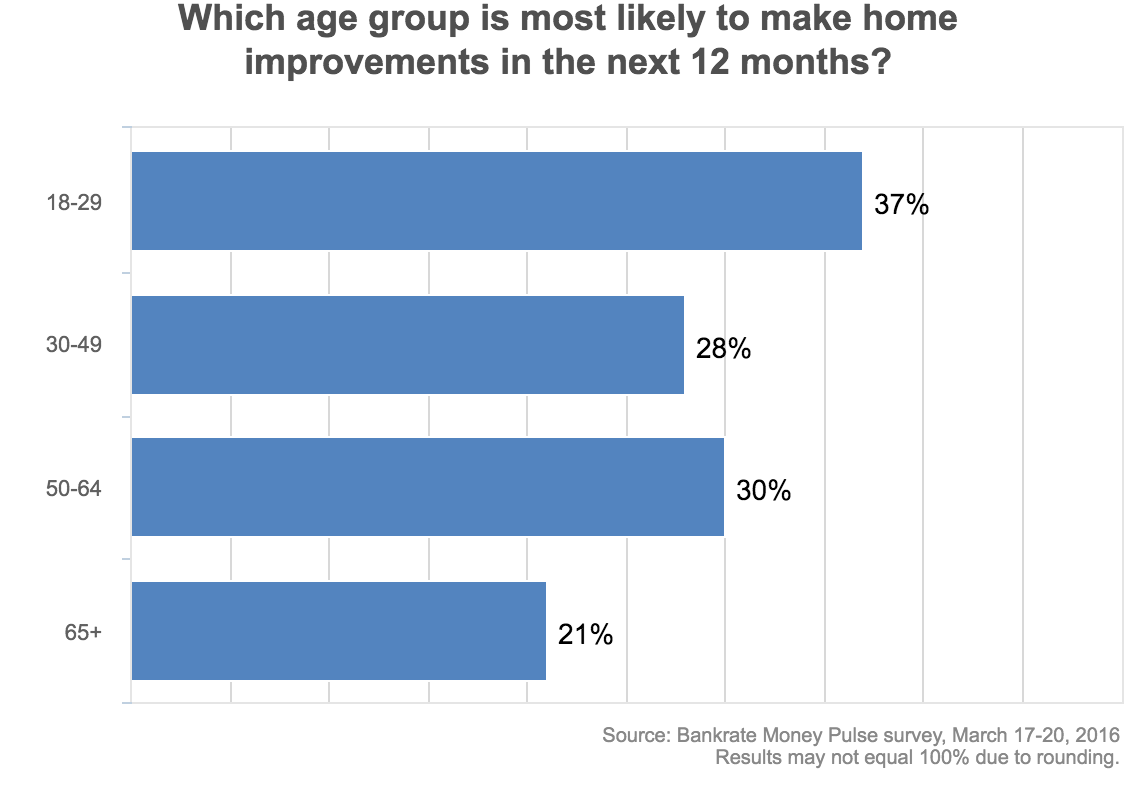

Homeowners aged 18-29 are among the 37% of Americans with property who plan to remodel, expand or otherwise improve their homes in the next 12 months, according to the latest Bankrate Money Pulse survey.

According to Bankrate writer Mike Cetera, the survey was conducted March 17-20, 2016, by Princeton Survey Research Associates International and included responses from 1,000 adults living in the continental United States. The margin of error is plus or minus 3.8 percentage points.

Click to enlarge

From Bankrate:

As home prices plummeted and access to home equity vanished during the last recession, Americans cut back on their home improvement projects. But the remodeling market has rebounded in recent years. By one measure, called the Leading Indicator of Remodeling Activity, or LIRA, annual home improvement spending in nominal terms is expected to set a record in 2016.

"The last couple of years in particular, we've been seeing the activity trending up with homeowners doing more projects, spending more on projects," says Abbe Will, a research analyst in the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University, which developed the LIRA.

"What really swings the market up and down is project mix and project size, basically," Will says. "Are (homeowners) doing more replacement projects or bigger, more discretionary projects?"

The survey states that about 52% of homeowners planning a project over the next year indicate they want to work on their driveways, decks, patios, pools, landscaping or fencing.

A March survey by LightStream, the online lending arm of SunTrust Bank in Atlanta, found nearly two-thirds of homeowners planning renovations will pay for it with savings.

"If you go back 8 or 9 years ago, I think that people were more likely to use their home equity to fund these kinds of projects," says Todd Nelson, LightStream's business development officer. "They are clearly less willing today to use their home as a piggy bank than they were a decade ago."