While everyone possibly knows that California and New York are one of the most expensive states to live in, it’s no surprise that a few residents petitioned to receive higher paychecks.

According to the Washington Post:

California Gov. Jerry Brown (D) signed into law a measure Monday that will hike the state's minimum wage to $15 per hour by 2023 — making the Golden State the second in the nation to legislate a wage hike to that level. The first came minutes earlier in New York, where Gov. Andrew M. Cuomo (D) signed a similar piece of legislation, implementing staggered wage hikes throughout the state over the next several years.

In a pair of statements, President Obama commended both Cuomo and Brown, describing the increase as a step in the right direction.

"Since I first called on Congress to increase the federal minimum wage in 2013, 18 states and more than 40 cities and counties have acted on their own — thanks to the strong leadership of elected officials, businesses, and workers who organized and fought so hard for the economic security families deserve," he said in the statement on New York — and echoed in nearly identical language later on California's minimum wage hike. "Now Congress needs to act to raise the federal minimum wage and expand access to paid leave for all Americans."

According to the Los Angeles Times, Governor Jerry Brown along with labor unions came up with a proposal that would raise the rate from $10 an hour to $10.50 on Jan. 1, 2017, with a 50-cent increase in 2018, further $1-per-year increases through 2022, and inflation-indexed increases after that. Businesses with fewer than 25 employees would have until 2023 to hit $15.

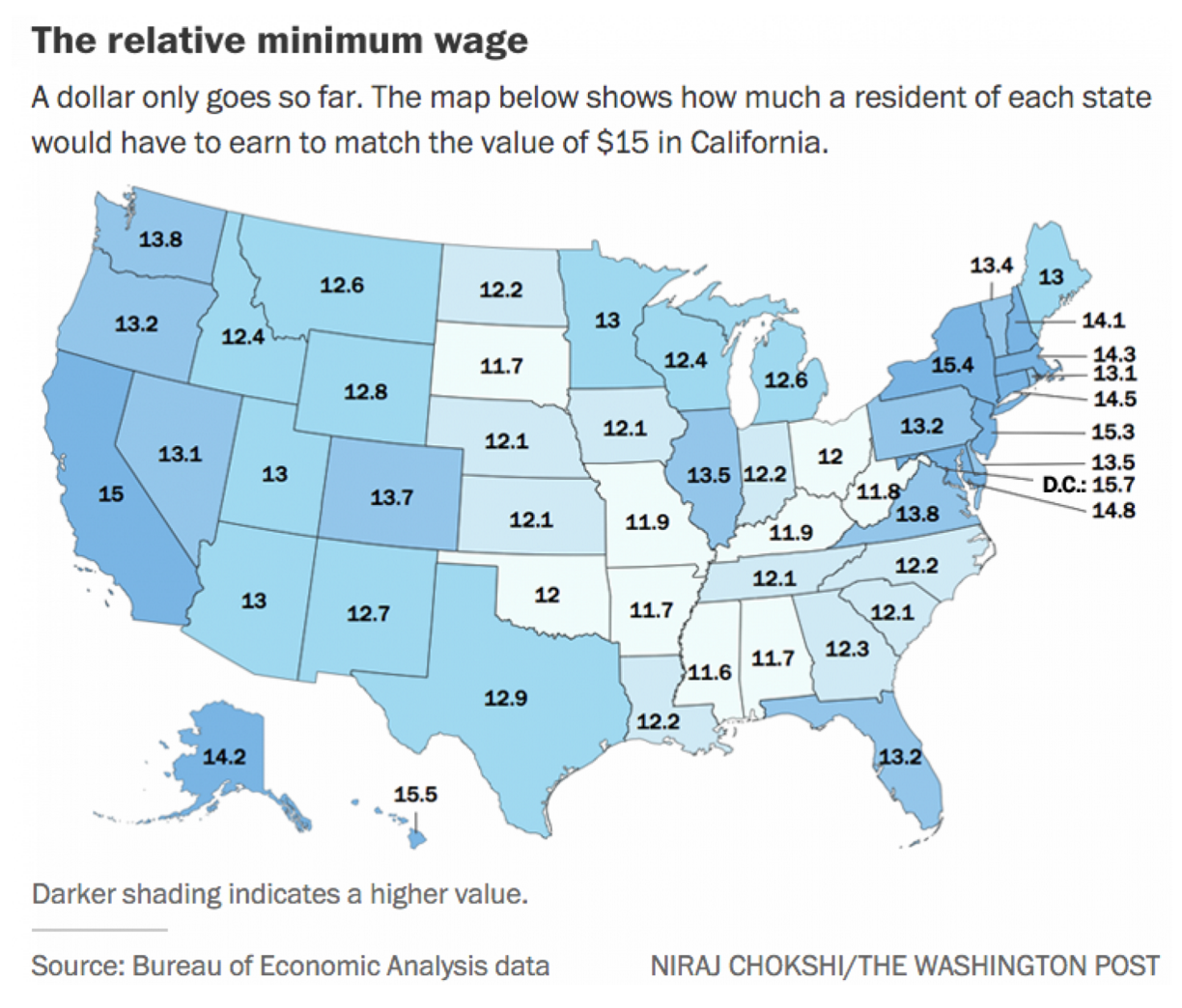

The article also states that with recent data from the Bureau of Economic Analysis, it indicates that with $15 in California it’ll buy much less that in it would in other states.

Besides California and New York, the prices of goods in Hawaii, New Jersey as well as Maryland are the highest in the nation. Louisiana, Mississippi and Arkansas are among the states where prices are lowest in the nation.

Click to enlarge

So now that they’ve raised the minimum wage, what will happen to the cost of rent or the price of a home?

Washington Post says a $1,000 rent in California buys far less than it does in other parts of the nation. (Rents are only higher in Hawaii and D.C.) In Arkansas, home to the nation's cheapest rents, one need only spend $431 to match the value of a $1,000 rent in California. In Pennsylvania, $621 goes as far as $1,000 in California.

Most of the price increases for both single-family residences and condominiums happened during the first four months of 2015. Since April 2015, prices have been trending mostly sideways, the report stated.

“Affordability has become a significant issue in many coastal counties throughout the state, particularly in the Bay Area,” said Madeline Schnapp, director of economic research for PropertyRadar.

“Recent stock market volatility and growing fears about the national economy may send investors scampering to the perceived safety of real estate, putting additional upward pressure on prices.”