Appraisal volume doesn’t appear to be budging for anything, trudging along at a very low volume for the majority of spring and now into summer.

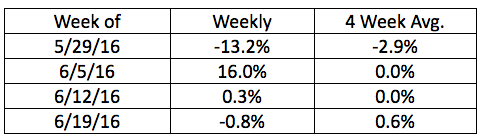

According to the latest National Appraisal Volume Index from a la mode, the four-week moving average finally moved up from 0%, increasing to 0.6% for the week of June 19.

However, the volume for the week dropped .8% from the previous week.

a la mode is an appraisal forms software company that provides its findings exclusively to HousingWire each week.

“Nevertheless, the appraisal volume growth appears to be continuing its anemic journey. With Brexit as a new facet we will see if it produces the lower rates or economic slow down as predicted and whether either of these will affect the market,” said Kevin Golden, director of analytics with a la mode.

Click to enlarge

(Source: a la mode)

The current environment for appraisal volume appears ripe, with the 30-year fixed-rate mortgage sitting extremely low at 3.56%.

And this isn’t even the lowest rates will go, according to new reports in the aftermath of Brexit.

Analysts at Fitch Ratings posted that mortgage rates could hit all-time lows as the Brexit dust settles. In a note sent to clients on Tuesday, Fitch Managing Director Grant Bailey and Senior Analyst Rob Rowan write that the “increased uncertainty” surrounding the Brexit could drive rates to lows never before seen.

However, Golden noted that low rates might not do much for appraisal volume or housing.

“We have had low rates for most of the year. I think it’s not the rates, but how the market reacts to the rest of the economic change that will change the direction,” he said.

Golden said he sees rates dropping in expectation of a slumping British and EU economy but doesn’t see anything really happening in the short term— the exit isn’t for two years.

For now, housing isn’t expected to liven up. “The economic meandering we see for the rest of this year was present before Brexit. I believe we’ll continue to get good news and bad about the economy and how the markets will react is anybody’s guess. With Brexit, people may now tend more to the gloom and doom side of things,” he said.

Mortgage applications posted similar lackluster news, with mortgage applications actually decreasing 2.6% in the latest report from the Mortgage Bankers Association.

Appraisal volume is an indicator of market strength and holds some advantages over mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after credit worthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year.