government MCAI decreased 0.3%.

Per the MBA, the primary difference between the total MCAI and the Component Indices are the population of loan programs that they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo MCAI looks at everything flagged as “jumbo” while the Conforming MCAI examines loan programs that fall under conforming loan limits.

“Credit availability decreased over the month driven primarily by a decrease in availability of conventional conforming loan offerings,” said Lynn Fisher, MBA vice president of research and economics. “In particular, a number of investors discontinued their conventional high balance seven-year adjustable rate loan programs while leaving their five-year and 10-year ARM programs unchanged.”

Tight credit isn’t holding prospective borrowers back from applying for a mortgage though, as both the MBA and Zillow both reported sharp increases in mortgage applications, especially refinance applications, in the wake of Britain’s decision to leave the European Union.

The MBA’s own mortgage application report showed that refinance applications rose to an 18-month high for the week ending July 1, while Zillow reported a 132% increase in refinance mortgage requests through its mortgage marketplace in the week right after the Brexit.

Whether the increase in applications actually leads to more mortgages is yet to be seen, but the data doesn’t look terribly promising.

Click the image below to see the trend in mortgage credit availability, courtesy of the MBA's report.