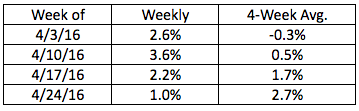

While appraisal volume continued to inch higher for the week of April 24, it only increased 1%, a drop from 2.2% last week, according to the latest appraisal volume numbers from a la mode, an appraisal forms software company that provides its findings exclusively to HousingWire.

Appraisal volume has increased over the past four weeks, helping push the four-week average up.

Click chart to enlarge

(Source: a la mode)

Kevin Golden, director of analytics with a la mode, explained that the four-week average rose this week to 2.7% due to the decline in late March dropping out.

“The NAVI seems to be plodding along this spring due to the low inventories and tight credit balanced by low interest rates and good employment numbers,” Golden said.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness is determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year.