The single-family rental market comprises 13% of all occupied housing and 37% of the total rental market and is only poised for more growth from here, a new white paper from the National Rental Home Council stated.

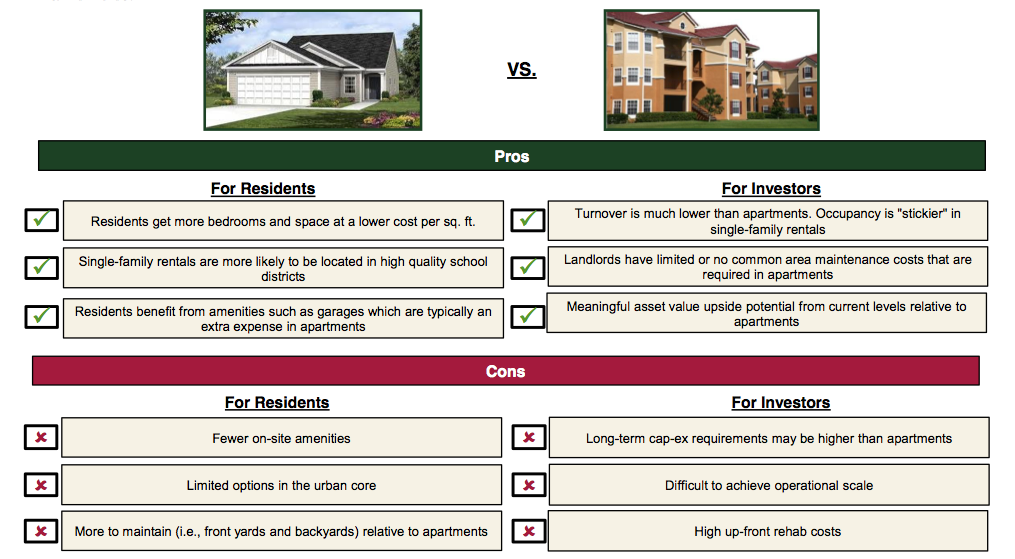

For potential investors on the fence, NRHC outlined the pros and cons of single-family rentals versus apartments for investors and residents, along with the risks and opportunities associated with it.

Institutional investor portfolios, as it stands, represent just 1% of the total single-family rental market, with “mom and pop” owners traditionally dominating the market.

Roughly four years ago, Warren Buffett suggested the opportunity to invest in single-family rentals and said, "If I had a way of buying a couple hundred thousand single-family homes and if I had a way of managing them…, I would load up on them.”

Since then, the NRHC cited that the number of homes owned by NRHC members jumped from just under 100,000 SFRs in early 2012 to more than 160,000 SFRs in early 2016.

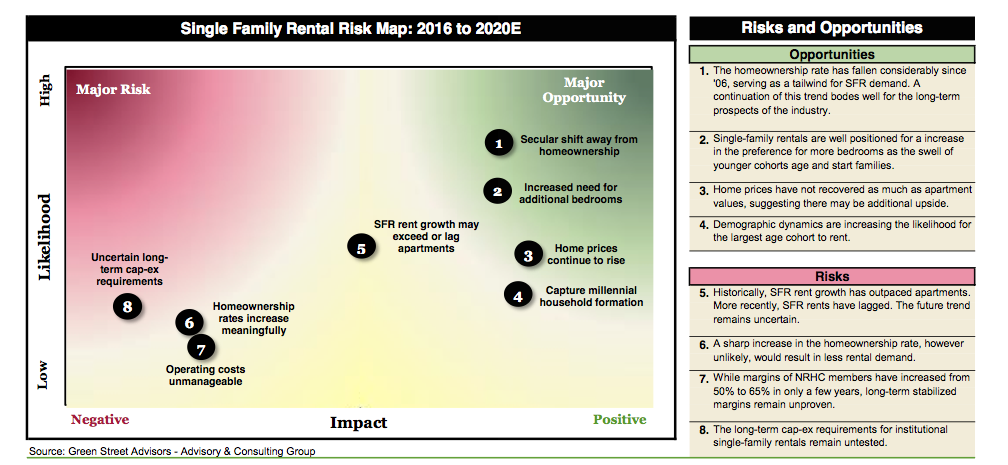

In light of this, the National Rental Home Council and Green Street Advisors’ Advisory and Consulting Group published new data on the single-family rental industry that details the investment thesis behind the institutional single-family rental business.

The report’s findings are based on data provided by NRHC members Colony Starwood Homes, Invitation Homes, Silver Bay Homes, American Homes 4 Rent, Progress Residential and Tricon American Homes.

This first chart shows the pros and cons in single-family housing versus apartments for investors and residents.

Click to enlarge

(Source: NHRC)

This second chart set shows the risks and opportunities for investors in single-family housing.

Click to enlarge

(Source: NHRC)

And for those investors that do choose to go into the single-family rental business, here are the spring’s hottest single-family housing markets.