First-time homebuyers and those looking for a smaller, new home in the Dallas-Fort Worth area are out of luck now, and will remain that way into perpetuity, according to a new report from Metrostudy.

According to Metrostudy’s 2016 first-quarter survey of the DFW metro area’s housing market, homebuilding is booming in the area with first-quarter new home starts up more than 39% from last year, but none of that growth is coming at entry-level prices.

Metrostudy’s report showed that there were 7,015 new home starts in the first quarter of 2016, which is up 39.1% from the same time period last year, although that data was affected by the bad weather during that quarter, including snow and ice.

But most of that growth is coming in higher-price brackets, which could very well force many Millennials and other young would-be homebuyers to wait to buy their first home because there’s simply nothing they can afford.

At least, not anything new. If this trend continues, DFW first-time buyers may be relegated to buying the starter homes of all those that are moving up to the only homes being built, the more expensive ones.

“First-quarter starts data presents further evidence of Dallas-Ft. Worth’s market shift in price,” said Paige Shipp, regional director of Metrostudy’s Dallas office. “Historically, most of DFW’s starts and closings occurred below $200,000. The new normal reflects a meteoric rise in starts above $200,000.”

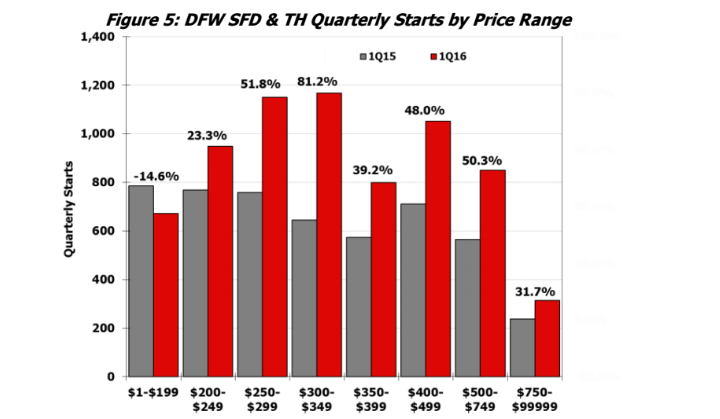

According to Shipp, housing starts to be priced between $300,000 and $349,999 jumped 81.2%, which is almost twice the increase in closings.

On the other hand, starts below $200,000 dropped 14.6% from last year and closings plummeted 31%, Shipp said.

And Shipp said that there’s not much hope on the horizon for those looking for a new home priced under $200,000.

“Due to rapidly rising land and development costs, developers argue there is little hope for the revival of the sub-$200,000 new-home market,” Shipp added. “This will remain an issue until municipalities, developers and builders understand and deliver higher-density lots and smaller homes to the market.”

Metrostudy’s report showed that while buyers looking for new homes in the DFW area that don’t carry a hefty price tag may be left relatively hopeless, builders are responding to the price points that carry the highest demand, and right now, that’s between $250,000 and $400,000.

According to Metrostudy’s report, housing starts in that price range made up 44.4% of the first quarter’s total.

But DFW buyers don’t just want homes priced between $250,000 and $400,000; Metrostudy’s report showed that a “whopping” 31.6% of starts occurred above $400,000.

Broken out by more specific price bucket, home starts to be priced between $250,000 and $299,999 rose 51.8% year-over-year in the first quarter, while homes to be priced between $300,000 and $349,999 rose 81.2% from last year.

Click the image below to see how DFW’s home starts broke out by price bracket, courtesy of Metrostudy’s report.

“For the first three months of the year, builders and developers report that prices are stable but anticipate an increase in the cost of concrete in April,” Shipp said.

“If builders are not able to pass the costs onto the buyer, margins may be affected,” Shipp continued.

“Demand for homes in Dallas-Ft. Worth persists, but builders, developers and municipalities must work together to deliver attainably priced homes,” Shipp concluded. “Land prices, development costs, fees and home-building costs cannot be controlled. The only way to provide new homes below $300k will be by increasing home density and decreasing home square footage.”